The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

Tennessee Complaint Objecting to Discharge in Bankruptcy Proceedings for Concealment by Debtor and Omitting from Schedules Fraudulently Transferred Property

Description

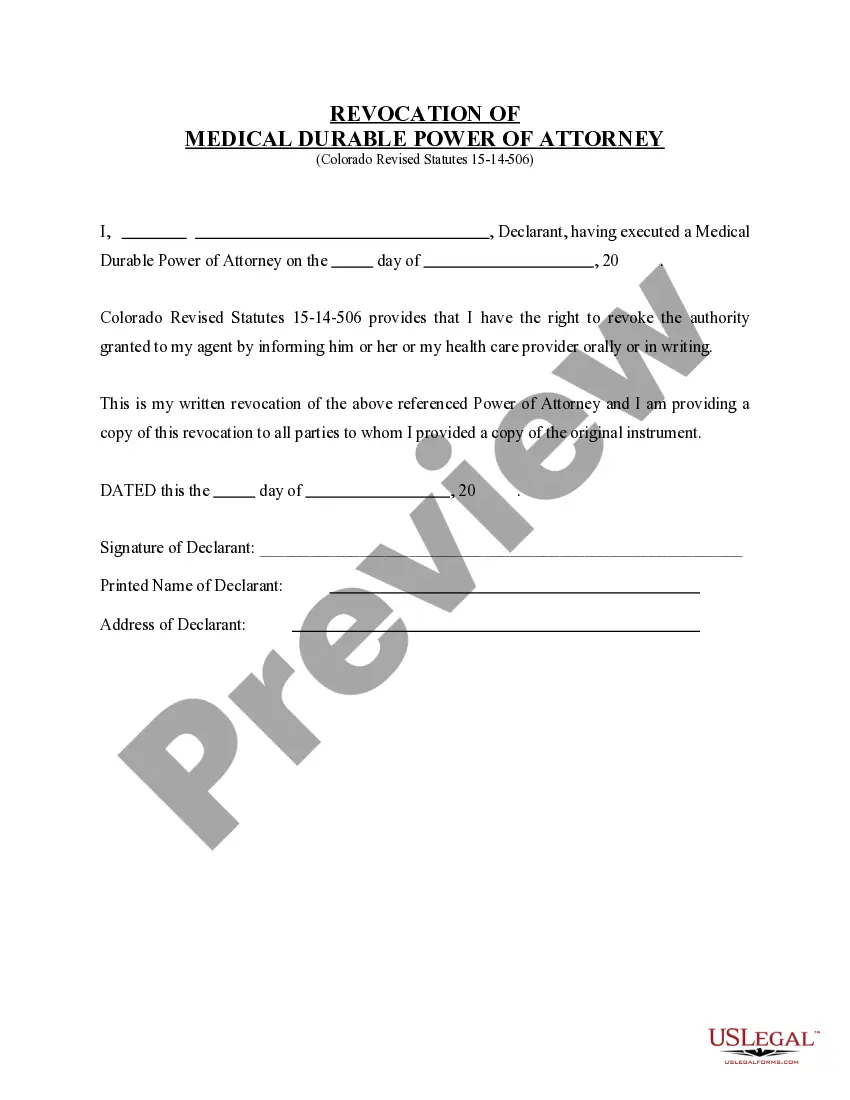

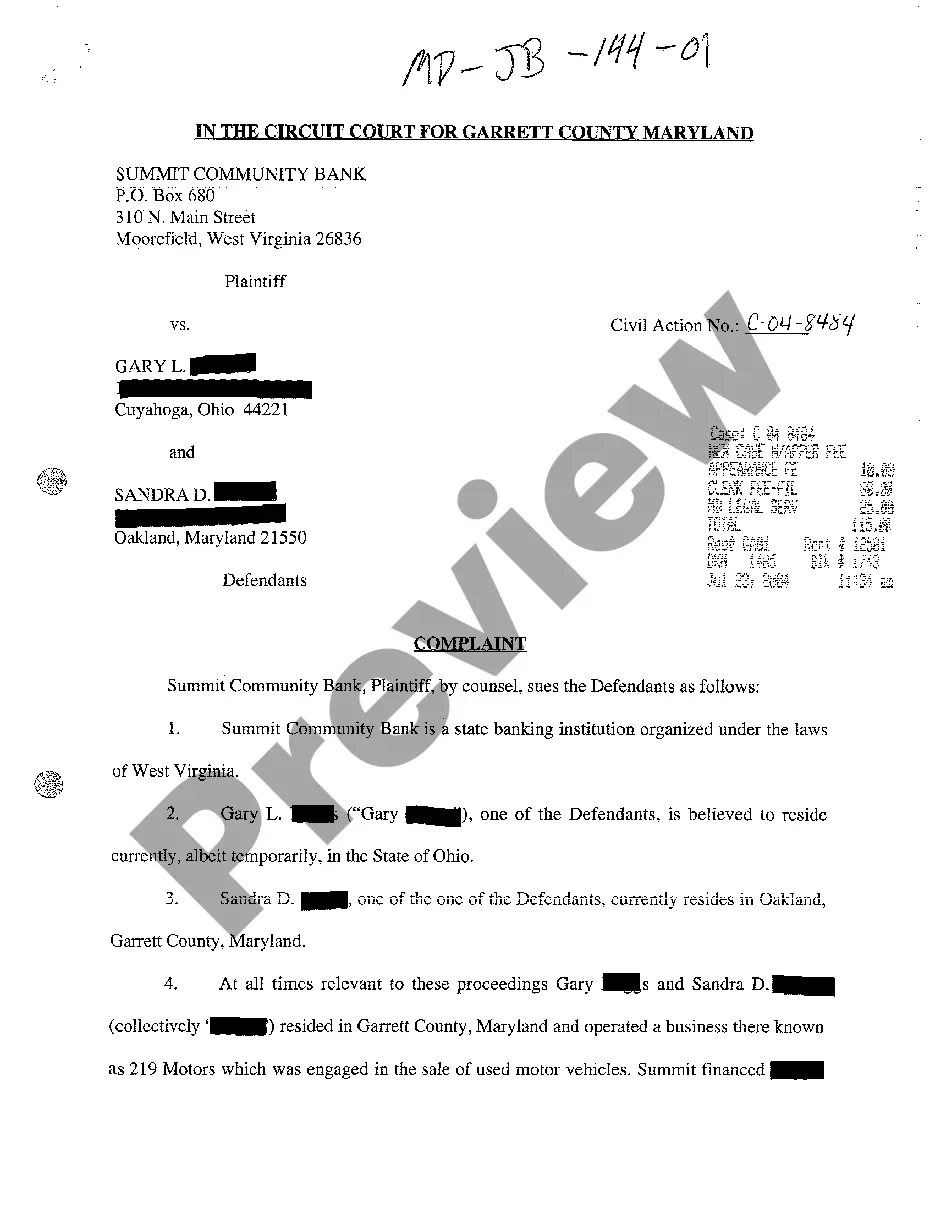

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceedings For Concealment By Debtor And Omitting From Schedules Fraudulently Transferred Property?

You can spend hours on the web looking for the lawful file template that meets the federal and state requirements you require. US Legal Forms offers a huge number of lawful forms that are reviewed by professionals. It is simple to download or print the Tennessee Complaint Objecting to Discharge in Bankruptcy Proceedings for Concealment by Debtor and Omitting from Schedules from your services.

If you already have a US Legal Forms profile, you can log in and click on the Acquire option. Afterward, you can complete, change, print, or indication the Tennessee Complaint Objecting to Discharge in Bankruptcy Proceedings for Concealment by Debtor and Omitting from Schedules. Every lawful file template you acquire is yours permanently. To obtain another copy of the acquired type, check out the My Forms tab and click on the corresponding option.

If you use the US Legal Forms site initially, stick to the simple instructions below:

- Initial, make sure that you have selected the proper file template for the county/town of your choice. Read the type description to ensure you have selected the correct type. If offered, take advantage of the Review option to check from the file template at the same time.

- If you wish to locate another model of the type, take advantage of the Lookup discipline to get the template that meets your needs and requirements.

- When you have identified the template you need, simply click Purchase now to continue.

- Find the prices plan you need, enter your references, and sign up for a merchant account on US Legal Forms.

- Complete the purchase. You may use your credit card or PayPal profile to purchase the lawful type.

- Find the format of the file and download it for your device.

- Make alterations for your file if necessary. You can complete, change and indication and print Tennessee Complaint Objecting to Discharge in Bankruptcy Proceedings for Concealment by Debtor and Omitting from Schedules.

Acquire and print a huge number of file layouts using the US Legal Forms website, that provides the most important selection of lawful forms. Use expert and status-particular layouts to handle your business or individual requires.

Form popularity

FAQ

§ 523(a)(4) Section 523(a)(4) of the U.S. Bankruptcy Code states that any debt arising from an individual debtor's "fraud or defalcation while acting in a fiduciary capacity" is nondischargeable. 11 U.S.C. § 523(a)(4).

Among the grounds for denying a discharge to a chapter 7 debtor are that the debtor failed to keep or produce adequate books or financial records; the debtor failed to explain satisfactorily any loss of assets; the debtor committed a bankruptcy crime such as perjury; the debtor failed to obey a lawful order of the ...

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

The most common types of nondischargeable debts are certain types of tax claims, debts not set forth by the debtor on the lists and schedules the debtor must file with the court, debts for spousal or child support or alimony, debts for willful and malicious injuries to person or property, debts to governmental units ...

Section 523 of the U.S. Bankruptcy Code sets forth certain requirements that a debtor must meet to have certain debts discharged. You can file a lawsuit in the bankruptcy court asserting that your debt does not meet those requirements or falls under an exception for discharge and should remain the debtor's obligation.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

Section 523(a)(2)(A) ? Fraud. Section 523(a)(2)(A) of the Bankruptcy Code provides an exception from the discharge of any debt for money, property or services, to the extent such debt was obtained by false pretenses, a false representation, or actual fraud.

A trustee's or creditor's objection to the debtor being released from personal liability for certain dischargeable debts. Common reasons include allegations that the debt to be discharged was incurred by false pretenses or that debt arose because of the debtor's fraud while acting as a fiduciary.