Tennessee Agreement to Assign Lease to Incorporators Forming Corporation

Description

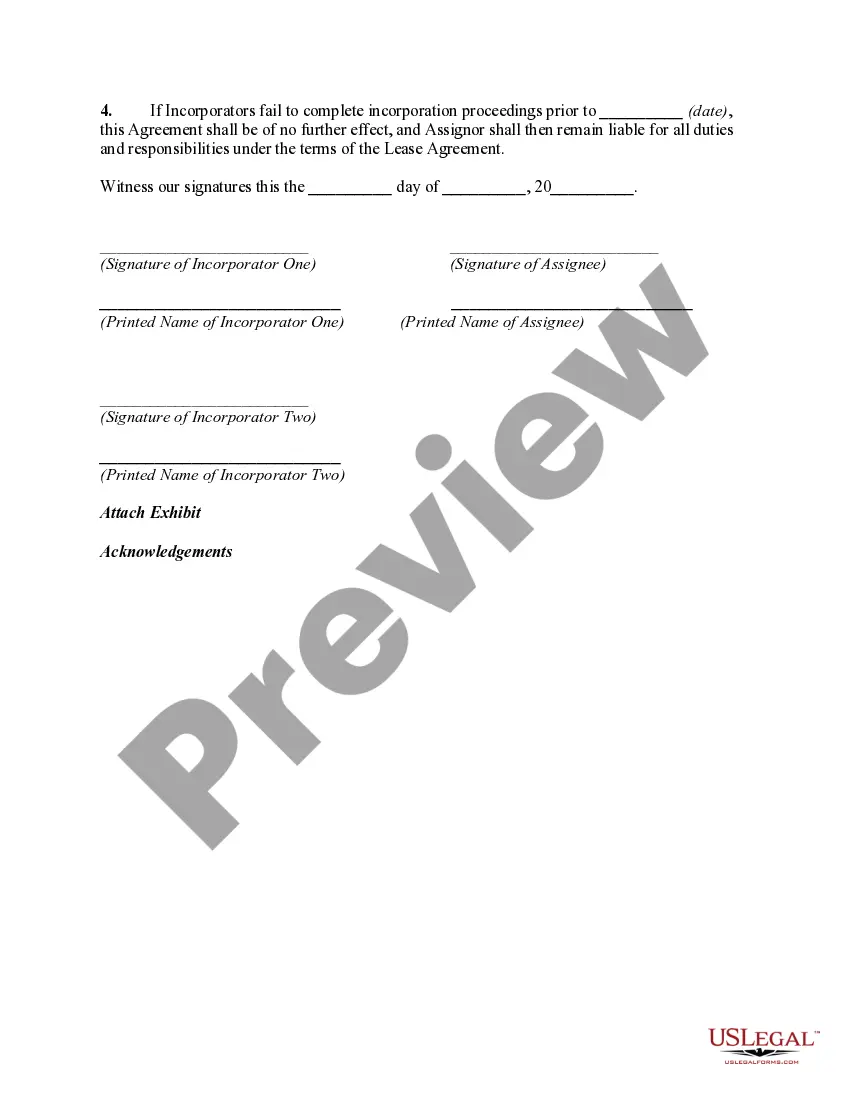

How to fill out Agreement To Assign Lease To Incorporators Forming Corporation?

Finding the appropriate legal document template can be a challenge.

Naturally, there are numerous templates available online, but how do you locate the legal form you require.

Make use of the US Legal Forms website.

If you are a new user of US Legal Forms, follow these simple steps: First, ensure you have selected the correct form for your city/region. You can review the form using the Review option and read the form description to confirm it is suitable for your needs. If the form does not meet your requirements, utilize the Search field to find the right form. Once you are certain that the form is appropriate, click the Purchase now button to obtain the form. Choose the pricing plan you wish to use and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the received Tennessee Agreement to Assign Lease to Incorporators Forming Corporation. US Legal Forms is the largest repository of legal forms where you can discover various document templates. Use this service to procure well-crafted documents that adhere to state regulations.

- This service offers a wide array of templates, including the Tennessee Agreement to Assign Lease to Incorporators Forming Corporation, which serves both business and personal purposes.

- All templates are vetted by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Tennessee Agreement to Assign Lease to Incorporators Forming Corporation.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the form you need.

Form popularity

FAQ

Yes, it is possible to assign a lease in Tennessee, although the terms of the lease must allow for such an assignment. Typically, landlords may need to provide written consent for such transfers. If you are considering assigning a lease, the Tennessee Agreement to Assign Lease to Incorporators Forming Corporation can streamline the process and ensure everything is handled legally and efficiently.

Yes, Tennessee has comprehensive lease laws that help regulate agreements between landlords and tenants. These laws address essential elements such as eviction procedures, lease renewals, and maintenance responsibilities. Familiarizing yourself with these laws, especially in the context of a Tennessee Agreement to Assign Lease to Incorporators Forming Corporation, is vital for ensuring compliance.

Tennessee offers a balanced approach to landlord-tenant relationships, meaning it has provisions that protect both parties. While tenants have rights regarding habitability and lease terms, landlords also have the right to enforce lease agreements. Therefore, understanding the nuances of the Tennessee Agreement to Assign Lease to Incorporators Forming Corporation can benefit both tenants and landlords considerably.

In Tennessee, you can get out of a lease under certain circumstances, such as a breach of contract by the landlord or health and safety violations. However, exiting a lease early can involve legal repercussions. It is advisable to consult a legal expert or use a Tennessee Agreement to Assign Lease to Incorporators Forming Corporation for more clarity and guidance.

Yes, Tennessee has specific lease laws that govern rental agreements and relationships between landlords and tenants. These laws cover various aspects such as security deposits, late fees, and lease termination. Understanding these regulations is essential for anyone dealing with real estate in the state, especially when using a Tennessee Agreement to Assign Lease to Incorporators Forming Corporation.

A lease addendum in Tennessee is a document added to an existing lease agreement that modifies specific terms or conditions. This could include rules about pets, maintenance responsibilities, or lease assignments. When working with lease assignments, using a proper addendum along with the Tennessee Agreement to Assign Lease to Incorporators Forming Corporation can ensure that any modifications are legally binding and clear to all parties involved.

Assigning the lease means transferring your rights and obligations under the original lease agreement to another individual, known as the assignee. This process typically requires landlord approval and can help you exit your rental commitment without penalty. Using the Tennessee Agreement to Assign Lease to Incorporators Forming Corporation can streamline this process, ensuring that all legal requirements are met during the assignment.

A tenant is the individual who originally signs the lease agreement and is responsible for the rental property. An assignee, on the other hand, is someone who takes over the lease obligations from the tenant, usually with the landlord's approval. Understanding this distinction is vital when considering the Tennessee Agreement to Assign Lease to Incorporators Forming Corporation, as it can help clarify the roles and responsibilities of each party.

To assign an apartment, start by checking your lease for any assignment clauses. If permitted, notify your landlord in writing about your intention to assign the lease and ensure the new tenant meets any screening criteria. After reaching an agreement with the new tenant, complete the assignment documentation, which can include the Tennessee Agreement to Assign Lease to Incorporators Forming Corporation for clarity and legal protection.

In Tennessee, lease agreements do not typically require notarization to be valid. However, having a notarized lease can provide added security and clarity, especially in disputes. It's always advisable to retain a copy of your lease agreement for your records. Utilizing the Tennessee Agreement to Assign Lease to Incorporators Forming Corporation can be a smart move when transferring lease responsibilities to protect your interests.