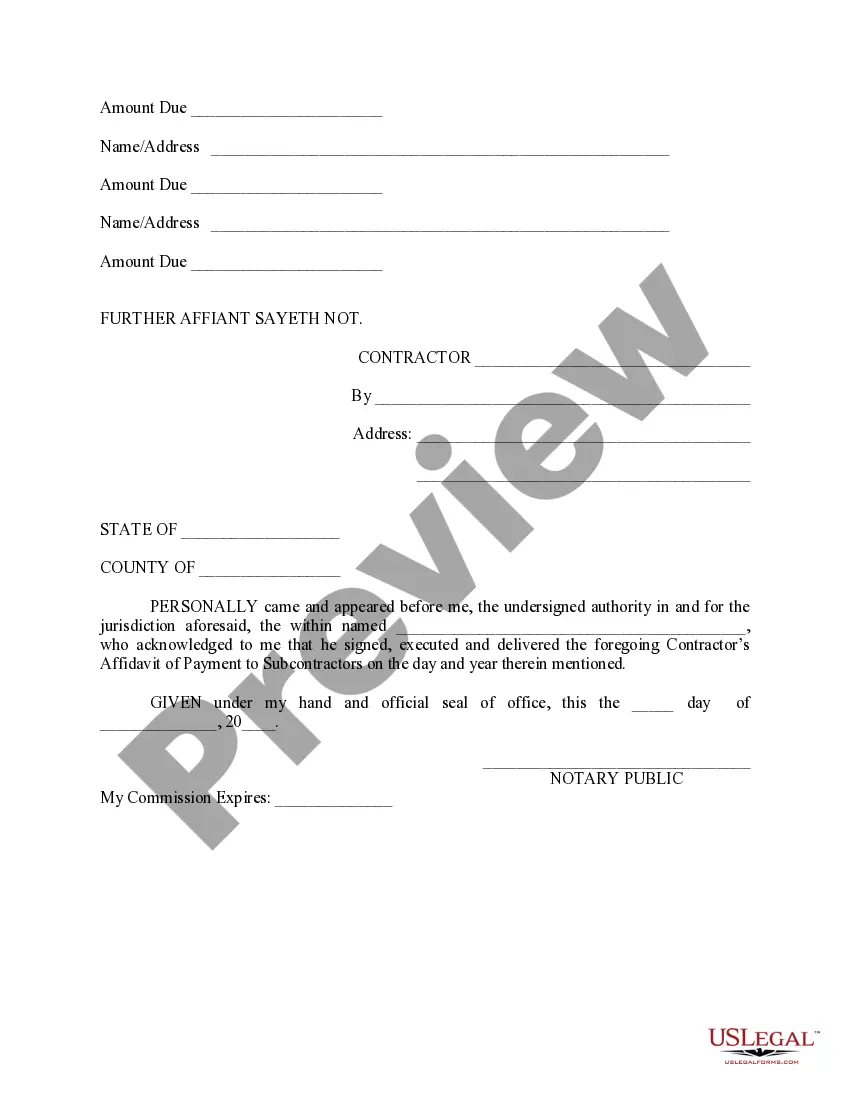

The Tennessee Contractor's Affidavit of Payment to Subs is a legal document used by contractors in Tennessee to declare and certify that they have made full and timely payments to subcontractors who have performed work or provided materials on a construction project. This affidavit is typically required by the project owner or general contractor as a condition for payment release and serves as a means to ensure that subcontractors are paid properly. It is an important tool to promote transparency and accountability in the construction industry. The Tennessee Contractor's Affidavit of Payment to Subs includes essential details and statements to guarantee compliance with payment obligations. These details may include the contractor's name, contact information, and license number, the project's name and location, as well as the subcontractor's names, contact information, and the amount paid to each. The affidavit will state that the contractor has paid the subcontractors in full for the work provided, including any applicable retain age. It may also contain an affirmation that the contractor has not received any claims or notices of non-payment from the subcontractors. This helps protect the owner or general contractor from any potential claims or liens that the subcontractors may place against the property due to non-payment. It is important to note that there may be different types of Contractor's Affidavit of Payment to Subs in Tennessee. These types may include specific forms tailored to certain projects or government contracts. Some examples of additional types of affidavits may include the Tennessee Contractor's Affidavit of Payment for Public Works Projects or the Tennessee Contractor's Affidavit of Payment for Federal Contracts. In conclusion, the Tennessee Contractor's Affidavit of Payment to Subs is a critical legal document used by contractors in Tennessee to declare full and timely payment to subcontractors. Its purpose is to promote transparency, ensure compliance with payment obligations, and protect project owners and general contractors from potential claims or liens. Different types of affidavits may exist depending on specific project requirements or government contracts.

Tennessee Contractor's Affidavit of Payment to Subs

Description

How to fill out Tennessee Contractor's Affidavit Of Payment To Subs?

You might spend hours online searching for the correct legal document template that meets the federal and state requirements you need.

US Legal Forms offers a wide variety of legal documents that are reviewed by professionals.

You can obtain or create the Tennessee Contractor's Affidavit of Payment to Subs through our service.

To find another version of the form, use the Search field to find the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, create, or sign the Tennessee Contractor's Affidavit of Payment to Subs.

- Every legal document template you obtain is yours permanently.

- To get an additional copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you’ve selected the right document template for the area/town you choose.

- Read the form description to ensure you have selected the correct form.

Form popularity

FAQ

It is unfortunately common for a contractor to fail to pay a subcontractor within the agreed terms. If so, the subcontracting party is entitled to pursue debt collection action to recover what is owed to them.

Can a Contractor Sue for Non-Payment? The short answer is yes. If you've exhausted all other means, you can bring the case to a small claims court. It's a good idea to speak to a lawyer first to see what your options are and whether it's worth it.

A direct payment clause says that if you have paid the main contractor for work done by subcontractors and your money is not passed on to them, you can pay the subcontractor directly and deduct the payment from any other monies due to the main contractor.

How to get paid (faster) on every construction projectGet licensed.Write a credit policy.Prequalify potential customers.Get the contract in writing.Collect information about the property and other parties.Track your deadlines.Send Preliminary Notice.Submit Detailed Pay Applications or Invoices.More items...?

When the subcontractor does not get paid then they have grounds to pursue the contractor for monies owed. This could be in the form of wages or unpaid invoices for services rendered. In the USA, the owner of the property can be held liable for payment under a Mechanics Lien.

In order to get paid, subcontractors need to issue invoices to the contractors they work for. Every invoice you issue needs to include some basic information, including: An invoice number: a unique code that follows a sequential order.

A general rule of contributory negligence is that a main contractor is not liable for the negligence of its independent subcontractor. There are some exceptions to this rule, including: The main contractor had actual knowledge that the sub-contractor's work had been done in a foreseeably dangerous way and condoned it.

When you pay subcontractors, you'll usually need to make deductions from their payments and pay the money to HMRC. Deductions count as advance payments towards the subcontractor's tax and National Insurance bill. You'll need to file monthly returns and keep full CIS records - you may get a penalty if you do not.

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

You usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

Interesting Questions

More info

Forms Other products.