Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Tennessee Bartering Contract or Exchange Agreement

Description

How to fill out Bartering Contract Or Exchange Agreement?

Selecting the finest legal documents website template can be quite a challenge.

It goes without saying that there are numerous designs available online, but how do you find the legal document you require.

Utilize the US Legal Forms website. This service offers a plethora of templates, such as the Tennessee Bartering Contract or Exchange Agreement, which can be utilized for both business and personal purposes.

First, ensure you have selected the correct form for your city/state. You can review the document using the Preview button and check the form details to make sure it is the right one for you.

- All the forms are reviewed by professionals and meet federal and state standards.

- If you are currently registered, Log In to your account and click on the Download button to obtain the Tennessee Bartering Contract or Exchange Agreement.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions that you should follow.

Form popularity

FAQ

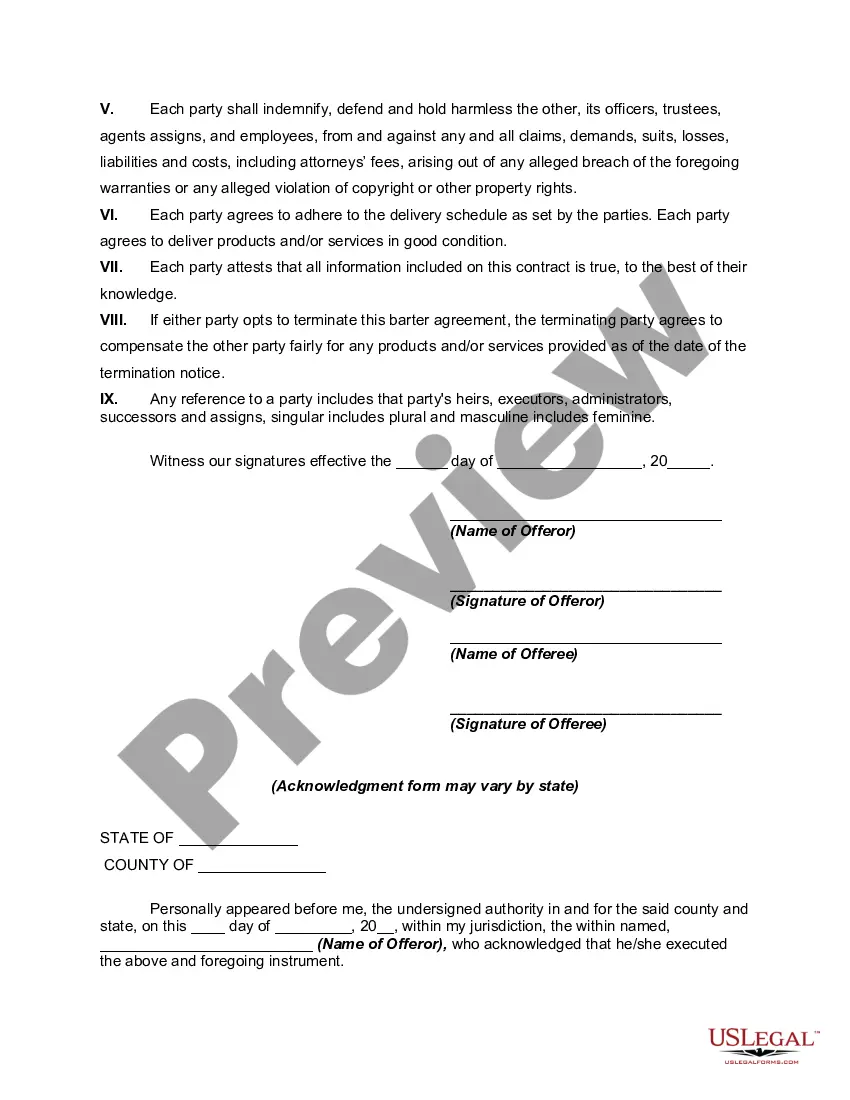

To record a barter transaction, you should document the details of the exchange, including the date, description of the goods or services, and their fair market value. Utilize a Tennessee Bartering Contract or Exchange Agreement to formalize the transaction for accuracy. This documentation will not only help track exchanges but will also support your tax reporting. Keeping clear records makes it easier to manage your bartering activities.

The primary rules for bartering include reporting the fair market value of exchanged goods or services, maintaining proper documentation, and complying with taxation laws. Entering into a Tennessee Bartering Contract or Exchange Agreement can help you meet these requirements effectively. It’s crucial to ensure both parties understand and agree to the terms. Following these guidelines leads to a successful barter experience.

Bartering works for taxes by treating the fair market value of exchanged items as taxable income. In a Tennessee Bartering Contract or Exchange Agreement, both parties must report their respective income from the transaction. This includes keeping accurate records to document each exchange. Understanding your tax obligations allows for a smoother barter process.

Yes, bartering can be considered a business if it involves exchange for profit. When you enter into a Tennessee Bartering Contract or Exchange Agreement, you engage in commercial activities that may generate income. It's essential to understand that bartering transactions may still be subject to taxation. Keeping detailed records can help you stay compliant with tax regulations.

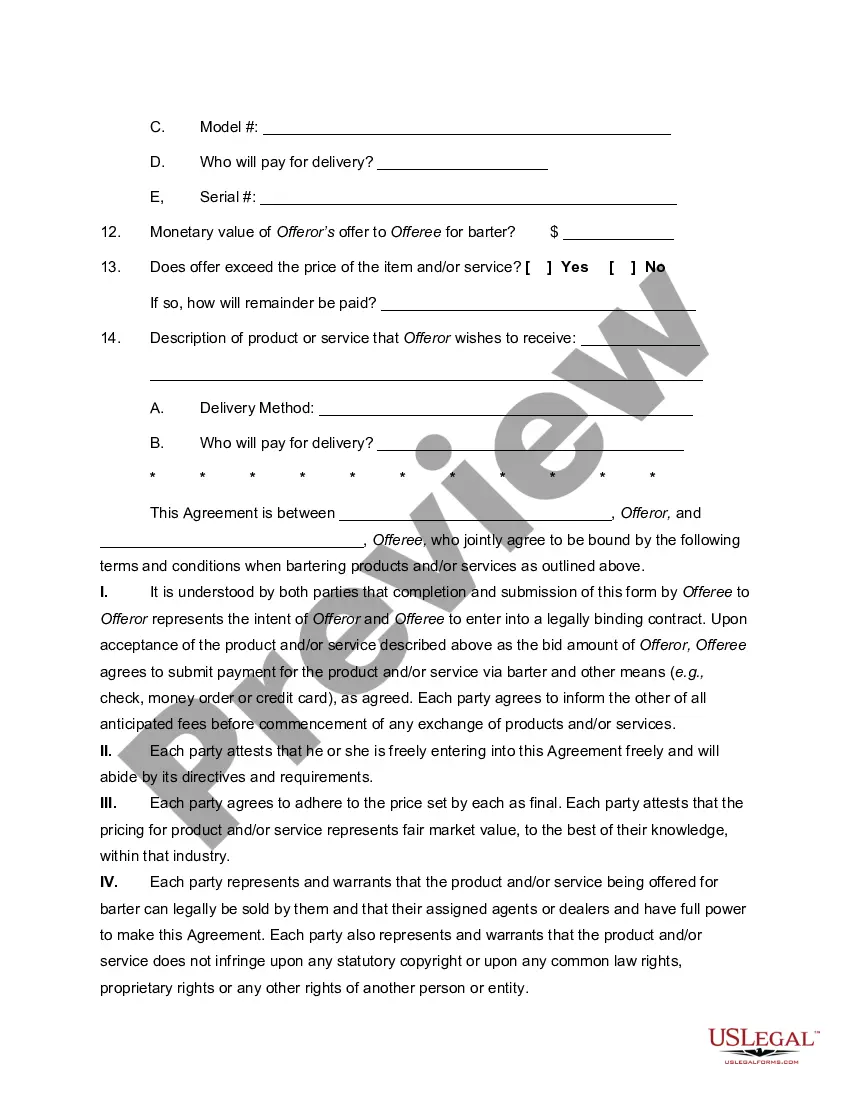

Writing a barter agreement involves outlining the terms of the exchange clearly. You should describe the items or services involved, the agreed value, and any conditions for the transaction. Using a Tennessee Bartering Contract or Exchange Agreement template ensures you cover all essential details. This minimizes misunderstandings between the parties involved.

To claim bartering on your taxes, you must report the fair market value of the goods or services received. Under a Tennessee Bartering Contract or Exchange Agreement, this value is treated as income. Be sure to maintain accurate records of each transaction. This way, you provide clear evidence in case of an audit.

Writing a barter agreement involves clearly outlining the terms of the exchange between parties. Begin by identifying each party, then specify the goods or services being exchanged, including any conditions or deadlines. Using a platform like US Legal Forms can simplify the process, providing templates for a structured Tennessee Bartering Contract or Exchange Agreement.

An example of a barter could include two friends trading books. One friend may have a fiction novel while the other has a travel guide. They agree to swap these items directly, creating a simple form of a Tennessee Bartering Contract that specifies each person's contribution.

A barter exchange typically occurs in a network where multiple parties trade goods and services. For instance, in a community barter group, a yoga instructor might offer classes in return for groceries from a local store. This collective trading operates under the principles of a Tennessee Bartering Contract, facilitating the ecosystem of exchanges.

An example of a barter contract can be seen when a farmer exchanges vegetables with a local baker for bread. This agreement outlines the specific quantities and quality of goods exchanged. Such a transaction exemplifies a Tennessee Bartering Contract, ensuring that both parties understand their responsibilities in the exchange.