Tennessee Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

Have you ever found yourself in a circumstance where you require documentation for either organizational or personal reasons nearly every day.

There are numerous legal form templates accessible online, but locating ones that you can trust is not easy.

US Legal Forms offers thousands of document templates, such as the Tennessee Private Annuity Agreement, which can be drafted to comply with state and federal regulations.

Once you find the right form, click Purchase now.

Choose the payment plan you prefer, complete the necessary information to create your account, and purchase your order using PayPal or credit card. Select a convenient file format and download your copy. Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Tennessee Private Annuity Agreement at any time, if needed. Just select the required form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid errors. The service provides expertly crafted legal document templates suitable for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Tennessee Private Annuity Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Acquire the form you require and ensure it is for the correct state/county.

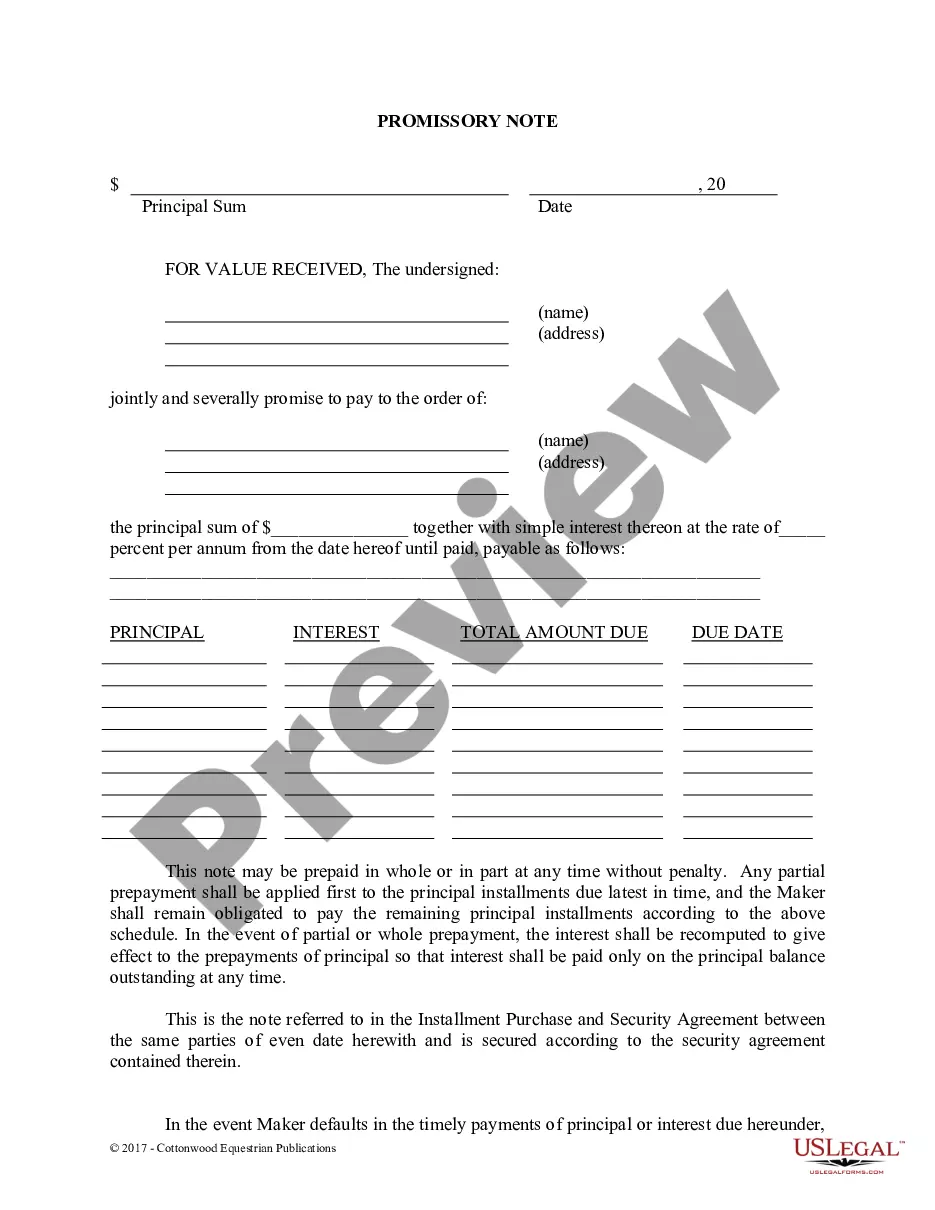

- Use the Review button to evaluate the form.

- Read the details to confirm you have selected the correct form.

- If the form is not what you’re looking for, use the Search field to find the template that meets your requirements.

Form popularity

FAQ

Annuities in Tennessee are not insured in the same way as bank deposits. Instead, they may be backed by the financial strength of the issuing insurance company. A Tennessee Private Annuity Agreement can also play a role in your overall financial security strategy. It's often wise to research the financial stability of the issuing company to ensure your investment is secure.

The protection of your annuity from creditors largely depends on its structure and the laws in Tennessee. A properly executed Tennessee Private Annuity Agreement often provides a level of protection against creditors. However, certain factors, such as the timing of the agreement and the intent behind it, can impact this protection. Consulting with a legal advisor can help clarify how your annuity is viewed under the law.

Under Tennessee law, several assets enjoy protection from creditors, including certain types of retirement accounts, life insurance proceeds, and some annuities. A Tennessee Private Annuity Agreement may also offer protection against creditors when set up correctly. It is advisable to review your financial situation with a legal professional to ensure your assets are adequately safeguarded. Understanding the specific protections can help you make informed financial decisions.

In general, a creditor cannot directly garnish a Tennessee Private Annuity Agreement. However, the specific terms of the agreement and the type of annuity may influence this outcome. It's essential to consult with a legal expert to understand your rights and protections regarding this financial instrument. Keep in mind that properly structured agreements may provide additional protection against creditors.

A Single Premium Immediate Annuity (SPIA) has its downsides, such as limited liquidity since the initial investment usually cannot be accessed once the annuity is in place. Additionally, with a SPIA, the income payments are fixed, which might not keep pace with inflation over time. When considering a Tennessee Private Annuity Agreement, it is wise to evaluate all your options and seek guidance to find the best solution for your situation.

Setting up a private annuity involves creating a formal agreement that specifies payment terms and the duration of the annuity. You will need to outline the amount and frequency of payments and ensure compliance with Tennessee laws. Utilizing services from platforms like USLegalForms can simplify the process of creating a legally sound Tennessee Private Annuity Agreement.

Generally, the value of a private annuity may be included in the gross estate of the deceased if the annuitant dies. However, if structured correctly, a Tennessee Private Annuity Agreement may allow for specific exclusions. It's essential to work with an estate planning expert to ensure the agreement aligns with your financial goals.

A private annuity works by establishing a contract where one party pays the other a specified amount over a certain period. Usually, these payments are made for the lifetime of the annuitant. The mechanics of the Tennessee Private Annuity Agreement can help individuals provide financial support to family members while simultaneously managing their estate.

While private annuities can be beneficial, they do come with some disadvantages. One significant drawback is that the payments may not be flexible, restricting access to your capital. Additionally, a Tennessee Private Annuity Agreement typically does not provide for a refund of premiums upon the death of the annuitant, which can impact your estate planning strategy.

A private annuity agreement is a financial arrangement between two parties where one party makes payments to the other in exchange for the right to receive future income. This type of agreement can often serve as an estate planning tool to transfer wealth efficiently. Many find that using a Tennessee Private Annuity Agreement can provide financial stability while also benefiting from potential tax advantages.