Tennessee Demand for Collateral by Creditor

Description

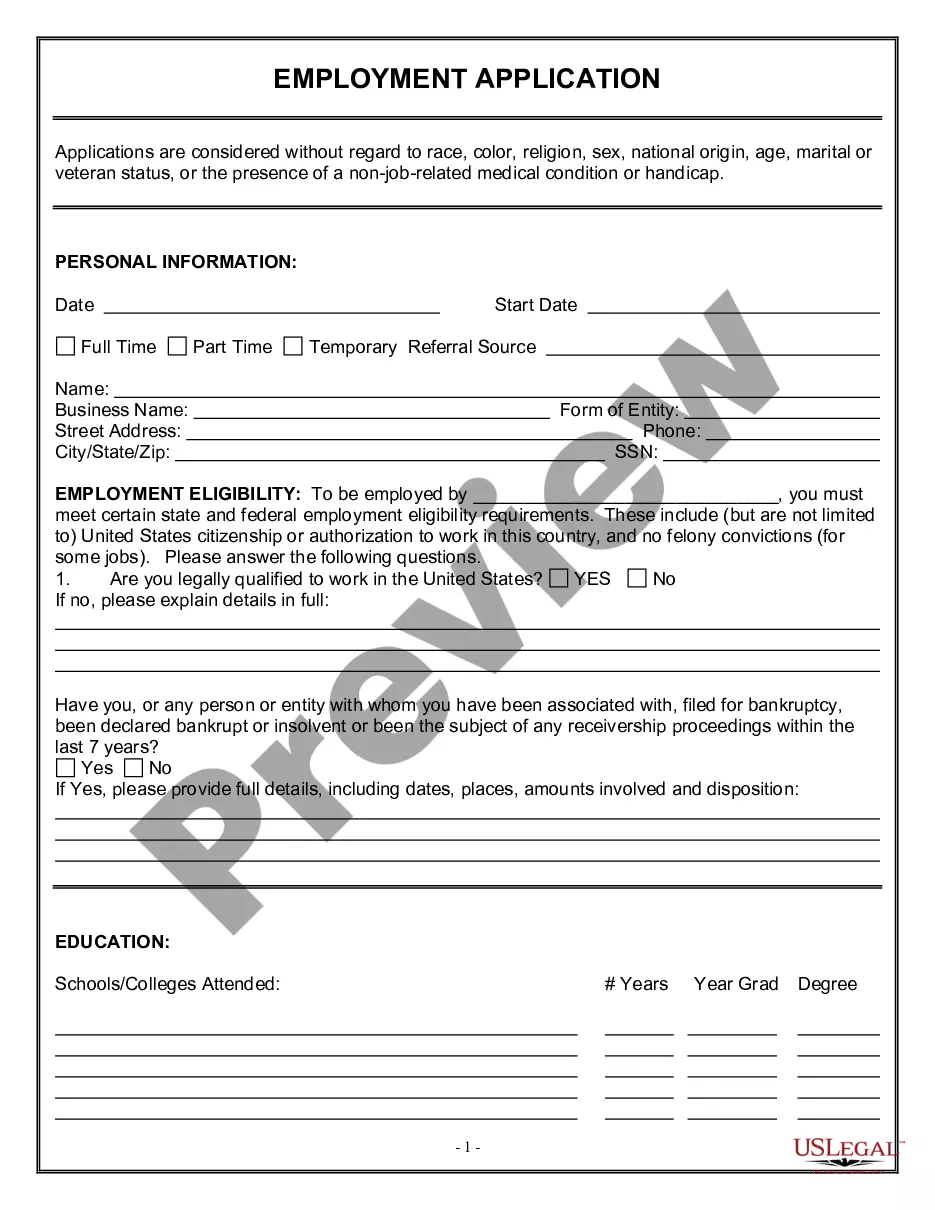

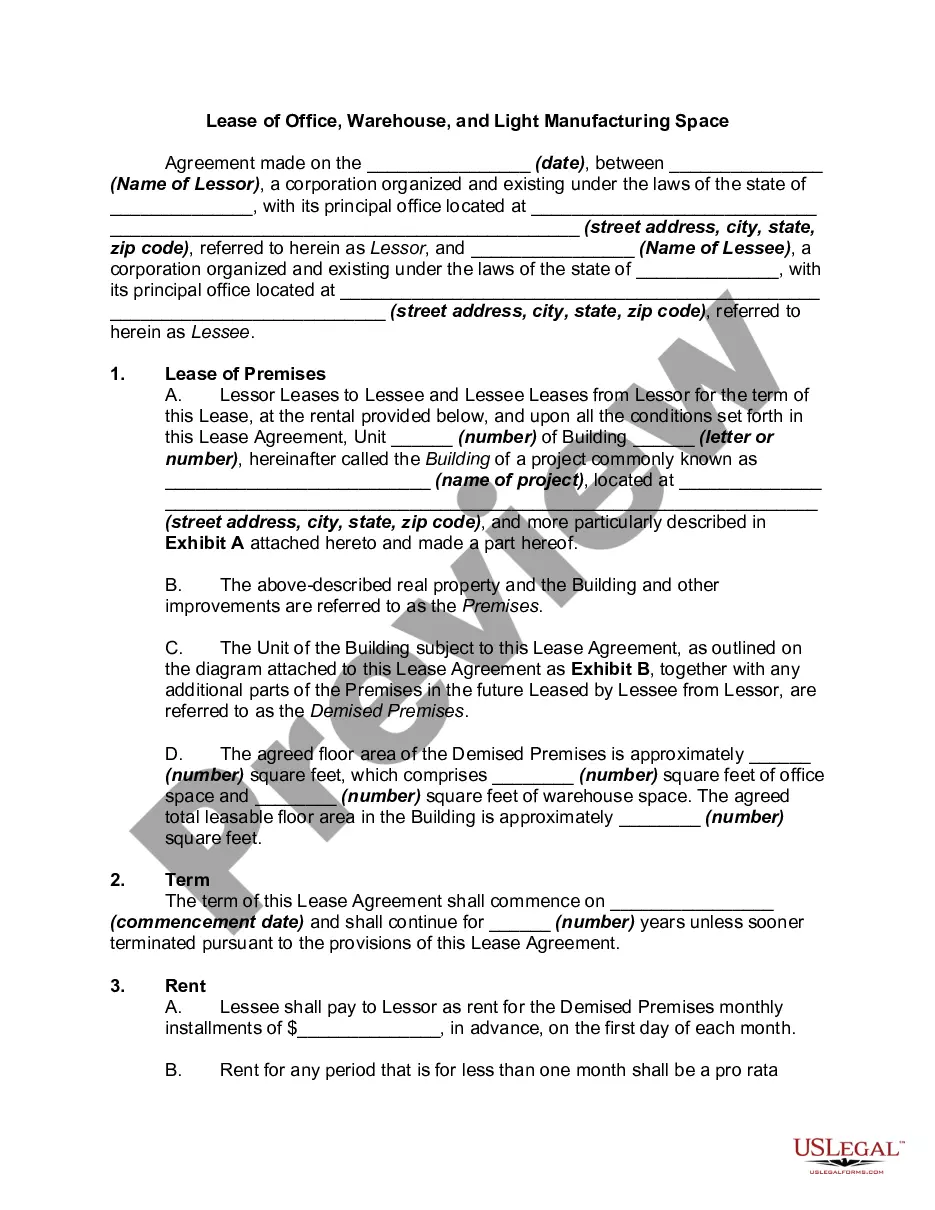

How to fill out Demand For Collateral By Creditor?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a wide range of legal document templates that you can download or generate.

By utilizing the platform, you will access a multitude of documents for business and individual purposes, organized by categories, claims, or keywords. You will find the latest versions of forms like the Tennessee Demand for Collateral by Creditor within moments.

If you have an account, Log In to download the Tennessee Demand for Collateral by Creditor from the US Legal Forms repository. The Download button will appear on each document you view. You can access all previously downloaded documents in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Tennessee Demand for Collateral by Creditor. Every document added to your account has no expiration date and belongs to you indefinitely. So, to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Tennessee Demand for Collateral by Creditor with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast array of professional and state-specific templates that cater to your business or personal needs.

- Ensure you have chosen the correct document for your city/state.

- Review the form to check its content.

- Read the description of the form to confirm that you have selected the appropriate one.

- If the form does not meet your requirements, use the Search area at the top of the screen to find one that does.

- If you are content with the form, validate your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

Possession of collateral refers to the physical control or custody of the secured item by the creditor. This control is often exercised to safeguard the collateral until the related debt is settled. Educating yourself about Tennessee Demand for Collateral by Creditor can illuminate your responsibilities and rights surrounding possession in financial dealings.

The process that makes a security interest in the collateral enforceable involves several steps, including attachment and perfection. Once a creditor’s interest is attached, it establishes their claim on the collateral. By understanding the Tennessee Demand for Collateral by Creditor, you can learn how to secure your rights effectively.

The right to take possession of collateral until a debt is repaid is known as the right of retention. This allows creditors to hold onto the secured item until the borrower fulfills their financial obligations. Familiarity with the Tennessee Demand for Collateral by Creditor gives you the insight needed to protect your interests in such arrangements.

A creditor's right to utilize collateral to recover a debt is referred to as a security interest. This legal right allows the creditor to assert a claim against the collateral if the borrower defaults on their obligations. In the context of Tennessee Demand for Collateral by Creditor, understanding this right empowers you to navigate financial agreements confidently.

Generally, a UCC filing in Tennessee is processed within a few business days. However, the timeframe can vary based on the volume of filings at the time. If you require rapid assistance, utilizing services like US Legal Forms can expedite the process. They offer efficient solutions and up-to-date information to help you secure your interests under the Tennessee Demand for Collateral by Creditor.

A debtor maintains certain rights in collateral despite a creditor's interest. These rights include the ability to possess and use the collateral until default occurs. Understanding these rights is crucial, especially if you are dealing with a Tennessee Demand for Collateral by Creditor. US Legal Forms offers resources to help you navigate these intricacies and protect your interests.

The maximum principal indebtedness in Tennessee varies depending on the type of transaction. For secured transactions, there is typically no set cap, allowing creditors to secure collateral as needed. Thus, when navigating your rights under the Tennessee Demand for Collateral by Creditor, it's vital to consult with legal resources or services like US Legal Forms. They can provide up-to-date insights and guidance tailored to your situation.

In Tennessee, UCC filings typically last for five years. After this period, the creditor must renew the filing to maintain their rights under the Tennessee Demand for Collateral by Creditor. It's essential to keep track of these dates to ensure that your interests remain protected. You can use platforms like US Legal Forms to manage your filings efficiently.

A UCC lien is a serious matter as it establishes a creditor's legal claim on a debtor's assets. It can impact a debtor's ability to secure further financing and affect their credit. Additionally, if the debtor defaults, the creditor has the right to reclaim the collateral. Therefore, handling a Tennessee Demand for Collateral by Creditor carefully is essential to minimize potential repercussions.

A UCC lien can be deemed invalid for several reasons, which often include improper filing, lack of an enforceable security agreement, or failure to perfect the security interest. If the collateral does not exist or the debtor lacks rights to it, the lien may also be challenged. Additionally, any mistakes in documentation or non-compliance with UCC regulations can void a lien. Understanding these factors can aid when managing a Tennessee Demand for Collateral by Creditor.