Tennessee Sample Letter for Agreement to Compromise Debt

Description

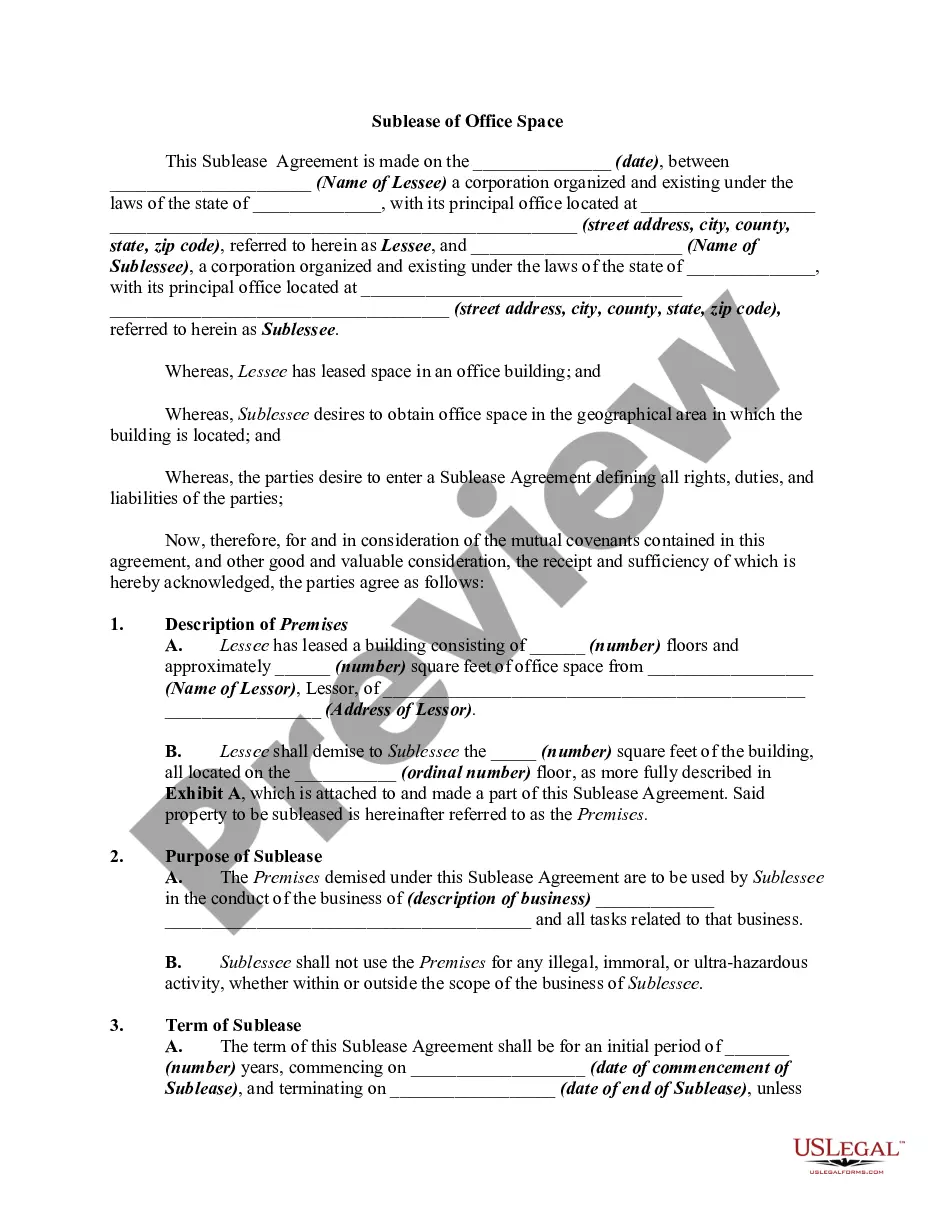

How to fill out Sample Letter For Agreement To Compromise Debt?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal use, organized by categories, states, or keywords. You can quickly retrieve the latest versions of forms like the Tennessee Sample Letter for Agreement to Compromise Debt.

If you are a subscriber, Log In and obtain the Tennessee Sample Letter for Agreement to Compromise Debt from the US Legal Forms library. The Download button will appear on every form you review.

Once you are satisfied with the form, confirm your selection by clicking the Buy Now button. Then, choose your desired pricing plan and provide your details to create an account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Select the format and download the form to your device. Edit. Fill in, modify, print, and sign the downloaded Tennessee Sample Letter for Agreement to Compromise Debt.

Every template you add to your account does not have an expiration date and is yours to keep permanently. Therefore, if you wish to download or print another version, simply go to the My documents section and click on the form you desire.

Access the Tennessee Sample Letter for Agreement to Compromise Debt with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- You have access to all previously acquired forms in the My documents section of your account.

- If you are new to US Legal Forms, here are some simple tips to get you started.

- Ensure you have selected the right form for your specific city/county.

- Click the Preview button to examine the content of the form.

- Check the form summary to confirm that you've chosen the appropriate form.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

Form popularity

FAQ

The 777 rule states that debt collectors must follow specific guidelines when attempting to collect debts. Under this rule, they cannot make false claims or threaten legal action unless they intend to take it. If you're facing challenges with debt collectors, using a Tennessee Sample Letter for Agreement to Compromise Debt can help you negotiate a settlement. This letter outlines your proposal clearly, helping you to communicate effectively with the collector.

To negotiate a good settlement, start by assessing your financial situation and determining what you can realistically afford. Approach your creditor professionally, using a well-structured proposal, like a Tennessee Sample Letter for Agreement to Compromise Debt. Stay calm and patient during negotiations, and be prepared for a back-and-forth discussion to reach a satisfactory agreement.

To fill out a debt validation letter, include your personal information, a clear request for validation, and details about the debt in question. Specify the name of the creditor, the amount owed, and any other relevant information. You can find templates like the Tennessee Sample Letter for Agreement to Compromise Debt online, which can guide you in crafting an effective letter.

A reasonable full and final settlement offer typically ranges from 30% to 70% of your outstanding debt. This offer depends on your financial situation, the creditor's willingness to negotiate, and the age of the debt. Using a Tennessee Sample Letter for Agreement to Compromise Debt can help you present your offer clearly and professionally, increasing your chances of approval.

The 777 rule outlines specific guidelines for how debt collectors can communicate with individuals regarding their debts. Under this rule, collectors must provide clear information about the debt, including the amount owed and the creditor's details. Knowing the 777 rule is important when considering a Tennessee Sample Letter for Agreement to Compromise Debt, as it helps ensure fair treatment from collectors. Utilizing this knowledge can empower you to negotiate effectively and protect your rights.

To write a debt collection letter, start with a straightforward introduction and state the purpose of the letter clearly. Include relevant details about the debt, such as the amount owed and the due date. Aim for a respectful tone while asserting the necessity for payment. For a polished template, the Tennessee Sample Letter for Agreement to Compromise Debt can provide helpful structure.

Writing a debt agreement involves detailing the not only the creditor and debtor information but also the specific terms of repayment. It should specify the total amount owed, the payment plan, and any due dates. Make sure both parties sign the document to ensure its validity. Crafting this can be easier with a Tennessee Sample Letter for Agreement to Compromise Debt for proper formatting.

The 11-word phrase to stop debt collectors is: 'I do not want to discuss this debt any further.' Using this phrase communicates your intention firmly. Remember, however, that while it halts communication, it may not eliminate the debt itself. If you want to negotiate, consult a Tennessee Sample Letter for Agreement to Compromise Debt for effective language.

A debt settlement agreement should clearly outline the terms between you and the creditor. Start with the primary details, including the debtor’s and creditor’s information, the total debt amount, and the agreed settlement amount. Include how and when the payment will be made. A Tennessee Sample Letter for Agreement to Compromise Debt can serve as an excellent reference for structuring your agreement.

The 7 7 7 rule suggests that collectors should reach out to the debtor in seven days, seven weeks, and seven months. This systematic follow-up approach helps maintain communication without overwhelming the debtor. It can increase the chances of collecting the debt while keeping the lines of discussion open. Utilizing templates like the Tennessee Sample Letter for Agreement to Compromise Debt can streamline this process.