A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

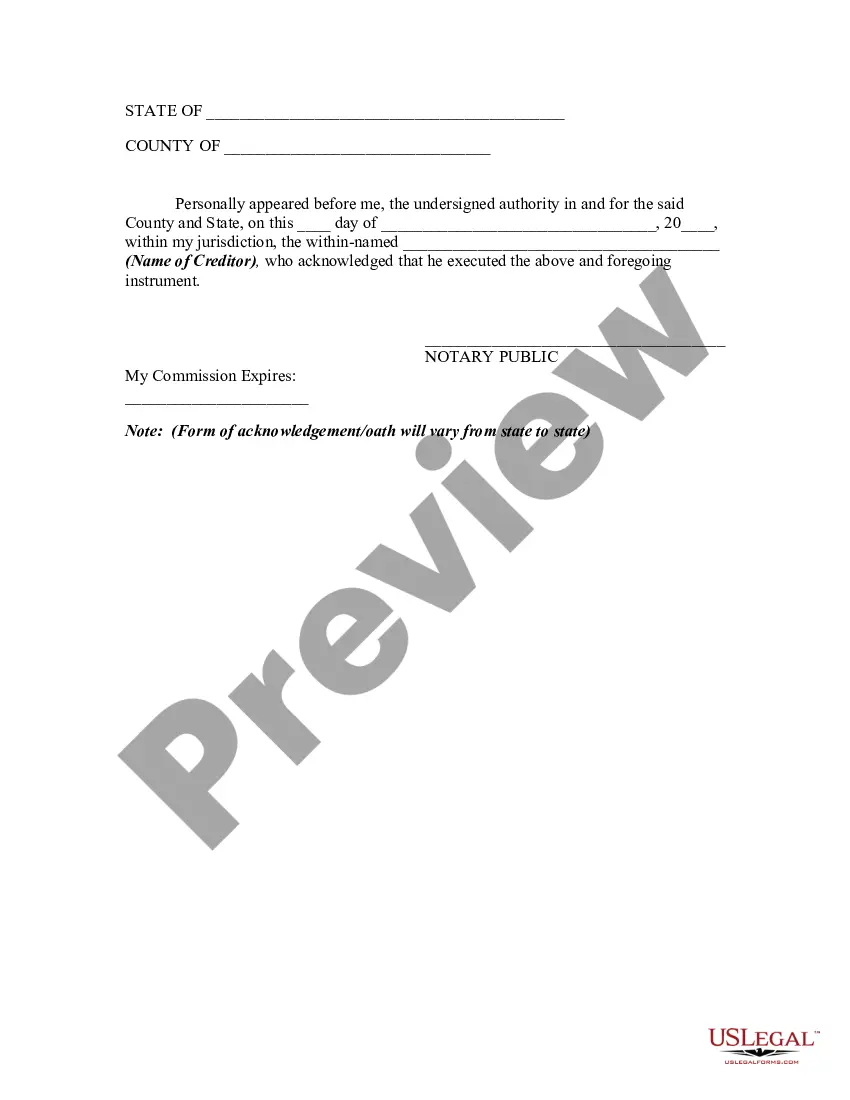

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding Tennessee Release of Claims Against an Estate By Creditor Keywords: Tennessee release of claims, estate creditor, estate collection, estate debt, Tennessee probate laws, estate settlement, creditor's rights, estate distribution, creditor protection Introduction: In Tennessee, when someone passes away, their assets and liabilities are handled through a legal process known as probate. During probate, creditors who are owed outstanding debts by the deceased individual have the opportunity to file a claim against the estate. However, creditors also have the option to release their claims against the estate, allowing for a smoother settlement process. This article aims to provide a detailed description of what the Tennessee Release of Claims Against an Estate By Creditor entails, its significance, and any potential variations that exist. I. Tennessee Release of Claims Against an Estate By Creditor: The Tennessee Release of Claims Against an Estate By Creditor is a legally binding document that allows a creditor to relinquish their right to pursue a specific debt owed to them by the decedent's estate. By signing this release, creditors formally acknowledge that they no longer have any claim against the estate and waive their right to further collection efforts. II. Significance and Purpose: 1. Streamlined Settlement: By utilizing the Tennessee Release of Claims, creditors play a pivotal role in facilitating a smoother settlement process for the estate by promptly releasing their claim. This action enables the estate's personal representative to distribute assets and fulfill other obligations efficiently. 2. Creditor Protection: The release serves as a legal shield for creditors, safeguarding them against potential claims by other interested parties. It helps protect the creditor's rights and interests while ensuring they receive equitable treatment throughout the estate distribution process. III. Types of Tennessee Release of Claims Against an Estate By Creditor: 1. General Release: A general release is a comprehensive waiver that encompasses all debts owed by the estate. It frees the estate from any and all future claims by the creditor pertaining to the decedent's estate, regardless of their nature. 2. Specific Release: Unlike a general release, a specific release is limited to a particular debt or obligation owed by the decedent's estate. The creditor releases only the specific debt mentioned in the document, retaining their right to pursue other outstanding obligations. 3. Partial Release: A partial release involves releasing a portion of the debt owed by the estate while reserving the right to collect the remaining balance. This type of release may arise in cases where the estate's assets are insufficient to satisfy the entire debt owed. Conclusion: Understanding the Tennessee Release of Claims Against an Estate By Creditor is crucial for both parties involved in the probate process. Whether creditors choose a general, specific, or partial release, this legally binding document not only expedites estate settlement but also protects their rights. Embracing the benefits yielded by a release ensures a smoother distribution of assets and streamlines the overall resolution of the estate's finances.Title: Understanding Tennessee Release of Claims Against an Estate By Creditor Keywords: Tennessee release of claims, estate creditor, estate collection, estate debt, Tennessee probate laws, estate settlement, creditor's rights, estate distribution, creditor protection Introduction: In Tennessee, when someone passes away, their assets and liabilities are handled through a legal process known as probate. During probate, creditors who are owed outstanding debts by the deceased individual have the opportunity to file a claim against the estate. However, creditors also have the option to release their claims against the estate, allowing for a smoother settlement process. This article aims to provide a detailed description of what the Tennessee Release of Claims Against an Estate By Creditor entails, its significance, and any potential variations that exist. I. Tennessee Release of Claims Against an Estate By Creditor: The Tennessee Release of Claims Against an Estate By Creditor is a legally binding document that allows a creditor to relinquish their right to pursue a specific debt owed to them by the decedent's estate. By signing this release, creditors formally acknowledge that they no longer have any claim against the estate and waive their right to further collection efforts. II. Significance and Purpose: 1. Streamlined Settlement: By utilizing the Tennessee Release of Claims, creditors play a pivotal role in facilitating a smoother settlement process for the estate by promptly releasing their claim. This action enables the estate's personal representative to distribute assets and fulfill other obligations efficiently. 2. Creditor Protection: The release serves as a legal shield for creditors, safeguarding them against potential claims by other interested parties. It helps protect the creditor's rights and interests while ensuring they receive equitable treatment throughout the estate distribution process. III. Types of Tennessee Release of Claims Against an Estate By Creditor: 1. General Release: A general release is a comprehensive waiver that encompasses all debts owed by the estate. It frees the estate from any and all future claims by the creditor pertaining to the decedent's estate, regardless of their nature. 2. Specific Release: Unlike a general release, a specific release is limited to a particular debt or obligation owed by the decedent's estate. The creditor releases only the specific debt mentioned in the document, retaining their right to pursue other outstanding obligations. 3. Partial Release: A partial release involves releasing a portion of the debt owed by the estate while reserving the right to collect the remaining balance. This type of release may arise in cases where the estate's assets are insufficient to satisfy the entire debt owed. Conclusion: Understanding the Tennessee Release of Claims Against an Estate By Creditor is crucial for both parties involved in the probate process. Whether creditors choose a general, specific, or partial release, this legally binding document not only expedites estate settlement but also protects their rights. Embracing the benefits yielded by a release ensures a smoother distribution of assets and streamlines the overall resolution of the estate's finances.