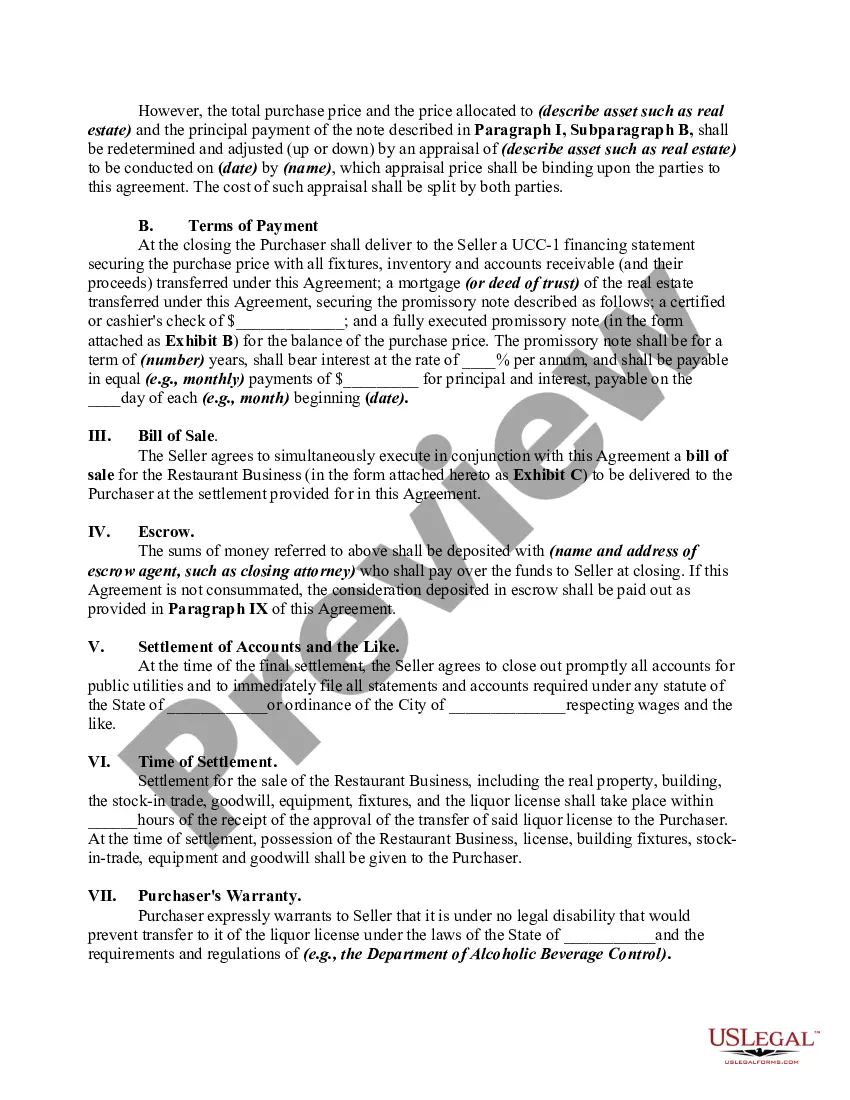

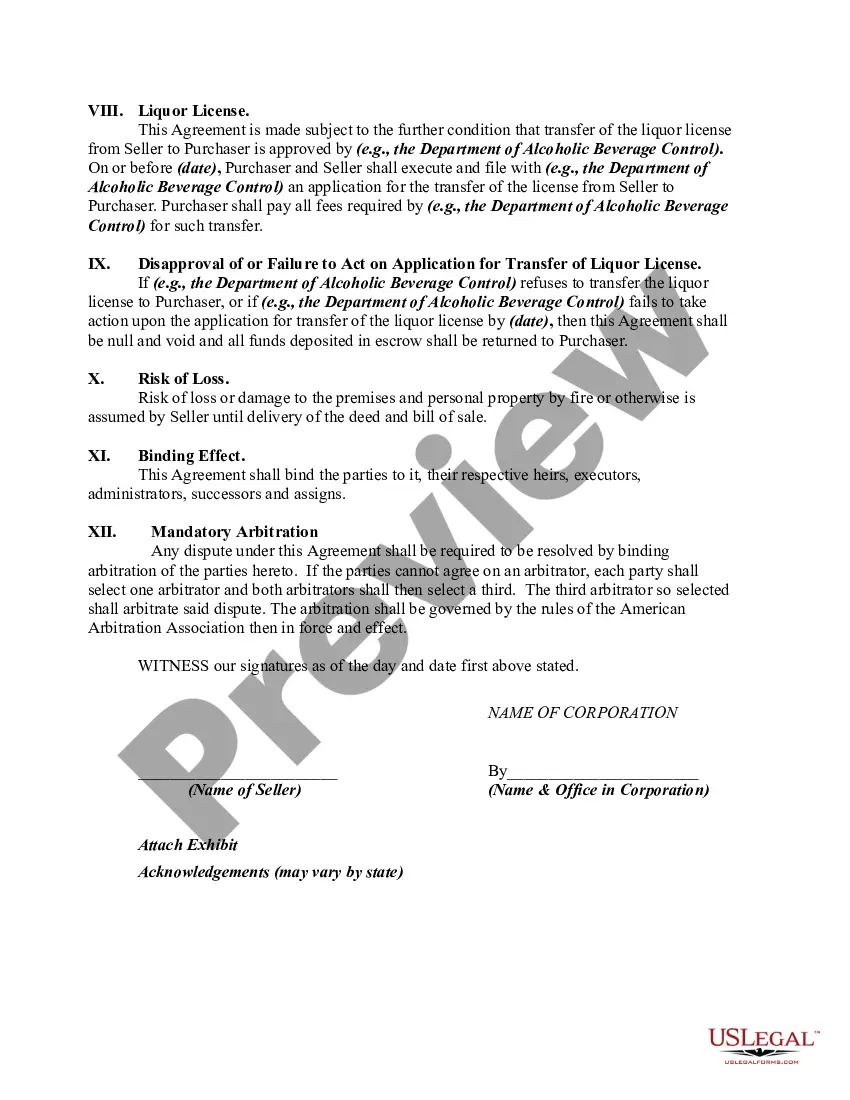

A Tennessee Agreement for Purchase and Sale of Restaurant including Bar Business, Liquor License, and Real Estate, with Purchase to Finance Part of Purchase Price is a legal document that outlines the terms and conditions for buying a restaurant business, including the bar, liquor license, and associated real estate properties, in the state of Tennessee. This agreement is typically used when the buyer intends to finance a portion of the purchase price. The agreement includes various clauses and provisions that protect the rights and interests of both the buyer and seller. It typically includes details such as the purchase price, payment terms, financing arrangements, closing date, inventory included, equipment and fixtures, lease terms for the premises, liquor license transfer process, and any other relevant contingencies. There may be different types of Tennessee Agreements for Purchase and Sale of Restaurant including Bar Business, Liquor License, and Real Estate, with Purchase to Finance Part of Purchase Price, depending on the specific circumstances of the transaction. These may include: 1. Asset Purchase Agreement: This type of agreement is used when the buyer intends to purchase specific assets of the restaurant business, such as equipment, inventory, leasehold improvements, and the liquor license. 2. Stock Purchase Agreement: If the restaurant business is operated as a corporation, the buyer may opt to purchase the shares or stock of the corporation, which includes ownership of all assets and liabilities associated with the business. 3. Leasehold Purchase Agreement: If the buyer intends to purchase only the leasehold rights to the premises where the restaurant business operates, this type of agreement is drafted to include the terms and conditions related to the lease transfer. 4. Conditional Purchase Agreement: In some cases, the purchase of the restaurant business may be subject to certain conditions, such as obtaining financing or securing necessary permits and licenses. A conditional purchase agreement outlines the specific conditions that must be met for the sale to proceed. In all cases, it is crucial for both parties to consult legal professionals to ensure that the agreement accurately reflects their intentions and protects their respective interests.

Tennessee Agreement for Purchase and Sale of Restaurant including Bar Business, Liquor License and Real Estate, with Purchase to Finance Part of Purchase Price

Description

How to fill out Tennessee Agreement For Purchase And Sale Of Restaurant Including Bar Business, Liquor License And Real Estate, With Purchase To Finance Part Of Purchase Price?

If you have to full, acquire, or printing legal document themes, use US Legal Forms, the most important variety of legal types, that can be found online. Take advantage of the site`s simple and easy hassle-free research to find the documents you require. Different themes for business and specific uses are categorized by categories and states, or key phrases. Use US Legal Forms to find the Tennessee Agreement for Purchase and Sale of Restaurant including Bar Business, Liquor License and Real Estate, with Purchase to Finance Part of Purchase Price in just a number of mouse clicks.

If you are presently a US Legal Forms customer, log in for your bank account and click on the Down load button to have the Tennessee Agreement for Purchase and Sale of Restaurant including Bar Business, Liquor License and Real Estate, with Purchase to Finance Part of Purchase Price. You can also entry types you earlier downloaded from the My Forms tab of your respective bank account.

If you are using US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape to the correct metropolis/nation.

- Step 2. Make use of the Review option to check out the form`s content. Never neglect to see the explanation.

- Step 3. If you are not satisfied with the type, make use of the Look for industry towards the top of the monitor to locate other variations in the legal type web template.

- Step 4. Upon having discovered the shape you require, click on the Get now button. Opt for the rates plan you choose and add your qualifications to register for the bank account.

- Step 5. Approach the transaction. You should use your credit card or PayPal bank account to finish the transaction.

- Step 6. Choose the formatting in the legal type and acquire it on your device.

- Step 7. Comprehensive, modify and printing or signal the Tennessee Agreement for Purchase and Sale of Restaurant including Bar Business, Liquor License and Real Estate, with Purchase to Finance Part of Purchase Price.

Every single legal document web template you acquire is your own property permanently. You may have acces to each and every type you downloaded with your acccount. Click on the My Forms portion and pick a type to printing or acquire again.

Be competitive and acquire, and printing the Tennessee Agreement for Purchase and Sale of Restaurant including Bar Business, Liquor License and Real Estate, with Purchase to Finance Part of Purchase Price with US Legal Forms. There are thousands of expert and state-particular types you can utilize to your business or specific requires.