Tennessee Reimbursement for Expenditures - Resolution Form - Corporate Resolutions

Description

How to fill out Reimbursement For Expenditures - Resolution Form - Corporate Resolutions?

Are you currently in a position where you need documents for occasional organization or specific purposes frequently.

There are numerous legal document templates accessible online, yet locating reliable ones is not easy.

US Legal Forms offers a vast array of template forms, such as the Tennessee Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, which are crafted to meet both state and federal requirements.

Once you have the correct form, click Get now.

Select your desired pricing plan, enter the necessary information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Next, you can download the Tennessee Reimbursement for Expenditures - Resolution Form - Corporate Resolutions template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct area/state.

- Use the Review button to examine the form.

- Check the information to verify that you have chosen the right form.

- If the form is not what you seek, utilize the Research field to find the form that meets your requirements.

Form popularity

FAQ

An example of reimbursement involves an employee who travels for work and spends $200 on a hotel stay. After submitting the Tennessee Reimbursement for Expenditures - Resolution Form - Corporate Resolutions along with the hotel receipt, the company reimburses the employee for that amount. This process ensures that employees are compensated for out-of-pocket expenses incurred during business activities.

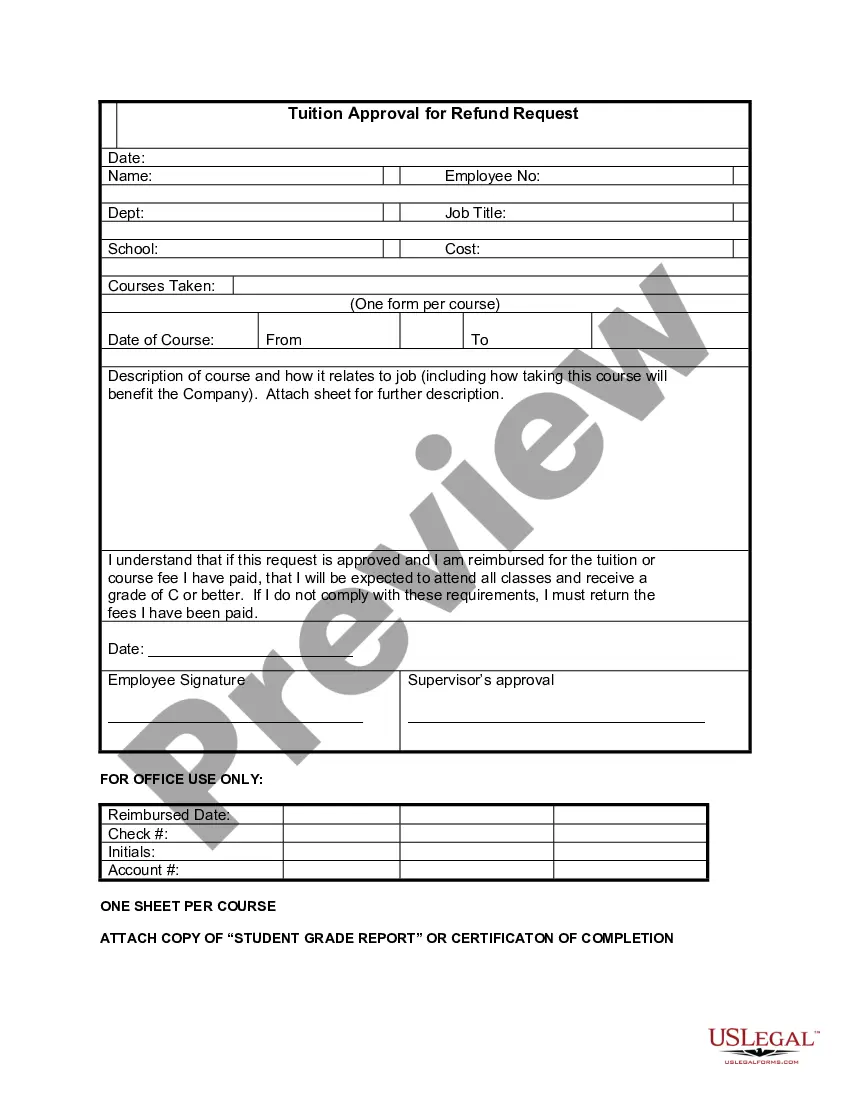

Writing a reimbursement form requires clarity and organization. Start with a title at the top indicating it is a reimbursement form, followed by sections for personal information, expense line items, and total amounts. Utilizing the Tennessee Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can help provide the necessary structure and format needed for effective documentation.

Creating a reimbursement form begins with outlining the information you need, such as the employee's details, expense categories, and a section for itemized expenses. You can find templates available online, including those tailored for Tennessee Reimbursement for Expenditures - Resolution Form - Corporate Resolutions. Simply modify these templates to suit your business needs, ensuring they include all vital information.

To fill out an expense reimbursement form, start by entering your personal and business information accurately. Include all relevant expense details, such as the dates, amounts, and descriptions of each expense. When using the Tennessee Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, make sure you provide any necessary receipts or proof of expenditures to support your claims.

Reimbursement is often abbreviated as 'Reim.' or 'Reimb.'. This simplified form is commonly accepted in business communication. If you are working with the Tennessee Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, using a clear abbreviation can help streamline your documentation process.

Closing a corporation in Tennessee requires a structured approach. Begin by obtaining approval from the board of directors and filing a Certificate of Dissolution with the Secretary of State. You should also address any outstanding debts and distribute remaining assets properly. For an efficient process, consider employing the Tennessee Reimbursement for Expenditures - Resolution Form - Corporate Resolutions to help guide you through financial obligations during the closure.

A reimbursement resolution is a document that authorizes a corporation to reimburse its officers or employees for expenses incurred on behalf of the company. This resolution specifies what types of expenses can be reimbursed and ensures compliance with tax regulations. By using the Tennessee Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, you can create a clear framework for handling expenses, fostering transparency and accountability within your organization.

Terminating a corporation in Tennessee involves a few key steps. First, you must secure approval from the board of directors and, in some cases, the shareholders as well. Then, you will need to file a Certificate of Dissolution with the Secretary of State. To address financial matters, using the Tennessee Reimbursement for Expenditures - Resolution Form - Corporate Resolutions helps clarify the distribution of assets and settlement of liabilities during the dissolution.

To initiate the process of terminating a corporation, you must first convene the board of directors to approve a resolution for dissolution. This resolution should detail the reasons for termination and how to handle company assets and liabilities. Subsequently, you will need to file the appropriate documents with the Tennessee Secretary of State. Utilizing the Tennessee Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can streamline this aspect of the process.