Tennessee Receipt for Payment of Rent

Description

How to fill out Receipt For Payment Of Rent?

Are you currently in need of documents for business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers a vast selection of form templates, including the Tennessee Receipt for Payment of Rent, which can be tailored to meet state and federal regulations.

When you find the correct form, click Get now.

Select the pricing plan you want, enter the necessary information to create your account, and complete your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Tennessee Receipt for Payment of Rent template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct city/county.

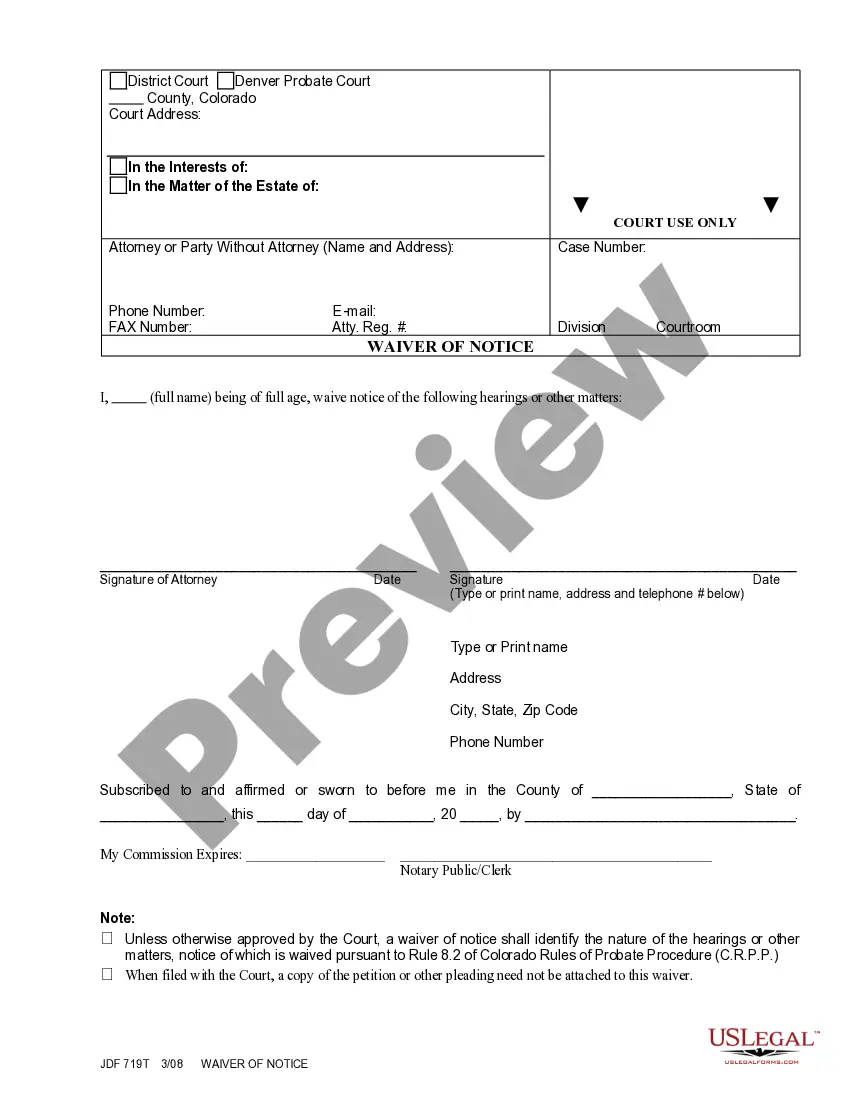

- Use the Preview button to examine the document.

- Review the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search section to locate the form that meets your needs.

Form popularity

FAQ

Yes, rental income is taxable in Tennessee. Landlords must report this income on their state tax returns. Additionally, it’s important to keep detailed records, such as the Tennessee Receipt for Payment of Rent, to substantiate your income and deductions. Using reliable resources, like US Legal Forms, can help you navigate the tax implications effectively.

Filling out a payment receipt is straightforward. Start with the date and include the names of the payer and payee, as well as the amount received. Specify the purpose of the payment, such as rent, and the address of the rental property. Conclude with a signature for added credibility. This creates a comprehensive Tennessee Receipt for Payment of Rent that is beneficial for both parties.

To acknowledge receipt of payment, create a formal receipt that includes the date, the payment amount, and the method of payment. Sign the receipt to validate it, ensuring it serves as a concrete record for the tenant. This document is your Tennessee Receipt for Payment of Rent and acts as evidence that the tenant has fulfilled their obligation.

In Tennessee, landlords are prohibited from using self-help evictions or changing the locks without notice. They cannot retaliate against tenants for exercising their legal rights, nor can they discriminate based on race, color, religion, or other protected statuses. Understanding these limitations helps landlords provide a better rental experience while protecting tenants' rights regarding the Tennessee Receipt for Payment of Rent.

To fill out a receipt form, start with the essential information such as the date of the payment and the names of the individuals involved. Include details such as the payment amount, the purpose of payment (in this case, rent), and the rental property's address. Don't forget to add a signature or stamp at the bottom, ensuring you have a reliable Tennessee Receipt for Payment of Rent.

Filling out a receipt of payment involves several key elements. Begin with the date and the names of the parties involved, followed by the payment amount and the property address. Indicate the payment method and provide a signature or stamp for verification. This process creates a legitimate Tennessee Receipt for Payment of Rent that both parties can refer to when needed.

In Tennessee, a landlord must typically give a minimum of 30 days' notice before terminating a rental agreement. This timeframe allows tenants to prepare for the end of their lease while ensuring they can obtain a Tennessee Receipt for Payment of Rent for their records. Understanding this requirement helps both landlords and tenants comply with the law and maintain a respectful rental relationship.

The contact information law in Tennessee requires landlords to provide tenants with accurate contact details for any issues that may arise. This includes a designated individual for maintenance requests and urgent communication. By adhering to this law, landlords make it easier for tenants to manage their responsibilities and request Tennessee Receipts for Payment of Rent without delay.

Tennessee code 66-7-109 relates to the rights and responsibilities of landlords and tenants concerning rental agreements. This code outlines the procedures for evicting tenants and specifies how rental payments should be documented. Familiarizing yourself with these legal stipulations can help both parties navigate the rental process and ensure the proper issuance of Tennessee Receipts for Payment of Rent.

The new landlord law in Tennessee introduces several updates aimed at protecting both landlords and tenants. These changes address issues such as security deposits, eviction notices, and maintenance responsibilities. Understanding these laws allows landlords to manage properties more effectively and provides tenants with better guidance for ensuring they receive valid Tennessee Receipts for Payment of Rent.