Tennessee Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death

Description

How to fill out Letter To Creditor, Collection Agencies, Credit Issuer Or Utility Company Notifying Them Of Death?

Choosing the right authorized document template can be quite a have a problem. Of course, there are plenty of layouts available on the Internet, but how can you obtain the authorized form you require? Utilize the US Legal Forms internet site. The service provides a huge number of layouts, like the Tennessee Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death, that you can use for organization and personal needs. Each of the types are checked out by pros and fulfill state and federal requirements.

If you are currently listed, log in to your profile and click the Obtain key to obtain the Tennessee Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death. Utilize your profile to search through the authorized types you may have ordered earlier. Check out the My Forms tab of your profile and obtain an additional duplicate of the document you require.

If you are a new user of US Legal Forms, listed below are simple instructions so that you can adhere to:

- First, make certain you have chosen the proper form for the city/region. You are able to check out the shape while using Preview key and look at the shape outline to make certain this is basically the best for you.

- If the form is not going to fulfill your expectations, use the Seach field to find the right form.

- When you are sure that the shape is acceptable, select the Get now key to obtain the form.

- Choose the costs strategy you want and enter in the essential information. Build your profile and buy the order with your PayPal profile or bank card.

- Opt for the submit file format and obtain the authorized document template to your product.

- Full, modify and print and sign the acquired Tennessee Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death.

US Legal Forms will be the most significant collection of authorized types that you will find various document layouts. Utilize the service to obtain expertly-made files that adhere to status requirements.

Form popularity

FAQ

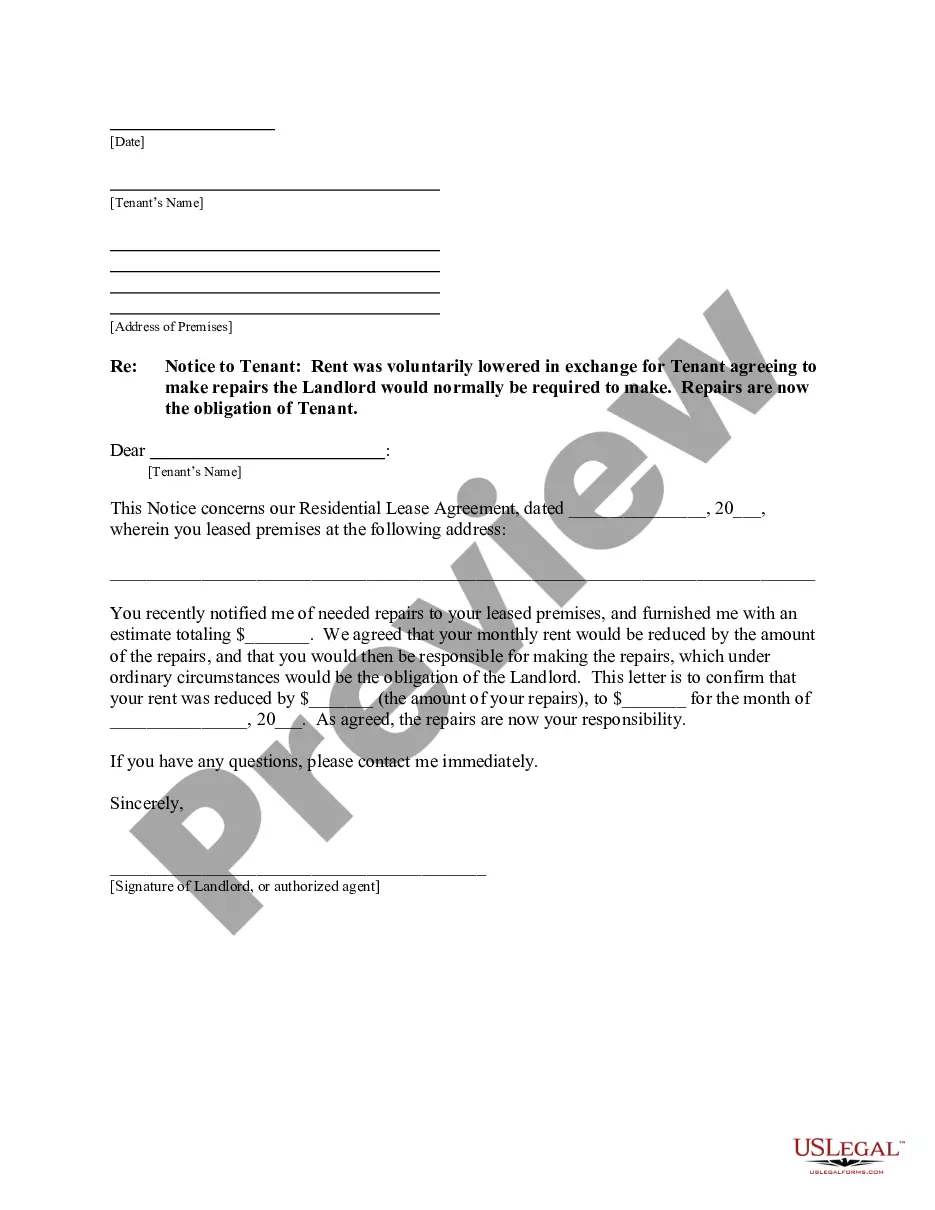

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.

Jump ahead to these sections: Step 1: Decide What Medium You'd Like To Use. Step 2: Begin With a Formal Salutation. Step 3: Begin With an Expression of Sympathy. Step 4: Let People Know Some Details Surrounding Your Loved One's Death. Step 5: Talk About Plans for Ceremonies or Services for Mourners.

Write a letter to one of the nationwide credit reporting agencies. Whichever agency you contact ? TransUnion, Equifax or Experian ? will then notify the other two on your behalf. Along with a copy of the death certificate, please also include the following for the deceased: Legal name.

Death Intimation Letter Sample I am Akash Reddy, holding a current account with number (mention your account number), beg to state that my mother passed away on 10th February, 2022 due to cardiac arrest. I kindly request you to update the information in my bank account at the earliest.

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.