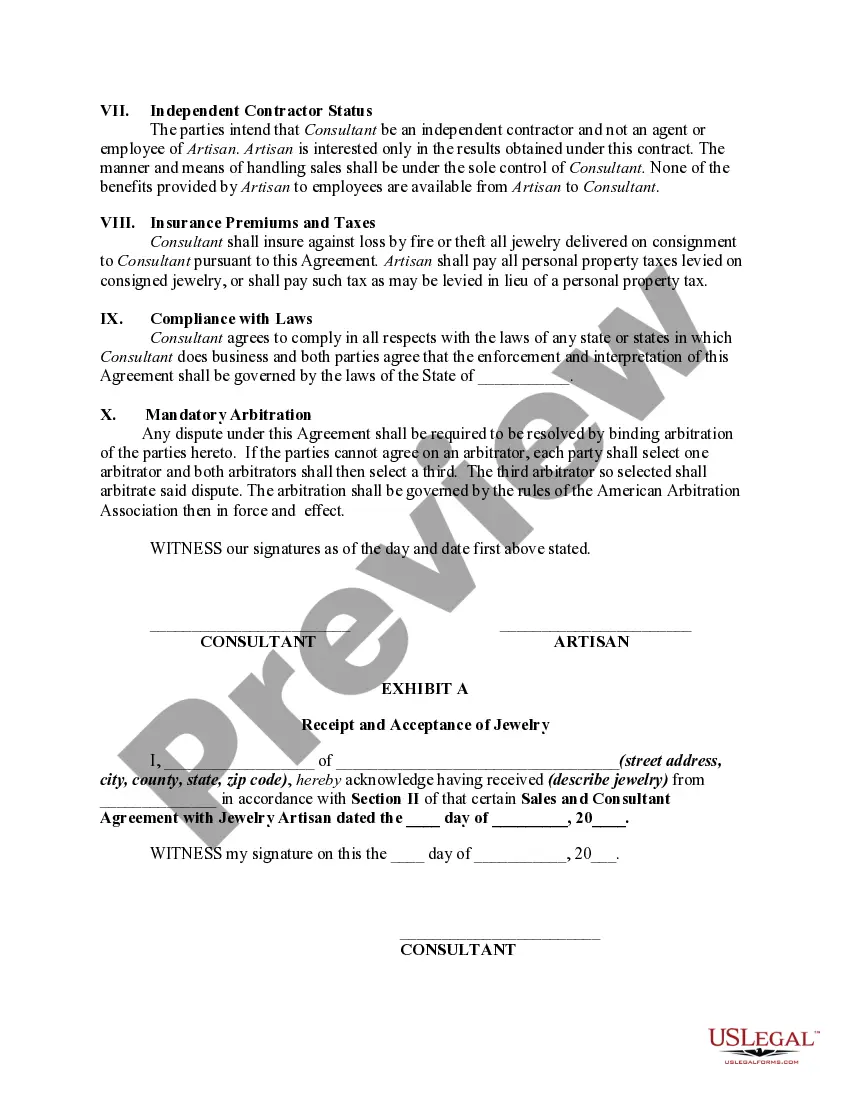

This form is a sample of an agreement to promote and sell jewelry between an artisan, who designs and creates fine jewelry, and an image consultant for various clients who have requested consultant's assessment of their wardrobe with regard to jewelry.

Tennessee Sales and Marketing Consultant Agreement with Jewelry Artisan: A Comprehensive Overview Introduction: A Tennessee Sales and Marketing Consultant Agreement with a Jewelry Artisan refers to a legally binding document that outlines the terms and conditions of a consulting arrangement between a sales and marketing consultant and a jewelry artisan. This agreement aims to establish a clear understanding of the relationship, responsibilities, compensation, and other pertinent aspects involved in the consulting engagement. It ensures that both parties are on the same page regarding expectations, deliverables, and the framework of their collaboration. Key Elements of the Agreement: 1. Scope of Work: This section defines the specific roles and responsibilities of the sales and marketing consultant and the jewelry artisan. It outlines the services to be provided by the consultant, such as market research, sales strategy development, brand positioning, promotional campaigns, advertising, customer relationship management, and more. The agreement may vary concerning the jewelry artisan's unique requirements. 2. Compensation: This segment outlines the payment terms for the sales and marketing consultant's services. It includes details such as the consultant's hourly rate, fixed fee, commission structure, reimbursement of expenses, and method of payment. The agreement should specify the agreed-upon payment intervals and any conditions for invoice submission. 3. Confidentiality: Since a jewelry artisan often deals with proprietary designs, techniques, trade secrets, and customer databases, maintaining confidentiality is crucial. This clause establishes a framework for protecting sensitive information by ensuring that the consultant does not disclose any confidential data or use it for personal or competitive advantages. 4. Term and Termination: This section describes the duration of the agreement — whether it is for a fixed term or an ongoing engagement. Additionally, it outlines the conditions under which either party can terminate the agreement, such as breaches of contract, failure to perform obligations, or changes in business circumstances. 5. Intellectual Property: In the scenario where the sales and marketing consultant creates or contributes to the creation of any intellectual property during the engagement, it is essential to define ownership rights. This clause specifies whether the jewelry artisan retains all rights to the designs, marketing materials, or any other deliverables, or if the consultant shares ownership or retains certain usage rights. Types of Tennessee Sales and Marketing Consultant Agreements with Jewelry Artisans: 1. General Sales and Marketing Consultant Agreement: This standard agreement outlines the general scope of services without focusing on any specialized aspects of the jewelry industry. It is suitable for jewelry artisans seeking comprehensive sales and marketing support. 2. E-commerce Sales and Marketing Consultant Agreement: This type of agreement caters specifically to jewelry artisans operating online, focusing on e-commerce strategies, digital marketing, social media management, and online sales optimization. 3. Branding and Product Positioning Consultant Agreement: Jewelry artisans who require assistance in rebranding, determining their target market, or establishing a unique brand identity can opt for this agreement. It focuses on strategic consultancy related to brand positioning, market research, and creating a distinct market presence. Conclusion: In summary, a Tennessee Sales and Marketing Consultant Agreement with a Jewelry Artisan is a crucial tool for establishing a collaborative partnership between a consultant and an artisan. By clearly delineating the terms, responsibilities, compensation, and other pertinent aspects, such an agreement ensures a successful and harmonious working relationship. While there are different types of agreements available, tailored to different needs, selecting the most suitable agreement type mainly depends on the specific requirements and goals of the jewelry artisan.