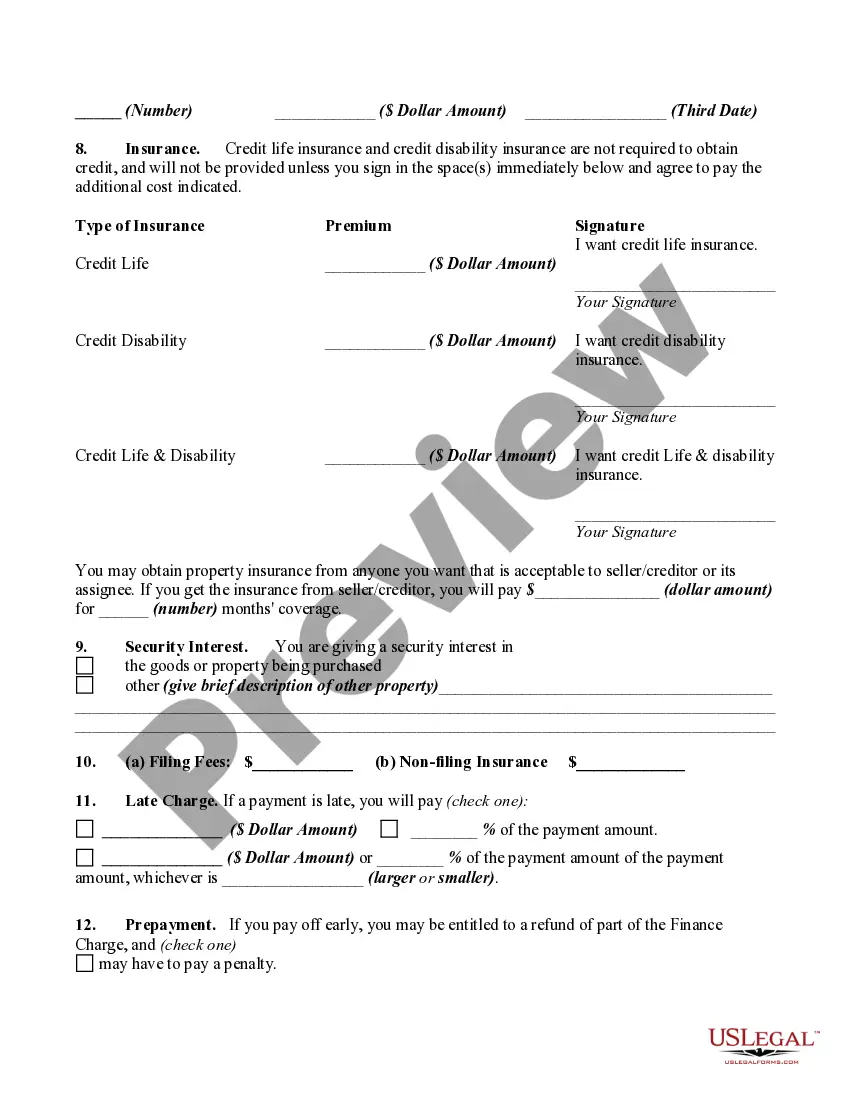

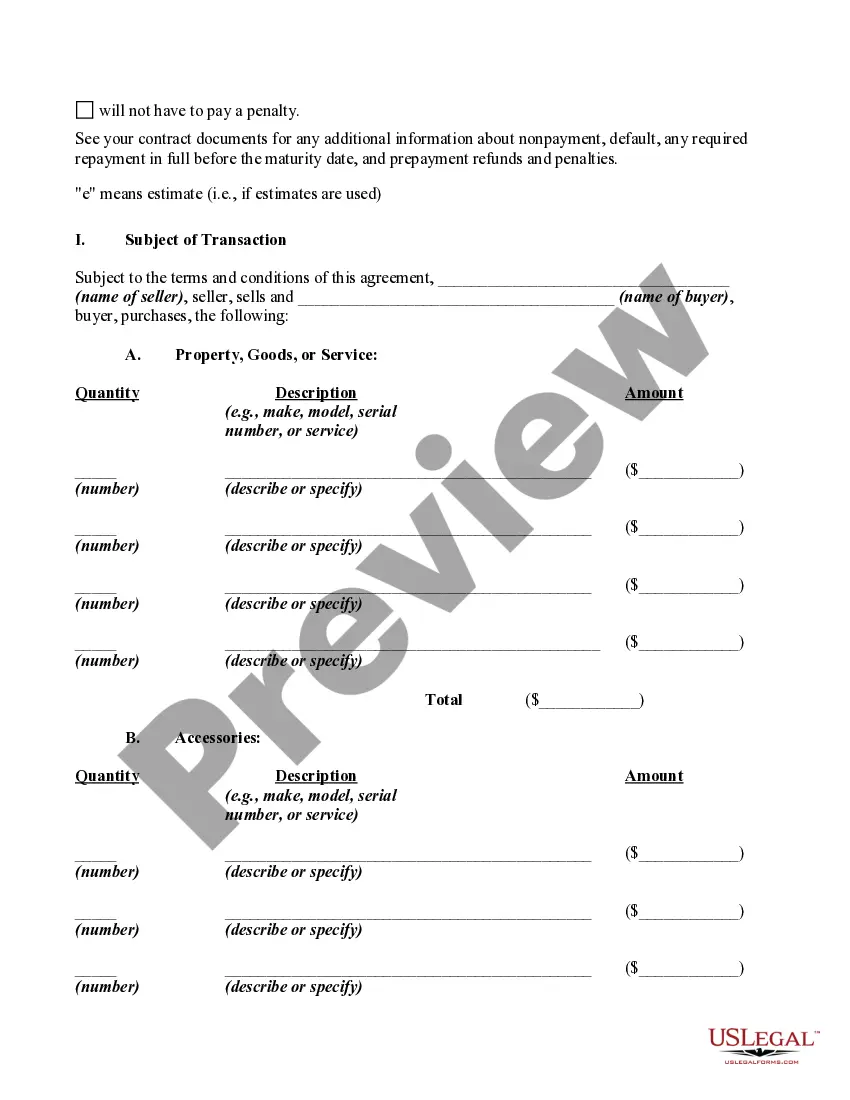

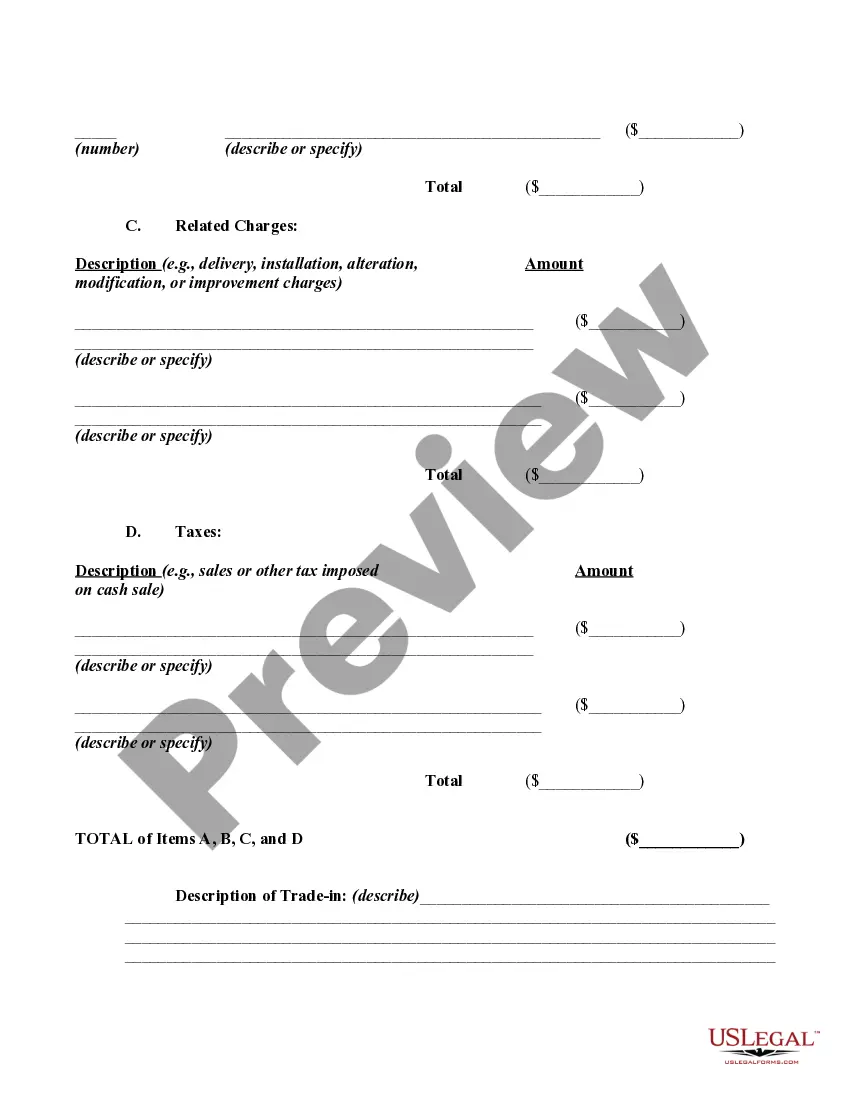

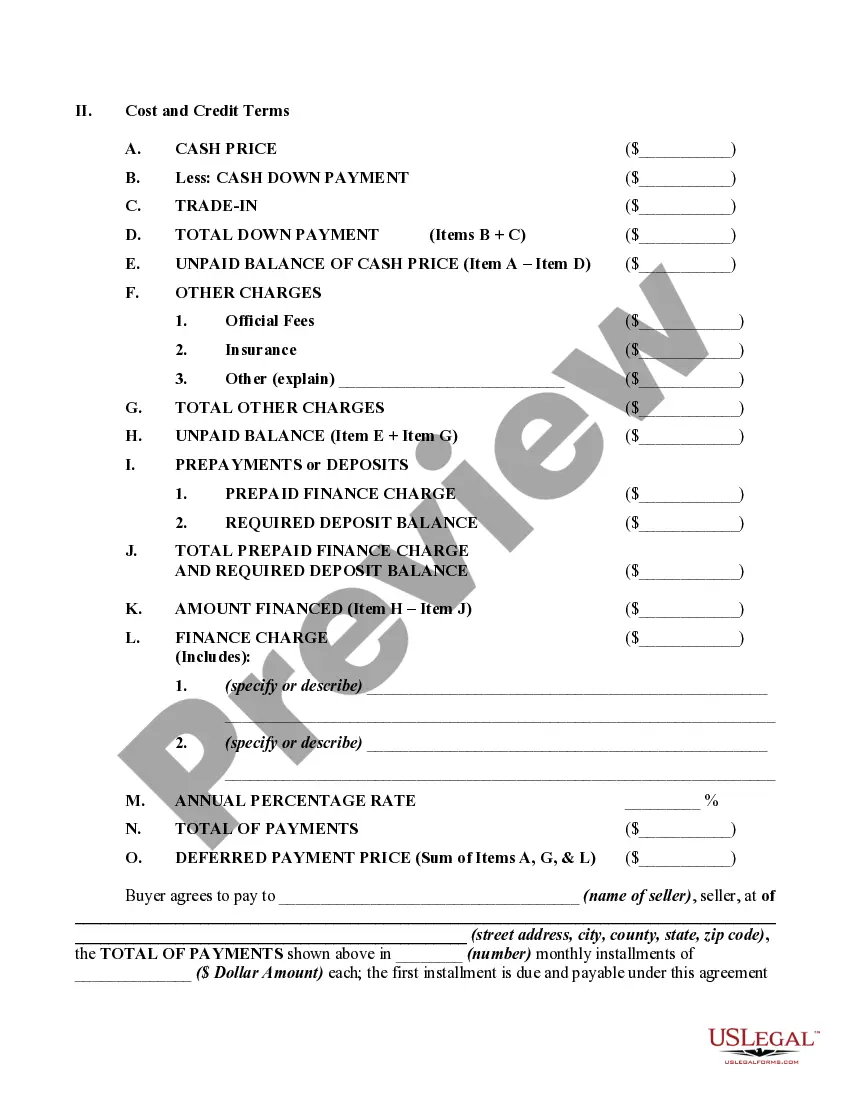

In a retail installment sale to a consumer as defined by Regulation Z of the Federal Trade Commission (FTC), the creditor must make the disclosures required by Regulation Z clearly and conspicuously in writing, in a form that the consumer may keep. The disclosures must be grouped, must be segregated from everything else, and must not contain any information not directly related to the disclosures required by Regulation Z (although the disclosures may include an acknowledgment of receipt, the date of the transaction, and the consumer's name, address, and account number). 12 C.F.R. § 226.17(a)(1). Regulation Z sets forth several closed-end model forms and clauses which illustrate other formats for these disclosures. 12 C.F.R. Part 226, Appendix H.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in at least 10- point, bold face, type or print and must be worded as shown if the form.

Tennessee Retail Installment Contract and Security Agreement (RI CSA) is a legal document that governs the sale and financing of goods in the retail industry within the state of Tennessee. This agreement outlines the terms and conditions between a buyer (consumer) and a seller (retailer) for the purchase of various goods, including but not limited to appliances, electronics, furniture, or vehicles. The RI CSA establishes the financial arrangement between the buyer and the seller, typically involving installment payments over a specified period. It sets forth the agreed-upon purchase price, the down payment, the interest rate, and the duration of the contract. The contract also includes details regarding late payment penalties, default provisions, repossession rights, and dispute resolution mechanisms. Key elements within the Tennessee RI CSA may include: 1. Promissory Note: This constitutes the buyer's promise to repay the amount financed, including any accrued interest, to the seller over the agreed-upon installment period. 2. Security Interest: The RI CSA establishes a security interest in the purchased goods. This allows the seller to repossess the goods if the buyer defaults on their payment obligations. The security interest protects the seller's right to recover the value of the goods in case of non-payment. 3. Disclosure Requirements: The Tennessee RI CSA mandates certain disclosures to be provided to the buyer before signing the contract. These disclosures typically include the total purchase price, the amount financed, the finance charge, the annual percentage rate (APR), and any additional fees or charges. 4. Cooling-off Period: In certain situations, the RI CSA may grant a cooling-off period during which the buyer can cancel the contract without incurring any penalties. This allows the consumer time to reconsider their purchase decision and ensure they are entering into a satisfactory agreement. Different types of Tennessee Retail Installment Contract and Security Agreements may exist within specific industries or for specialized products. For instance, there could be separate agreements for vehicle purchases, real estate transactions, or high-value goods. Each type of agreement may have variations in terms and conditions tailored to the unique requirements of the goods being sold. In summary, the Tennessee Retail Installment Contract and Security Agreement is a crucial legal document governing retail sales and financing in the state. It protects the rights and obligations of both buyers and sellers, ensuring a fair and transparent transaction. It is important for both parties to carefully read and understand the terms of the agreement before signing to avoid any potential conflicts or disputes down the line.Tennessee Retail Installment Contract and Security Agreement (RI CSA) is a legal document that governs the sale and financing of goods in the retail industry within the state of Tennessee. This agreement outlines the terms and conditions between a buyer (consumer) and a seller (retailer) for the purchase of various goods, including but not limited to appliances, electronics, furniture, or vehicles. The RI CSA establishes the financial arrangement between the buyer and the seller, typically involving installment payments over a specified period. It sets forth the agreed-upon purchase price, the down payment, the interest rate, and the duration of the contract. The contract also includes details regarding late payment penalties, default provisions, repossession rights, and dispute resolution mechanisms. Key elements within the Tennessee RI CSA may include: 1. Promissory Note: This constitutes the buyer's promise to repay the amount financed, including any accrued interest, to the seller over the agreed-upon installment period. 2. Security Interest: The RI CSA establishes a security interest in the purchased goods. This allows the seller to repossess the goods if the buyer defaults on their payment obligations. The security interest protects the seller's right to recover the value of the goods in case of non-payment. 3. Disclosure Requirements: The Tennessee RI CSA mandates certain disclosures to be provided to the buyer before signing the contract. These disclosures typically include the total purchase price, the amount financed, the finance charge, the annual percentage rate (APR), and any additional fees or charges. 4. Cooling-off Period: In certain situations, the RI CSA may grant a cooling-off period during which the buyer can cancel the contract without incurring any penalties. This allows the consumer time to reconsider their purchase decision and ensure they are entering into a satisfactory agreement. Different types of Tennessee Retail Installment Contract and Security Agreements may exist within specific industries or for specialized products. For instance, there could be separate agreements for vehicle purchases, real estate transactions, or high-value goods. Each type of agreement may have variations in terms and conditions tailored to the unique requirements of the goods being sold. In summary, the Tennessee Retail Installment Contract and Security Agreement is a crucial legal document governing retail sales and financing in the state. It protects the rights and obligations of both buyers and sellers, ensuring a fair and transparent transaction. It is important for both parties to carefully read and understand the terms of the agreement before signing to avoid any potential conflicts or disputes down the line.