[Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] State Tax Commission [Department Name] [Address] [City, State, Zip Code] Subject: Payment for Tennessee State Taxes (Tax Year: [Year]) Dear State Tax Commission, I am writing to inform you that I have enclosed my payment for the Tennessee state taxes that were assessed for the tax year [Year]. Please find the details of the payment provided below: 1. Payment Information: — Amount: $[Payment Amount— - PAYMENT ID: [Payment ID] — Taxpayer Name: [Your Name— - Taxpayer Identification Number: [Your Taxpayer Identification Number] 2. Tax Details: — Tax Type: [Type of tax or taxes paid, e.g., Income Tax, Sales Tax, Property Tax] — Taxpayer Identification Number: [Your Taxpayer Identification Number] — Tax Year: [Year— - Filing Status: [E.g., Single, Married filing jointly] Enclosed with this letter, you will find the following items: — Check or Money Order: [Include the check or money order made payable to the appropriate state tax authority] — Payment Voucher: [If applicable, attach the payment voucher provided by the state tax authority] — Completed Tax Return: [Attach a copy of the tax return, if required] I kindly request that you acknowledge the receipt of this payment by sending a confirmation notice to the following address or email: [Your Name] [Your Address] [City, State, Zip Code] [Email Address] In case of any issues or discrepancies with the payment, please do not hesitate to contact me at the provided phone number or email address. It is essential to ensure accurate and timely processing of my tax payment. Thank you for your attention to this matter, and I appreciate your assistance. Sincerely, [Your Name]

Tennessee Sample Letter to State Tax Commission sending Payment

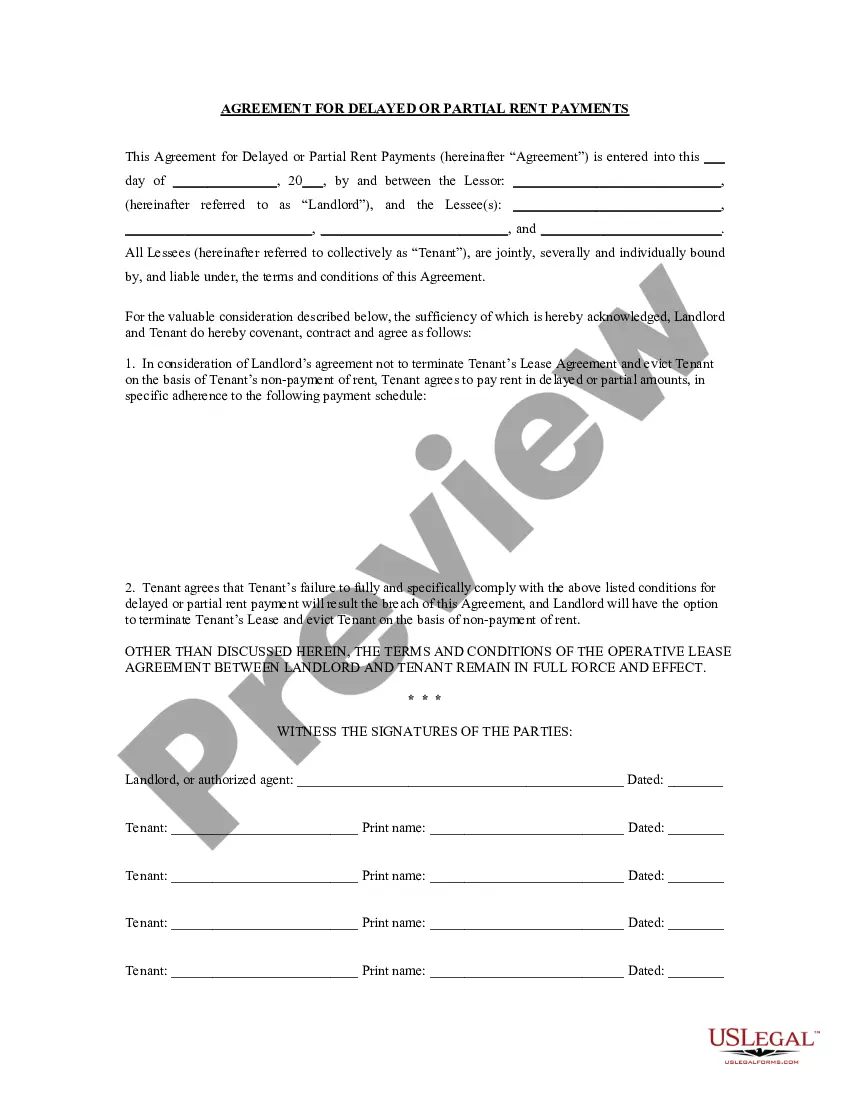

Description

How to fill out Sample Letter To State Tax Commission Sending Payment?

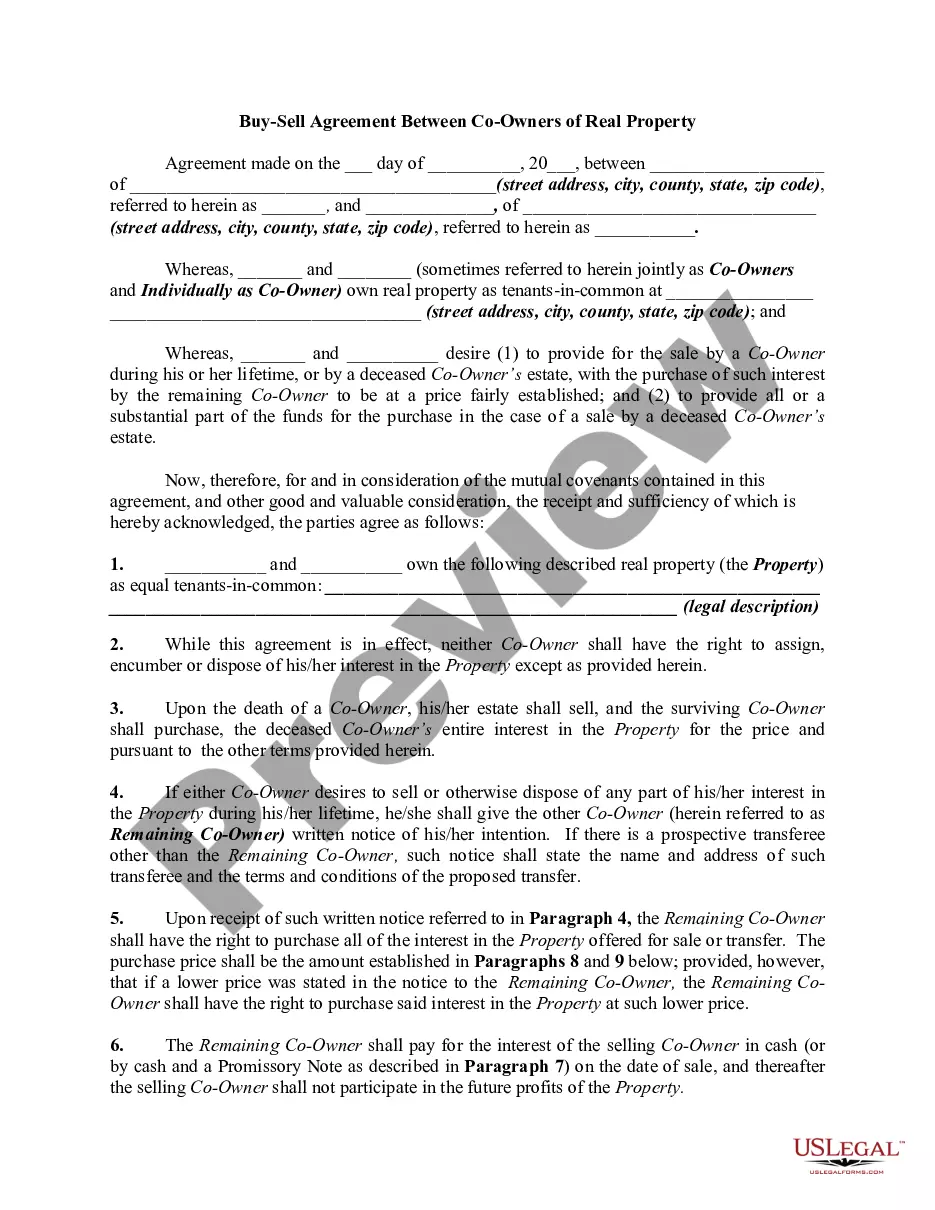

It is possible to spend time on the Internet searching for the lawful record template that meets the federal and state specifications you will need. US Legal Forms supplies 1000s of lawful types which can be reviewed by specialists. You can actually acquire or produce the Tennessee Sample Letter to State Tax Commission sending Payment from the service.

If you already have a US Legal Forms bank account, you may log in and click on the Download option. Next, you may comprehensive, modify, produce, or indicator the Tennessee Sample Letter to State Tax Commission sending Payment. Each lawful record template you acquire is your own eternally. To obtain another duplicate of the purchased kind, proceed to the My Forms tab and click on the related option.

If you are using the US Legal Forms web site initially, adhere to the basic recommendations listed below:

- Initially, ensure that you have chosen the right record template for your area/area of your liking. Browse the kind information to ensure you have selected the correct kind. If accessible, take advantage of the Review option to look through the record template at the same time.

- If you want to find another version from the kind, take advantage of the Search area to find the template that meets your requirements and specifications.

- Once you have identified the template you want, simply click Acquire now to move forward.

- Select the rates prepare you want, type in your references, and register for an account on US Legal Forms.

- Total the financial transaction. You can utilize your Visa or Mastercard or PayPal bank account to purchase the lawful kind.

- Select the formatting from the record and acquire it to your product.

- Make adjustments to your record if necessary. It is possible to comprehensive, modify and indicator and produce Tennessee Sample Letter to State Tax Commission sending Payment.

Download and produce 1000s of record templates making use of the US Legal Forms web site, that offers the most important collection of lawful types. Use skilled and condition-certain templates to take on your small business or person demands.

Form popularity

FAQ

In Tennessee, there are no income taxes whatsoever. However, prior to 2021, the state levied a flat-rate tax on all income earned from interest and dividends. No cities in Tennessee levy local income taxes. How many allowances should you claim?

Pay while logged into TNTAP: Log into TNTAP. Select your FAE Account and Period, then select the ?Make a Payment? link in the ?I Want To? section. Choose ACH Debit or Credit Card, and then fill in the information requested. Once completed, click the ?Submit? button.

If you do owe Tennessee state taxes, other than income tax, you can learn more about what is taxed at the TN Department of Revenue website. State tax ranges from business and sales tax, to inheritance and gift tax. To pay taxes, you may do so online at .

The Department of Revenue issues two types of notice of assessment letters when the following events occur. A taxpayer has not filed a return when due and the Department of Revenue has generated an estimated return. A taxpayer files a tax return but has not paid the full balance due on that return.

To calculate your property tax, multiply the appraised value by the assessment ratio for the property's classification. Then, multiply the product by the tax rate.

Tennessee has no state income tax on salaries, wages, bonuses or any other type of work income. Although the state used to tax income earned from interest and dividends, it has repealed this starting with the 2021 tax year.

For more details on how to use TNTAP for filing a business tax return, see the Department's ?how to? video. To contact the Department directly, email revenue.support@tn.gov or call 615-253-600.

File and Pay Electronically Using TNTAP All sales and use tax returns and associated payments must be submitted electronically. Sales and use tax, television and telecommunications sales tax, and consumer use tax can be filed and paid on the Tennessee Taxpayer Access Point (TNTAP).