Title: Tennessee Complaint for Breach of Fiduciary Duty — Trust: Understanding and Types Introduction: A Tennessee Complaint for Breach of Fiduciary Duty — Trust is a legal document used to bring a claim against a trustee who has failed to uphold their fiduciary duties. Fiduciary duties are legally binding responsibilities that trustees have towards their beneficiaries. This article aims to provide a detailed description of this complaint and explore some different types of breach of fiduciary duty cases in Tennessee. Keywords: Tennessee, Complaint for Breach of Fiduciary Duty — Trust, fiduciary duties, trustee, beneficiaries. 1. Overview and Purpose of a Tennessee Complaint for Breach of Fiduciary Duty — Trust: A Tennessee Complaint for Breach of Fiduciary Duty — Trust is filed by a beneficiary to seek legal recourse against a trustee who has breached their fiduciary duties. This complaint aims to address the harm caused by the trustee's actions or negligence, seeking compensation or removal of the trustee from their position. 2. Key Elements of a Tennessee Complaint for Breach of Fiduciary Duty — Trust: a) Identification: The complaint must clearly identify the parties involved, including the plaintiff (beneficiary) and defendant (trustee). b) Fiduciary Relationship: It is necessary to establish the existence of a fiduciary relationship between the trustee and beneficiary. c) Breach of Fiduciary Duty: The complaint must present specific instances where the trustee failed to fulfill their fiduciary obligations. d) Harm and Damages: The complaint must demonstrate the harm suffered by the beneficiary as a result of the trustee's breach of duty. e) Relief Sought: The complaint should outline the remedies sought, such as financial compensation, removal of the trustee, or other appropriate relief. 3. Types of Tennessee Complaint for Breach of Fiduciary Duty — Trust: a) Mismanagement of Trust Assets: When a trustee misuses or misappropriates trust assets for personal gain, leading to financial harm to the beneficiaries. b) Conflict of Interest: When a trustee engages in actions that benefit them personally or a third party, resulting in a conflict with their duty to act solely in the interest of the beneficiaries. c) Failure to Distribute or Administer the Trust: When a trustee unreasonably delays or fails to make timely distributions to the beneficiaries or fails to properly administer the trust in compliance with its terms and legal requirements. d) Self-dealing: Occurs when a trustee enters into transactions for personal gain, such as selling trust property to themselves or a related party at an unfair price. e) Negligence or Breach of Duty of Care: The trustee fails to exercise reasonable care, skill, and diligence in managing the trust, resulting in financial losses to the beneficiaries. Conclusion: A Tennessee Complaint for Breach of Fiduciary Duty — Trust is a vital tool for beneficiaries seeking to hold trustees accountable for their failure to meet fiduciary obligations. By understanding the purpose, key elements, and different types of breaches, beneficiaries can pursue legal remedies to protect their interests and seek fair compensation for any harm suffered.

Tennessee Complaint for Breach of Fiduciary Duty - Trust

Description

How to fill out Tennessee Complaint For Breach Of Fiduciary Duty - Trust?

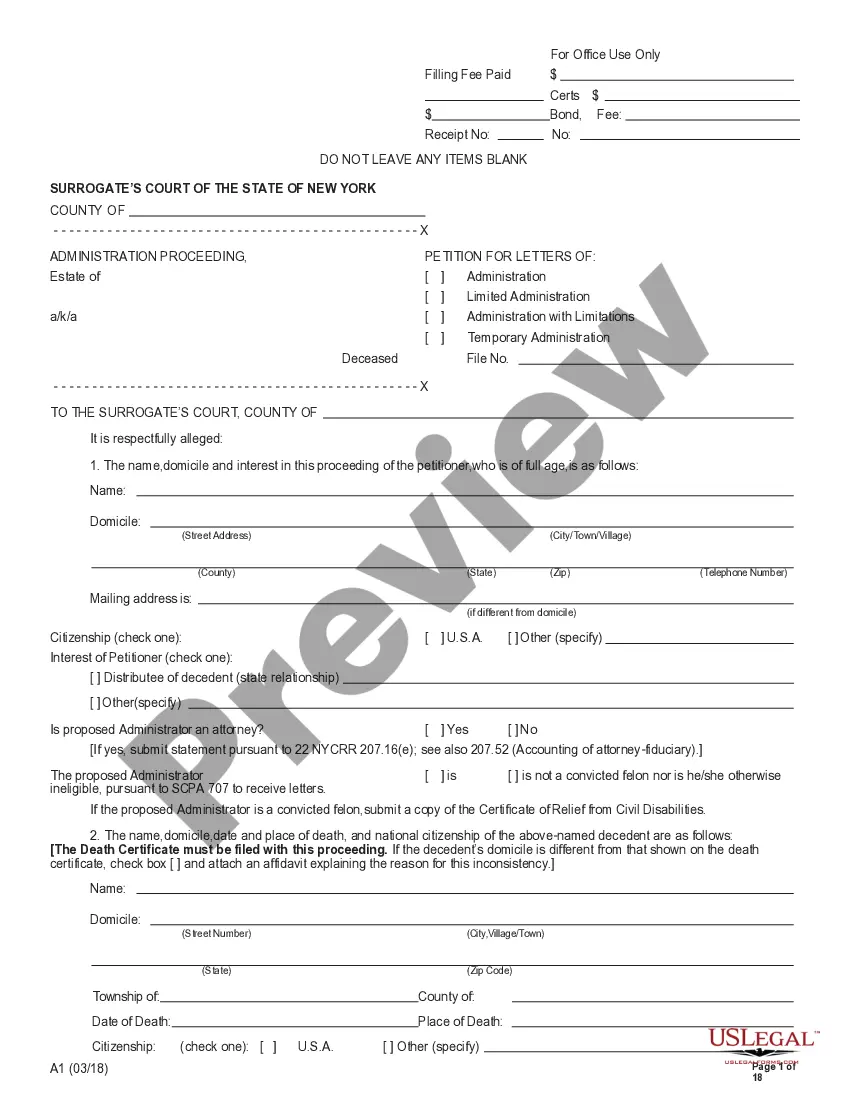

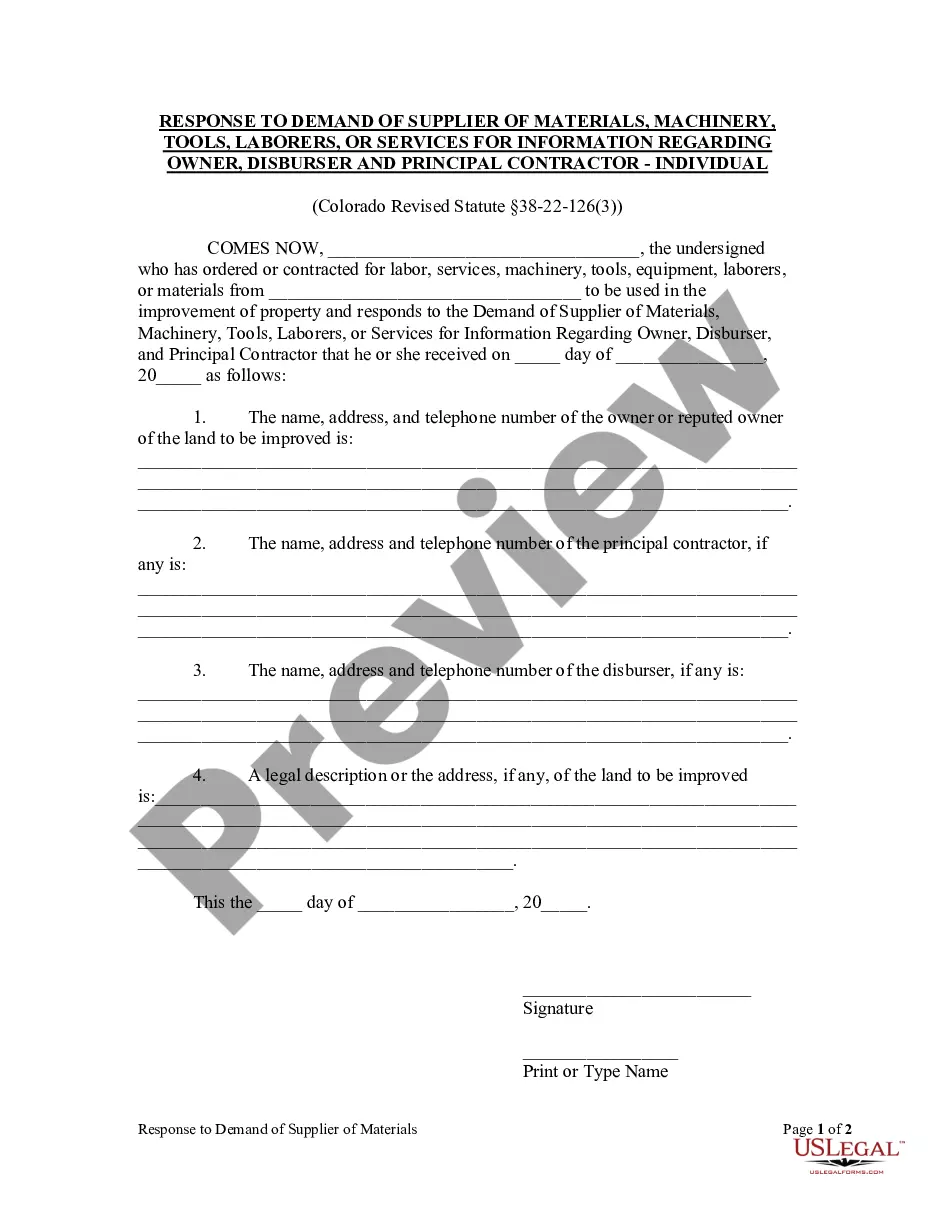

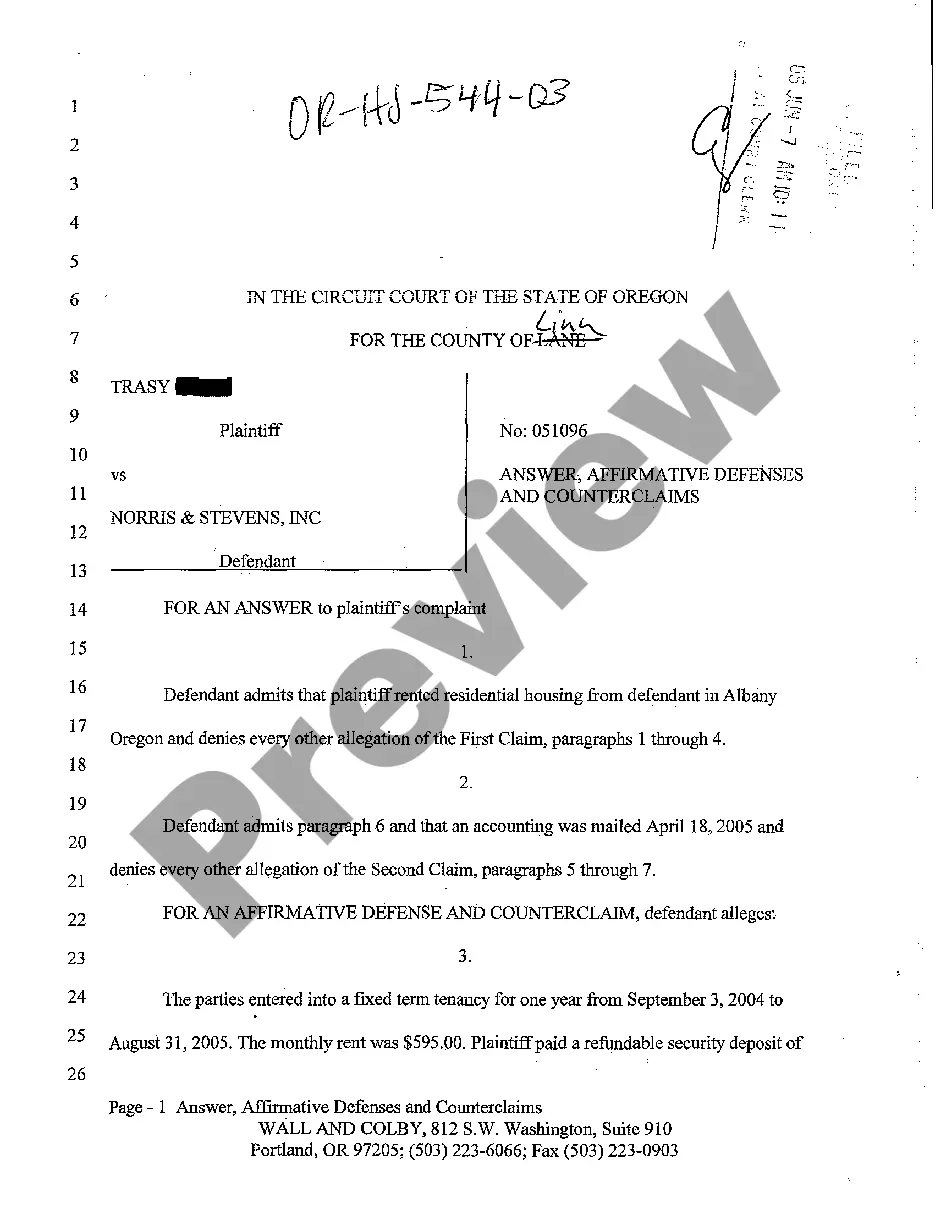

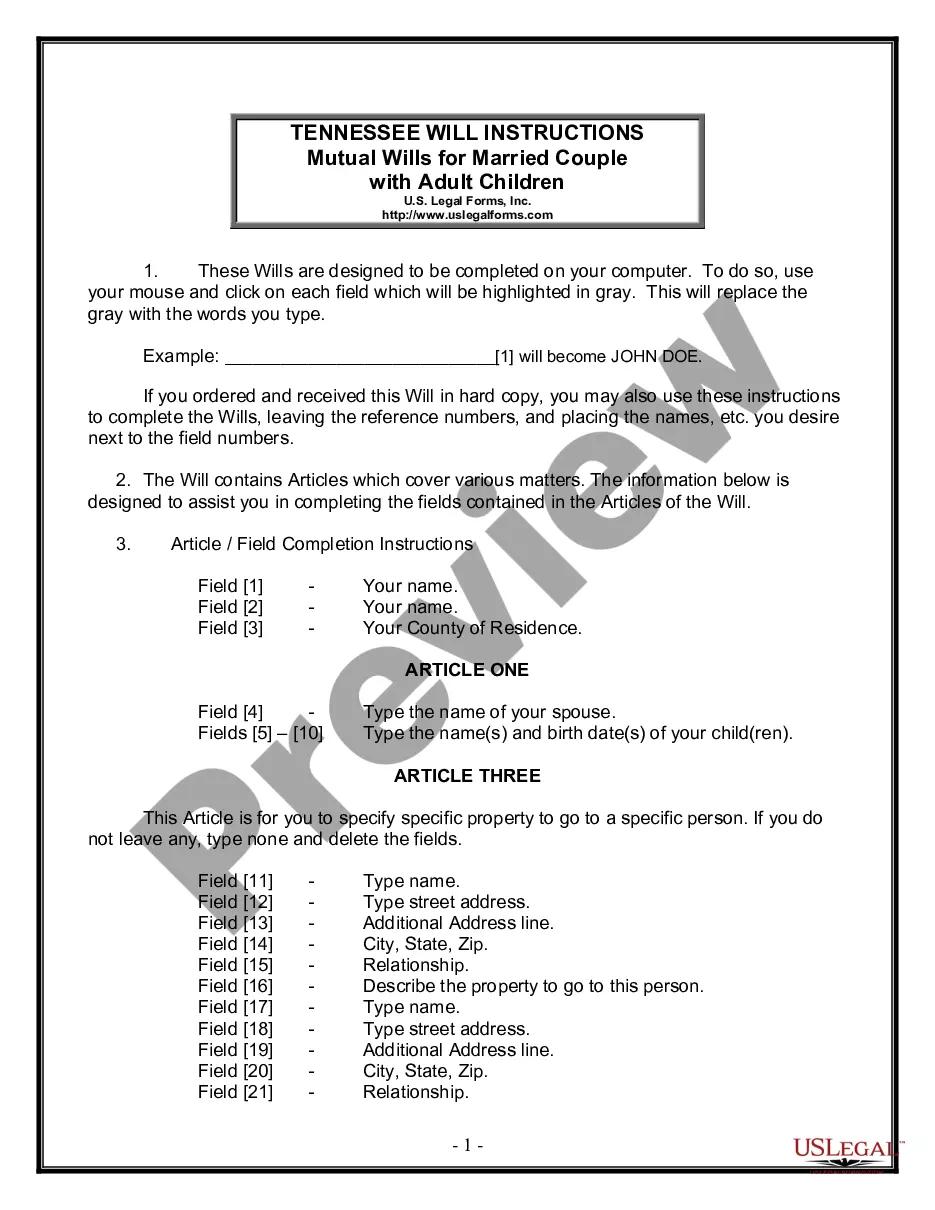

Are you presently within a place in which you will need papers for sometimes company or person functions virtually every time? There are plenty of lawful record web templates available on the Internet, but getting ones you can rely on is not easy. US Legal Forms delivers a large number of develop web templates, much like the Tennessee Complaint for Breach of Fiduciary Duty - Trust, which are published to meet state and federal requirements.

When you are already informed about US Legal Forms site and possess an account, simply log in. Afterward, it is possible to acquire the Tennessee Complaint for Breach of Fiduciary Duty - Trust design.

Should you not provide an account and want to begin to use US Legal Forms, abide by these steps:

- Find the develop you require and make sure it is for that proper metropolis/area.

- Utilize the Preview button to check the shape.

- Read the explanation to ensure that you have chosen the correct develop.

- When the develop is not what you`re trying to find, use the Search discipline to obtain the develop that suits you and requirements.

- If you get the proper develop, simply click Acquire now.

- Select the pricing program you would like, complete the required information to produce your bank account, and pay money for the order making use of your PayPal or Visa or Mastercard.

- Select a hassle-free data file format and acquire your copy.

Locate each of the record web templates you have purchased in the My Forms menu. You can aquire a extra copy of Tennessee Complaint for Breach of Fiduciary Duty - Trust any time, if necessary. Just click on the required develop to acquire or printing the record design.

Use US Legal Forms, by far the most considerable assortment of lawful forms, to save time and prevent faults. The service delivers appropriately made lawful record web templates that you can use for an array of functions. Make an account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

Proving an Actual Breach of Fiduciary Duty Is Difficult In a personal injury case, proving a breach of duty is often the most contested part. Here, you must demonstrate what the fiduciary did that fell short of their duty.

Section 21(3) of the Limitation Act 1980 provides a six year limitation period for actions by a beneficiary to recover trust property or in respect of any breach of trust.

A breach of fiduciary duty is not a criminal act but can be associated with one. For example, if the Trustee was self-dealing, e.g., selling a property, for instance, way below fair market value to a friend or themselves, then a court may see this as a form of embezzlement.

Any action alleging breach of fiduciary duties by members, managers, directors or officers, including alleged violations of the standards established in § 48-249-403 or § 48-249-404, must be brought within one (1) year from the date of the breach or violation; provided, that in the event the alleged breach or violation ...

A breach of fiduciary duty occurs when the fiduciary acts in his or her own self-interest rather than in the best interests of those to whom they owe the duty.

Exposing the partnership to liability through negligence or malfeasance; Damaging the goodwill of the company through illegal or wrongful behavior; Concealing important information from partners; Failing to disclose conflicts of interest; or.

The fiduciary will typically be removed from his role of trust. If financial loss occurred because of the fiduciary's breach of duty, it is possible that the fiduciary will be held accountable for those losses and money will be awarded to those who were damaged which the fiduciary would have to pay.

Any action alleging breach of fiduciary duties by members, managers, directors or officers, including alleged violations of the standards established in § 48-249-403 or § 48-249-404, must be brought within one (1) year from the date of the breach or violation; provided, that in the event the alleged breach or violation ...