A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

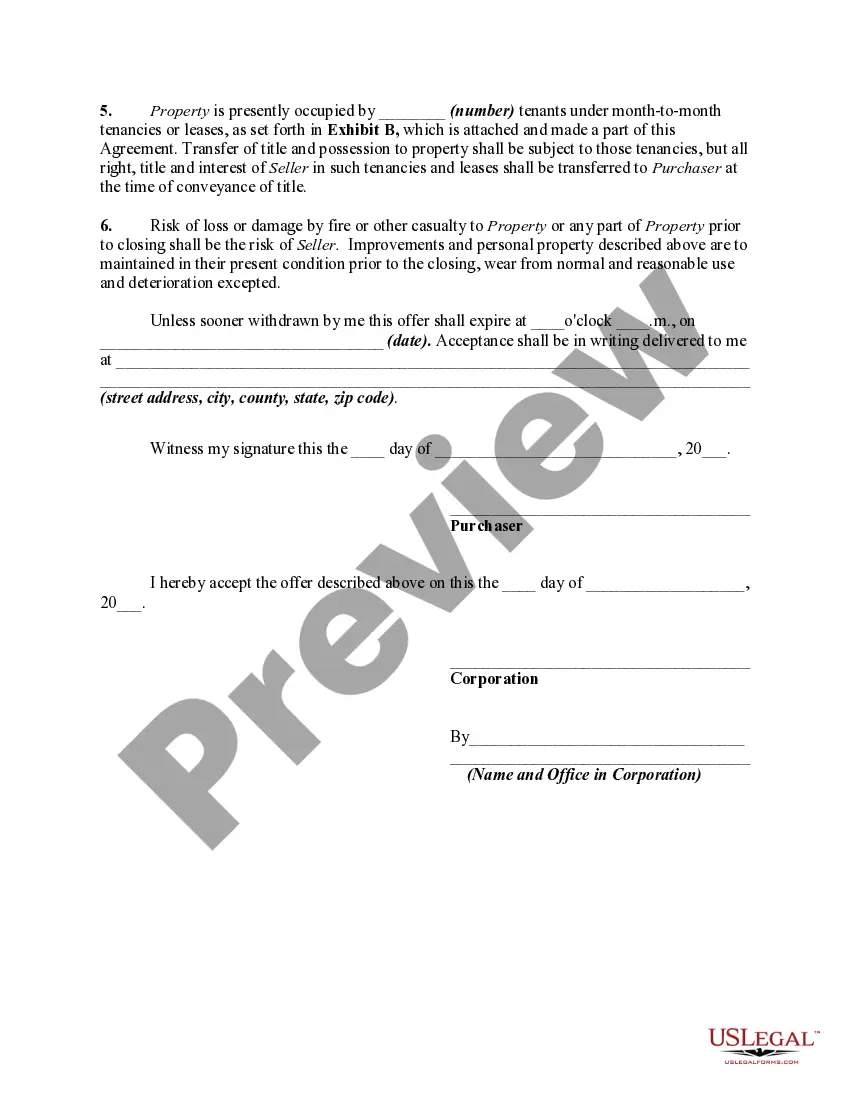

Tennessee Offer to Purchase Commercial Property is a legally binding document used by potential buyers to make an official offer to purchase a commercial property in Tennessee. This detailed description will provide an overview of the key elements, types, and importance of the Tennessee Offer to Purchase Commercial Property. Types of Tennessee Offer to Purchase Commercial Property: 1. Traditional Offer: This type of offer includes the essential terms and conditions required for a property purchase, such as the purchase price, financing arrangements, and contingencies. 2. All-Cash Offer: In this type of offer, the buyer intends to purchase the commercial property outright without the need for financing or obtaining a mortgage. 3. Installment Sale Offer: This offer involves the buyer paying for the property in installments over a specified period, often with agreed-upon interest. 4. Lease-Purchase Offer: A lease-purchase offer combines elements of a lease agreement and a purchase contract, enabling the buyer to lease the property with an option to purchase it at a later date. Key Elements of Tennessee Offer to Purchase Commercial Property: 1. Parties Involved: The offer will identify the buyer and the seller, including their legal names and contact information. 2. Description of the Property: The offer should include a detailed description of the commercial property being purchased, including its address, legal description, and any associated fixtures or equipment included in the sale. 3. Purchase Price and Payment Terms: The offer will specify the proposed purchase price as well as the payment terms, including the amount of earnest money deposited, down payment, and any financing arrangements. 4. Contingencies: Contingencies are conditions that must be met for the offer to be valid, such as property inspection, obtaining financing, or zoning approval. 5. Closing Date: The offer should indicate the desired closing date, allowing both parties to plan accordingly. 6. Closing Costs: The offer may address the allocation of closing costs, including expenses such as title insurance, transfer taxes, and attorney fees. 7. Disclosures: The offer may require the seller to disclose any known material defects or issues related to the property. 8. Termination: This section outlines the circumstances under which either party can terminate the offer and the consequences of such termination. Importance of Tennessee Offer to Purchase Commercial Property: 1. Legal Protection: The offer acts as a legally binding contract, protecting both the buyer and the seller by clearly outlining their rights and obligations. 2. Negotiation Tool: The offer serves as a starting point for negotiation between the buyer and the seller, allowing them to discuss and finalize essential details of the transaction. 3. Clarity and Documentation: This document ensures that all terms and conditions agreed upon by both parties are documented in writing, reducing the chances of confusion or disputes in the future. 4. Establish Terms: The offer establishes specific terms and contingencies, providing a clear roadmap for the purchase process and protecting the buyer from unforeseen circumstances. 5. Proof of Intent: By submitting an offer, the buyer demonstrates their serious intent to acquire the commercial property, indicating sincerity to the seller. In conclusion, the Tennessee Offer to Purchase Commercial Property is a critical document representing a buyer's intent to purchase a commercial property in Tennessee. The different types of offers cater to various financing and purchase scenarios, allowing flexibility for buyers. It is essential for both parties involved to carefully review and negotiate the terms outlined in the offer, ensuring a smooth and transparent transaction process.Tennessee Offer to Purchase Commercial Property is a legally binding document used by potential buyers to make an official offer to purchase a commercial property in Tennessee. This detailed description will provide an overview of the key elements, types, and importance of the Tennessee Offer to Purchase Commercial Property. Types of Tennessee Offer to Purchase Commercial Property: 1. Traditional Offer: This type of offer includes the essential terms and conditions required for a property purchase, such as the purchase price, financing arrangements, and contingencies. 2. All-Cash Offer: In this type of offer, the buyer intends to purchase the commercial property outright without the need for financing or obtaining a mortgage. 3. Installment Sale Offer: This offer involves the buyer paying for the property in installments over a specified period, often with agreed-upon interest. 4. Lease-Purchase Offer: A lease-purchase offer combines elements of a lease agreement and a purchase contract, enabling the buyer to lease the property with an option to purchase it at a later date. Key Elements of Tennessee Offer to Purchase Commercial Property: 1. Parties Involved: The offer will identify the buyer and the seller, including their legal names and contact information. 2. Description of the Property: The offer should include a detailed description of the commercial property being purchased, including its address, legal description, and any associated fixtures or equipment included in the sale. 3. Purchase Price and Payment Terms: The offer will specify the proposed purchase price as well as the payment terms, including the amount of earnest money deposited, down payment, and any financing arrangements. 4. Contingencies: Contingencies are conditions that must be met for the offer to be valid, such as property inspection, obtaining financing, or zoning approval. 5. Closing Date: The offer should indicate the desired closing date, allowing both parties to plan accordingly. 6. Closing Costs: The offer may address the allocation of closing costs, including expenses such as title insurance, transfer taxes, and attorney fees. 7. Disclosures: The offer may require the seller to disclose any known material defects or issues related to the property. 8. Termination: This section outlines the circumstances under which either party can terminate the offer and the consequences of such termination. Importance of Tennessee Offer to Purchase Commercial Property: 1. Legal Protection: The offer acts as a legally binding contract, protecting both the buyer and the seller by clearly outlining their rights and obligations. 2. Negotiation Tool: The offer serves as a starting point for negotiation between the buyer and the seller, allowing them to discuss and finalize essential details of the transaction. 3. Clarity and Documentation: This document ensures that all terms and conditions agreed upon by both parties are documented in writing, reducing the chances of confusion or disputes in the future. 4. Establish Terms: The offer establishes specific terms and contingencies, providing a clear roadmap for the purchase process and protecting the buyer from unforeseen circumstances. 5. Proof of Intent: By submitting an offer, the buyer demonstrates their serious intent to acquire the commercial property, indicating sincerity to the seller. In conclusion, the Tennessee Offer to Purchase Commercial Property is a critical document representing a buyer's intent to purchase a commercial property in Tennessee. The different types of offers cater to various financing and purchase scenarios, allowing flexibility for buyers. It is essential for both parties involved to carefully review and negotiate the terms outlined in the offer, ensuring a smooth and transparent transaction process.