Tennessee Multistate Promissory Note - Secured

Description

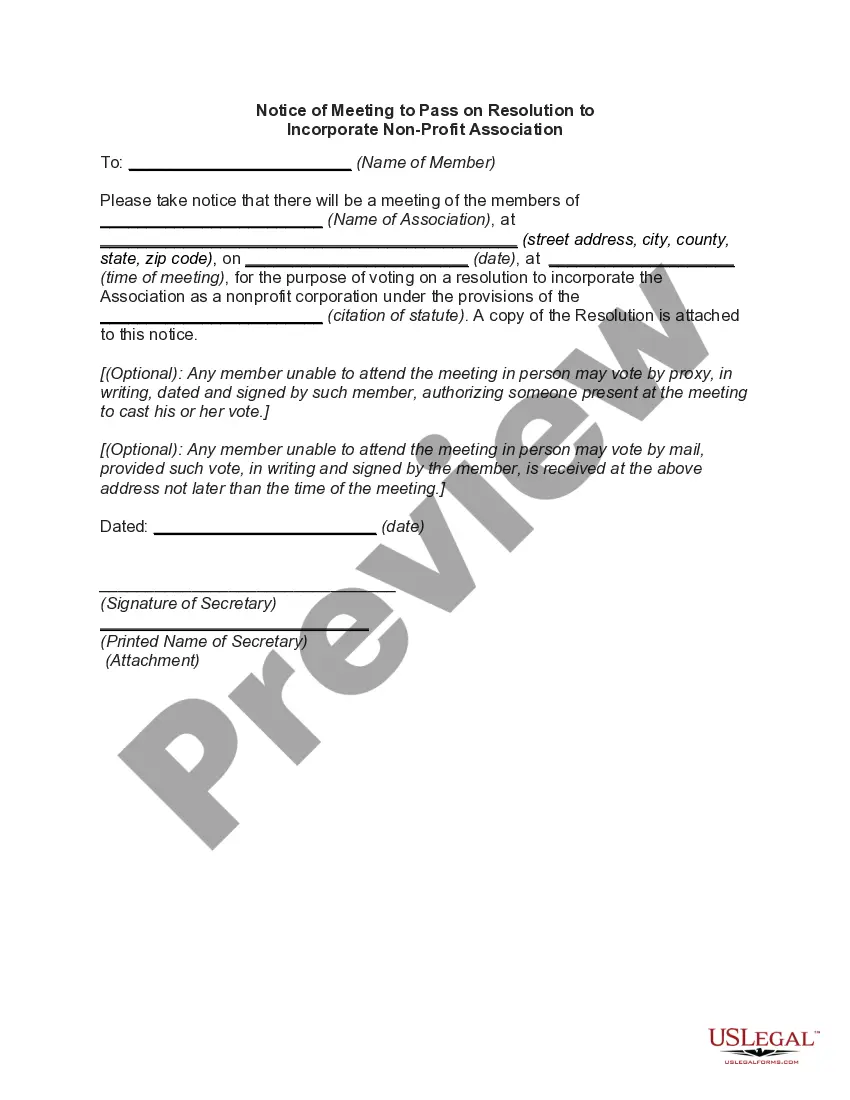

How to fill out Multistate Promissory Note - Secured?

Selecting the ideal legitimate document template can be quite challenging. Naturally, there are numerous designs accessible online, but how do you find the authentic type you need.

Utilize the US Legal Forms website. The service offers an extensive collection of templates, such as the Tennessee Multistate Promissory Note - Secured, suitable for business and personal needs. All the documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Tennessee Multistate Promissory Note - Secured. Use your account to search for the legitimate forms you have previously purchased. Visit the My documents tab of your account and get another copy of the documents you require.

Choose the document format and download the legitimate document template to your device. Complete, edit, print, and sign the fetched Tennessee Multistate Promissory Note - Secured. US Legal Forms is the largest repository of legitimate forms where you can discover various document templates. Utilize the service to obtain professionally crafted documents that adhere to state guidelines.

- First, ensure you have selected the appropriate form for your region/area.

- You can examine the document using the Review button and read the document description to confirm it is the correct one for you.

- If the form does not fulfill your requirements, use the Search field to find the right form.

- Once you are sure the document is appropriate, click the Buy now button to acquire the form.

- Select the pricing plan you desire and provide the necessary information.

- Create your account and complete the payment using your PayPal account or credit card.

Form popularity

FAQ

Yes, promissory notes are legal and recognized in the USA, including Tennessee. They serve as valid financial instruments, provided they meet state and federal requirements. Ensuring that your Tennessee Multistate Promissory Note - Secured adheres to legal standards is crucial for its enforceability. Legal resources like uslegalforms are invaluable tools for ensuring compliance with various laws.

Promissory notes are often classified as debt securities because they represent a borrower’s obligation to repay borrowed funds. This classification applies, especially when structured for investment purposes. Recognizing the implications of your Tennessee Multistate Promissory Note - Secured as a debt security can be beneficial. For comprehensive guidance, consider consulting services like uslegalforms.

An unsecured promissory note may indeed be considered a security based on its usage and intent. When it is offered for sale to the public with an expectation of profit, it can fall under the legal definition of a security. Understanding the distinctions of your Tennessee Multistate Promissory Note - Secured makes a significant difference. Legal platforms such as uslegalforms can clarify these complexities.

Yes, a promissory note can be categorized as a type of security, depending on various factors. When a note is structured for investment purposes, it often meets the criteria for securities classification. Therefore, having a clear understanding of your Tennessee Multistate Promissory Note - Secured can prevent legal complications. Use resources like uslegalforms to stay informed and compliant.

Typically, an unsecured promissory note is seen as a security under certain legal conditions. If the note is sold to investors with the expectation of profit, it may fall under securities laws. Thus, understanding the nature of your Tennessee Multistate Promissory Note - Secured is crucial to ensure compliance. Platforms like uslegalforms can help you navigate these regulations effectively.

The Tennessee Multistate Promissory Note - Secured generally is not classified as a security. In many cases, promissory notes are exempt from securities regulations if they meet specific criteria. However, it is essential to analyze the context and terms of each note to determine its classification. Consulting legal platforms like uslegalforms can provide clarity on your specific situation.

In Tennessee, a promissory note, including a Tennessee Multistate Promissory Note - Secured, does not need to be notarized to be enforceable. However, notarization may add an extra layer of verification and could be beneficial in case of disputes. It's wise to consult legal resources, such as uslegalforms, for specific guidance.

Filling out a Tennessee Multistate Promissory Note - Secured, in the form of a demand note, involves entering the borrower and lender details, along with the amount and terms. The critical difference is that demand notes require payment upon request from the lender, rather than on a fixed schedule. As always, clear documentation helps avoid misunderstandings.

To write a simple Tennessee Multistate Promissory Note - Secured, begin by clearly stating the amount borrowed and the repayment terms. Include essential details like the names of the parties, the interest rate, and what happens in case of default. You may consider using a template from uslegalforms for guidance to ensure legal compliance and clarity.

To fill out a Tennessee Multistate Promissory Note - Secured, start by entering the names of both the borrower and the lender at the top of the document. Next, specify the principal amount borrowed, the interest rate, and the repayment terms clearly. Finally, include details about any collateral securing the note, and ensure both parties sign the document.