Tennessee Loan Agreement - Long Form

Description

How to fill out Loan Agreement - Long Form?

Have you ever been in a situation where you require documentation for various business or specific purposes almost every time.

There are numerous authentic document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms provides an extensive array of form templates, including the Tennessee Loan Agreement - Long Form, which are designed to satisfy federal and state regulations.

Once you find the appropriate form, click Buy now.

Choose the payment plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or credit card. Select a suitable format and download your copy. You can view all the document templates you have purchased in the My documents section. You can download an additional copy of the Tennessee Loan Agreement - Long Form at any time, if necessary. Click the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of authentic forms, to save time and eliminate errors. The service provides properly crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess a free account, simply Log In.

- Then, you can download the Tennessee Loan Agreement - Long Form template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/state.

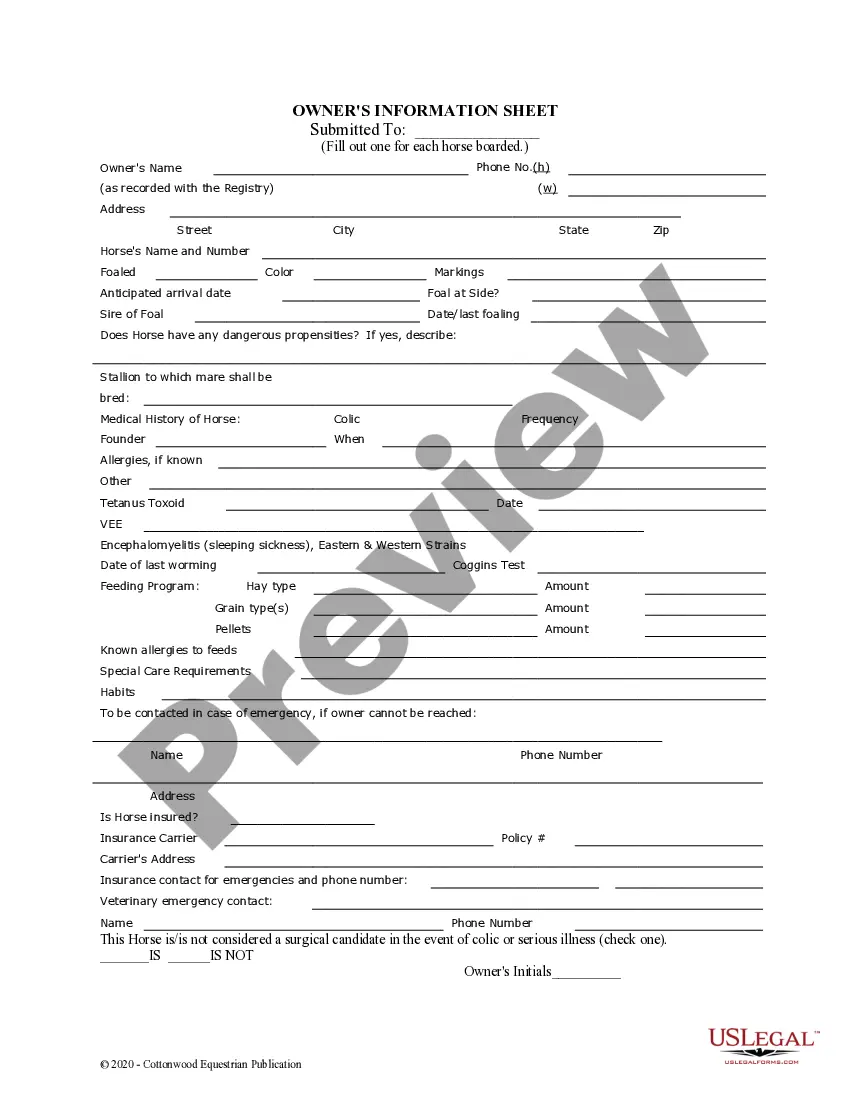

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search box to locate the form that meets your needs.

Form popularity

FAQ

A loan extension agreement is a mutual agreement between a lender and borrower that extends the maturity date on a borrower's loan. Most commonly used when a borrower falls behind on payments, a loan extension agreement can restructure the loan payment schedule to get the borrower back on track.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

A contract extension is an agreement between the parties to an existing contract to extend the terms of that agreement for an additional period of time. The duration of the extension is specified in the extension agreement.

A loan refers to any type of debt and is a sum of money that is borrowed and then repaid over time, typically with interest. In contrast, a mortgage is a loan used to purchase property or land.

A loan renewal also requires the cancelling of the original loan agreement. A loan extension is extending the original maturity date of the existing loan agreement with or without changes in the rates and or repayment terms.

It may be possible to extend your existing loan, but it'll be at the lender's discretion and may cost you in interest and charges. Alternatively, you could consider transferring the debt to a different source of finance with lower interest rates, and spread the repayments over a longer timeframe.

Loan terms refer to the terms and conditions involved when borrowing money. This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged, and any other special conditions that may apply.

The term refers to an amendment to a syndicated loan agreement where certain lenders agree in advance to extend the maturity date of their loans.