A bulk sale is a sale of goods by a business which engages in selling items out of inventory, often in liquidating or selling a business, and is governed by Article 6 of the Uniform Commercial Code (UCC) which deals with bulk sales. Article 6 has been adopted at least in part in all states. If the parties do not comply with the notification process for a bulk sale, creditors of the seller may obtain a declaration that the sale was invalid against the creditors and the creditors may take possession of the goods or obtain judgment for any proceeds the buyer received from a subsequent sale.

UCC Section 6-104 specifies the duties of the bulk sales buyer, including determining the identity of the seller, and preparation of a list of claimants and a schedule of distribution. These duties are imposed on the buyer in order to give claimants the opportunity to learn of the bulk sale before the seller has been paid and disappeared with the money.

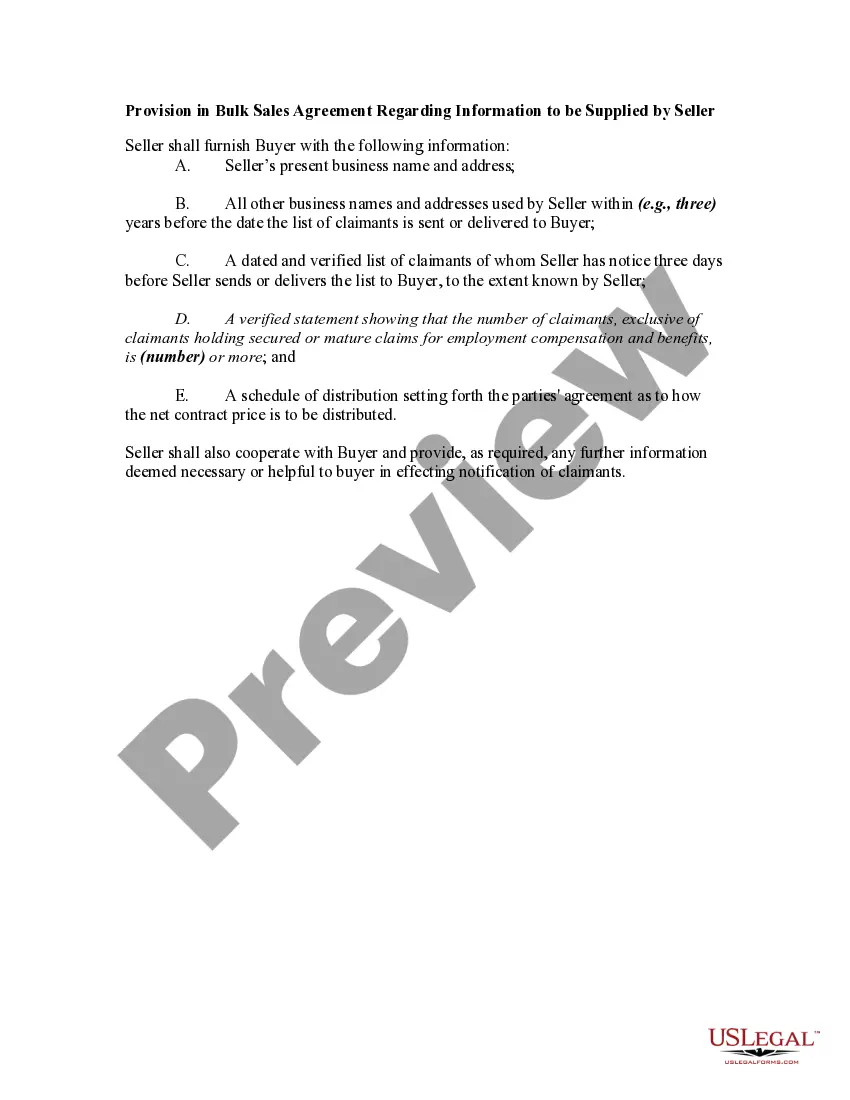

The Tennessee Provision in a Bulk Sales Agreement Regarding Information to be Supplied by Seller is a critical aspect that outlines the specific details and disclosures required by the seller during the sale of assets in bulk. This provision ensures transparency and protects the buyer's interests by mandating the seller to provide certain information. The key details that a seller must provide under the Tennessee Provision may include: 1. Full Disclosure of Assets: The seller must furnish a comprehensive list of all the assets being transferred to the buyer. This includes detailed descriptions, quantities, conditions, and values of each asset. 2. Liabilities and Debts: The seller must disclose any outstanding liabilities or debts associated with the assets being sold. This ensures the buyer is aware of any potential financial obligations that may be passed onto them after the sale. 3. Pending Legal Actions: Sellers must disclose any ongoing or pending legal actions that may impact the assets or the buyer's ability to operate the acquired business. 4. Existing Contracts and Leases: The seller must provide information about any existing contracts, leases, or agreements related to the assets being sold. This allows the buyer to understand their rights and obligations under these contracts. 5. Intellectual Property Rights: If the assets being sold include any intellectual property, such as trademarks, patents, or copyrights, the seller must provide details of these rights and any associated licenses or restrictions. 6. Employee Information: The seller must supply information about existing employees, including their number, job titles, compensation, and any important employment agreements or benefits. 7. Financial Statements and Tax Returns: The seller should disclose their financial statements and tax returns for a specified period to give the buyer a clear understanding of the financial health and history of the assets. 8. Environmental Concerns: In case the assets being transferred have potential environmental liabilities, the seller should disclose any known or potential environmental concerns or violations. Different types or sections of the Tennessee Provision may also include specific requirements based on the nature of the assets or industry involved. For example: — Real Estate Transactions: If the assets being sold involve real estate, additional information related to titles, surveys, zoning, and environmental assessments may be required. — Food Service Industry: If the bulk sale consists of a business in the food service industry, the seller must provide current health and safety inspection reports and any permits required for operation. — Liquor Licenses: In cases where the sale includes assets with liquor licenses, the seller must disclose any permits, licenses, or approvals required by the state or local authorities. — Franchise Agreements: If the assets being sold include a franchise, the seller should supply all pertinent franchise agreements, disclosure documents, and details about any ongoing obligations towards the franchisor. It is crucial for both parties involved in the transaction to thoroughly review and understand the Tennessee Provision within the Bulk Sales Agreement to avoid any misunderstandings or future disputes related to the supplied information.