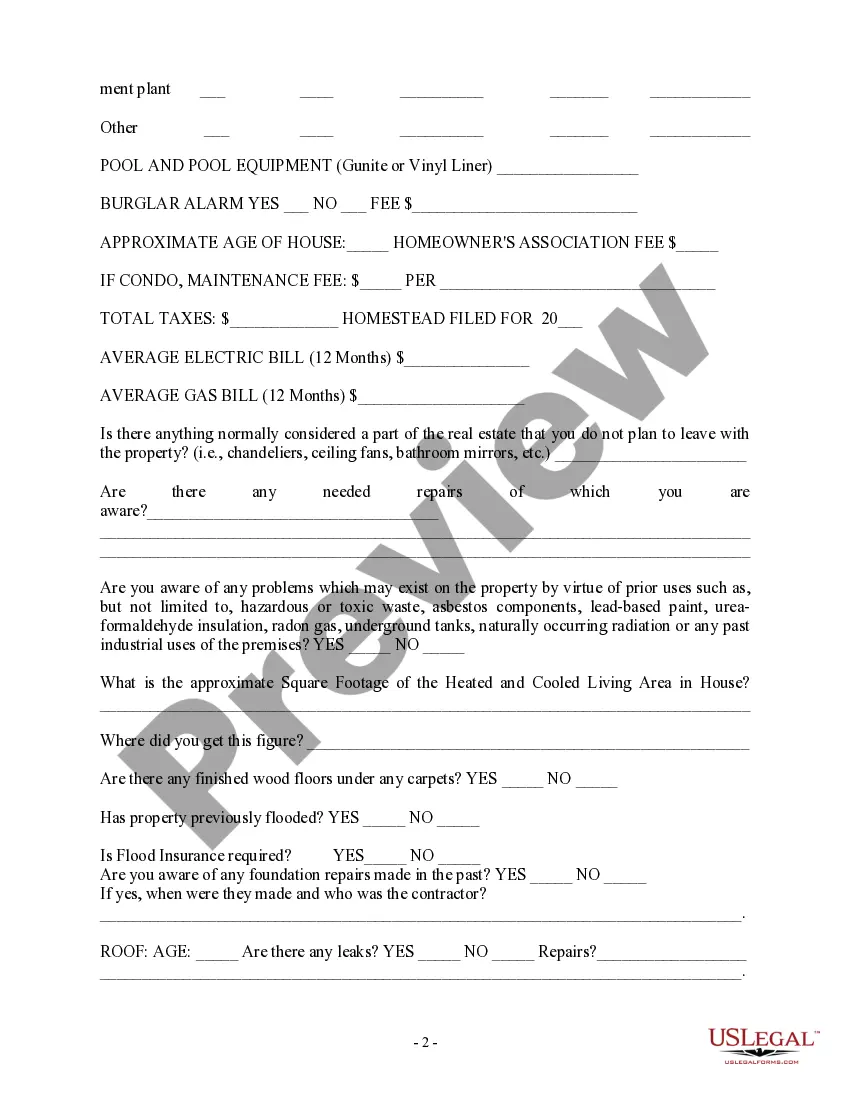

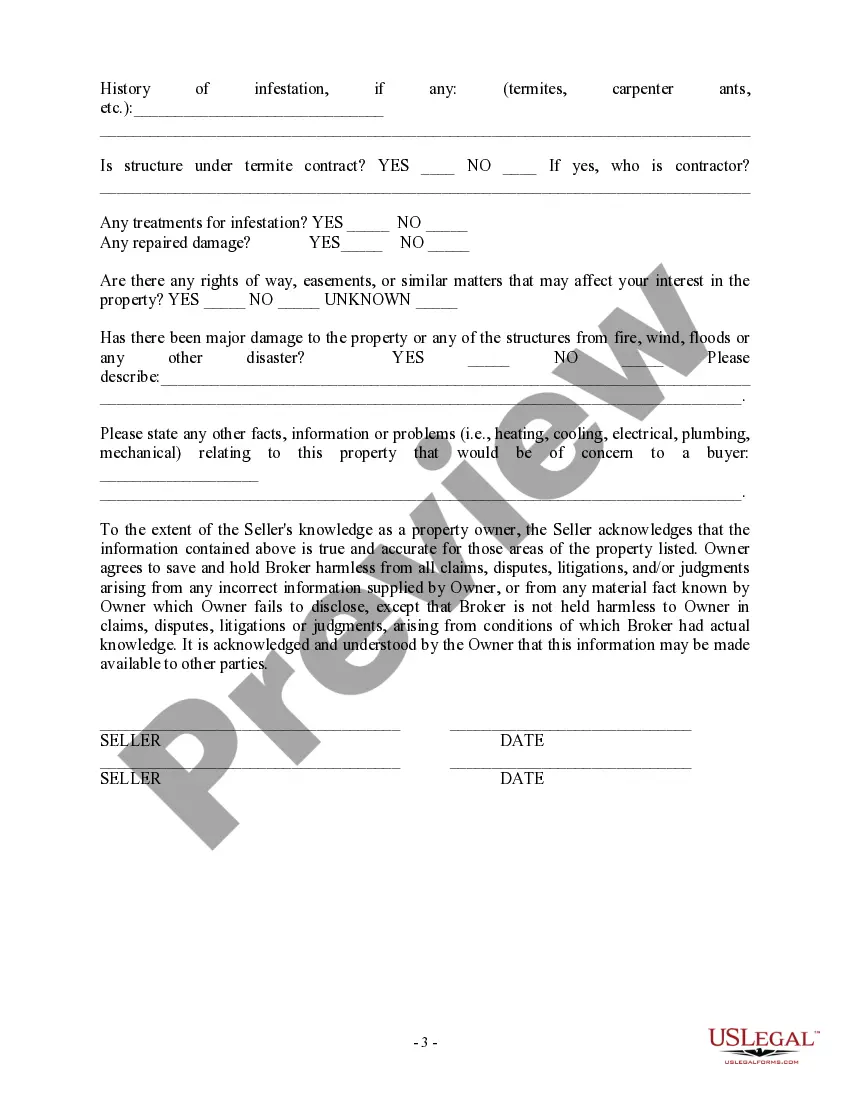

Tennessee Seller's Real Estate Disclosure Statement

Description

How to fill out Seller's Real Estate Disclosure Statement?

Locating the appropriate legal document template can be challenging.

It goes without saying that there are numerous formats available online, but how do you pinpoint the specific legal type you require.

Make use of the US Legal Forms website. The service provides thousands of templates, including the Tennessee Seller's Real Estate Disclosure Statement, suitable for both business and personal needs.

First, make sure you have selected the right form for your locality. You can preview the form using the Preview button and read the form description to ensure it meets your needs.

- All the forms are reviewed by professionals and adhere to state and federal regulations.

- If you are already registered, Log In to your account and click on the Obtain button to receive the Tennessee Seller's Real Estate Disclosure Statement.

- Utilize your account to view the legal forms you have previously purchased.

- Visit the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are some basic instructions you should follow.

Form popularity

FAQ

Commonly, there aren't definite disclosure laws and the sale prices will only reflect on public records if the seller submits one. These states are the following: Alabama, Arkansas, Louisiana, Nevada, North Carolina, Oklahoma, Rhode Island, and Tennessee.

Common exceptions include sales or transfers between co-owners, new construction, purchases from lenders after foreclosure, auction sales, or if the Seller has not lived in the home within the 3 years before the Closing.

The Act applies to all sales of residential real property consisting of not less than one dwelling unit, but not more than four dwelling units. The Act applies even if real estate agents are not involved in the sale. The disclosure form required in Tennessee is lengthy, detailed and comprehensive.

In Tennessee, there are no state laws on paranormal activity disclosure and a seller does not have to disclose if there was a homicide or suicide on the property as long as it did not affect the physical structure.

Tennessee law requires that, before you actually make a real estate transfer to a buyer, you first give that person a disclosure statement (unless the purchaser waives this right). By Ilona Bray, J.D. Imagine that you own a house, condominium unit, or parcel of land in Tennessee, and that you want to sell it.

Tennessee requires holders to send due diligence notifications for any property with a value of $50 or more. Due diligence letters must be sent via first class mail each reporting cycle to the apparent owner at the last known address not more than 180 days or less than 60 days from the reporting deadline.

The Tennessee Residential Property Disclosure Act states that anyone transferring title to residential real property must provide information about the condition of the property. This completed form constitutes that disclosure by the seller.

Most sellers of residential real property are required to complete a real estate transfer disclosure statement (TDS). Exemptions from the TDS requirement include court ordered sales, fiduciaries in the administration of estates and trusts, and REO sales. One of the most confusing exemptions has been for trustees.

Under certain circumstances, sellers may be exempted from completing the disclosure, substituting the Tennessee Residential Property Condition Exemption Notification in its place. The most common exemption is when the owner has not resided on the property at any time in the previous three years.

In general, a disclosure document is supposed to provide details about a property's condition that might negatively affect its value. Sellers who willfully conceal information can be sued and potentially convicted of a crime. Selling a property "As Is" will usually not exempt a seller from disclosures.