Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

If you wish to be thorough, acquire, or generate lawful document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site’s straightforward and efficient search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states or keywords. Use US Legal Forms to discover the Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause in just a few clicks.

Every legal document template you receive is yours permanently.

You have access to every form you acquired through your account. Visit the My documents section and select a form to print or download again. Engage and obtain, and print the Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause through US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Should you be a current US Legal Forms customer, Log In to your account and click the Acquire button to obtain the Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

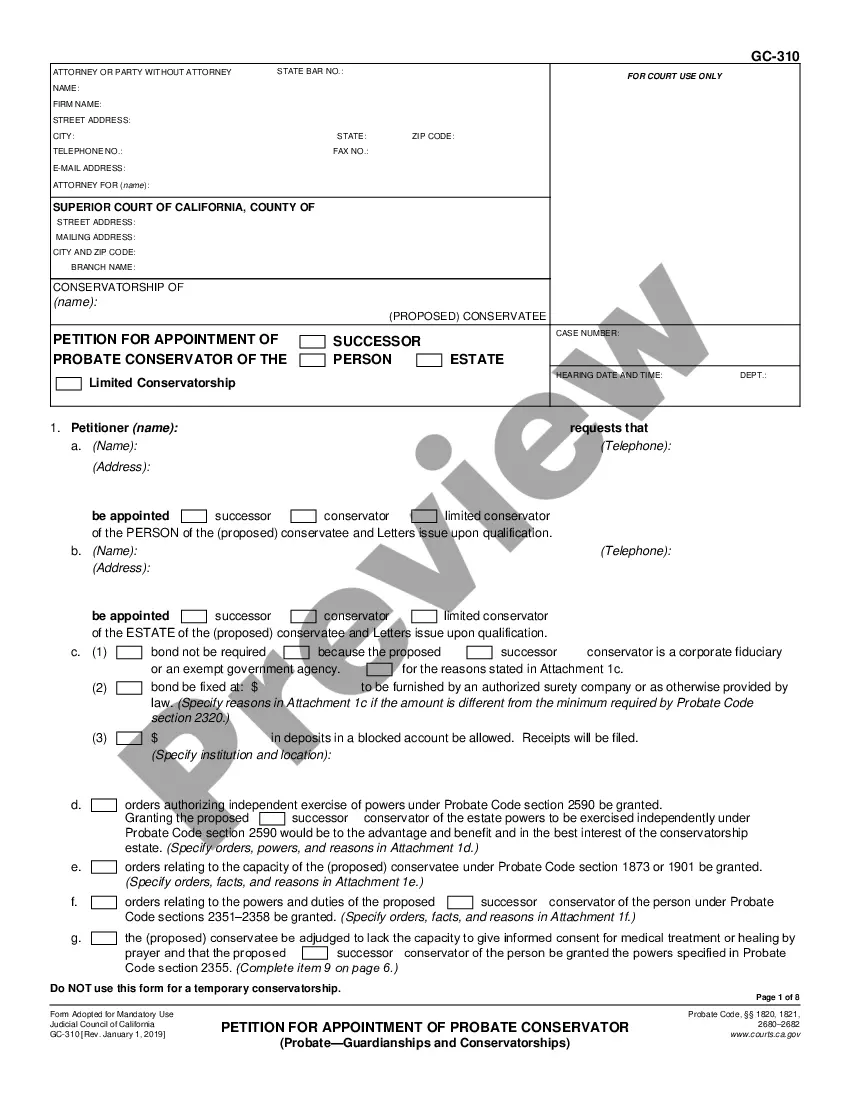

- Step 2. Use the Review option to examine the form’s content. Remember to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to locate other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose the payment plan you prefer and input your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

Form popularity

FAQ

A limitation of liability clause for a consultant in a Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause helps define the extent of responsibility the consultant has in case of losses or damages. This clause typically caps the amount of liability to a certain value, providing both parties with an understanding of potential risks. By including this clause, consultants can protect themselves from excessive claims while ensuring clients are aware of the boundaries of the service provided. Utilizing platforms like US Legal Forms can guide you in crafting an effective contract tailored to your needs.

An independent contractor agreement in Tennessee outlines the working relationship between a contractor and a client. This contract specifies the services to be provided, payment terms, and other important details, including the limitation of liability clause. Having a clear agreement protects both parties and ensures mutual understanding. Implementing a Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause is a prudent step in this process.

Yes, a contractor in Tennessee can face criminal charges under certain circumstances. This may include fraud, theft, or failure to adhere to local contracting laws. If you find yourself in a complicated legal situation, it’s wise to seek help in drafting a Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause for clear expectations and protections.

Yes, as an independent contractor in Tennessee, you generally need a business license to operate legally. This license helps verify your business and can protect you from legal repercussions. It's also important to comply with local regulations. A well-structured Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can further clarify your operational terms.

Yes, a contractor in Tennessee can face criminal charges under specific circumstances. If a contractor engages in fraudulent activities or violates licensing laws, they may be subject to prosecution. It is essential to include robust clauses in your Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause to mitigate risks associated with potential legal issues. This approach helps protect your interests and provides a clear framework for addressing disputes or violations.

Certain individuals in Tennessee, such as some non-profits and very small businesses, may be exempt from having a business license. Additionally, casual labor performed infrequently might qualify for exemptions. If you are diving into a Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it is essential to review these exemptions. You may also wish to explore how uslegalforms can guide you through the licensing process.

To operate as a general contractor in Tennessee, licensing is generally required for projects exceeding a specific dollar amount. However, for minor tasks or if you're working as a consultant, you might not need one. Engaging in a Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can clarify your responsibilities and safeguard your work. Always verify the requirements for your specific situation.

In Tennessee, the amount of work you can perform without a contractor license depends on the scope and nature of the services. For instance, if your work falls within certain financial limits, you can operate without a license. To safeguard your position when using a Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, ensure you clearly document your agreements. This can prevent potential disputes over licensure.

In Tennessee, independent contractors typically do not require a business license if they earn less than a certain threshold. However, to fully protect your interests, especially when entering a Tennessee Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it’s wise to check local regulations. Some cities or counties may have specific licensing requirements. Consider consulting a legal expert for tailored advice.