Tennessee Sample Letter for Denial of Individual Charge Account

Description

How to fill out Sample Letter For Denial Of Individual Charge Account?

Selecting the appropriate legal document template can be challenging. Naturally, there are numerous designs available online, but how can you find the legal form you require? Utilize the US Legal Forms website. The service offers thousands of templates, including the Tennessee Sample Letter for Denial of Individual Charge Account, which can be utilized for both business and personal needs. All forms are vetted by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Tennessee Sample Letter for Denial of Individual Charge Account. Use your account to search among the legal forms you have purchased previously. Visit the My documents tab of your account to retrieve another copy of the document you need.

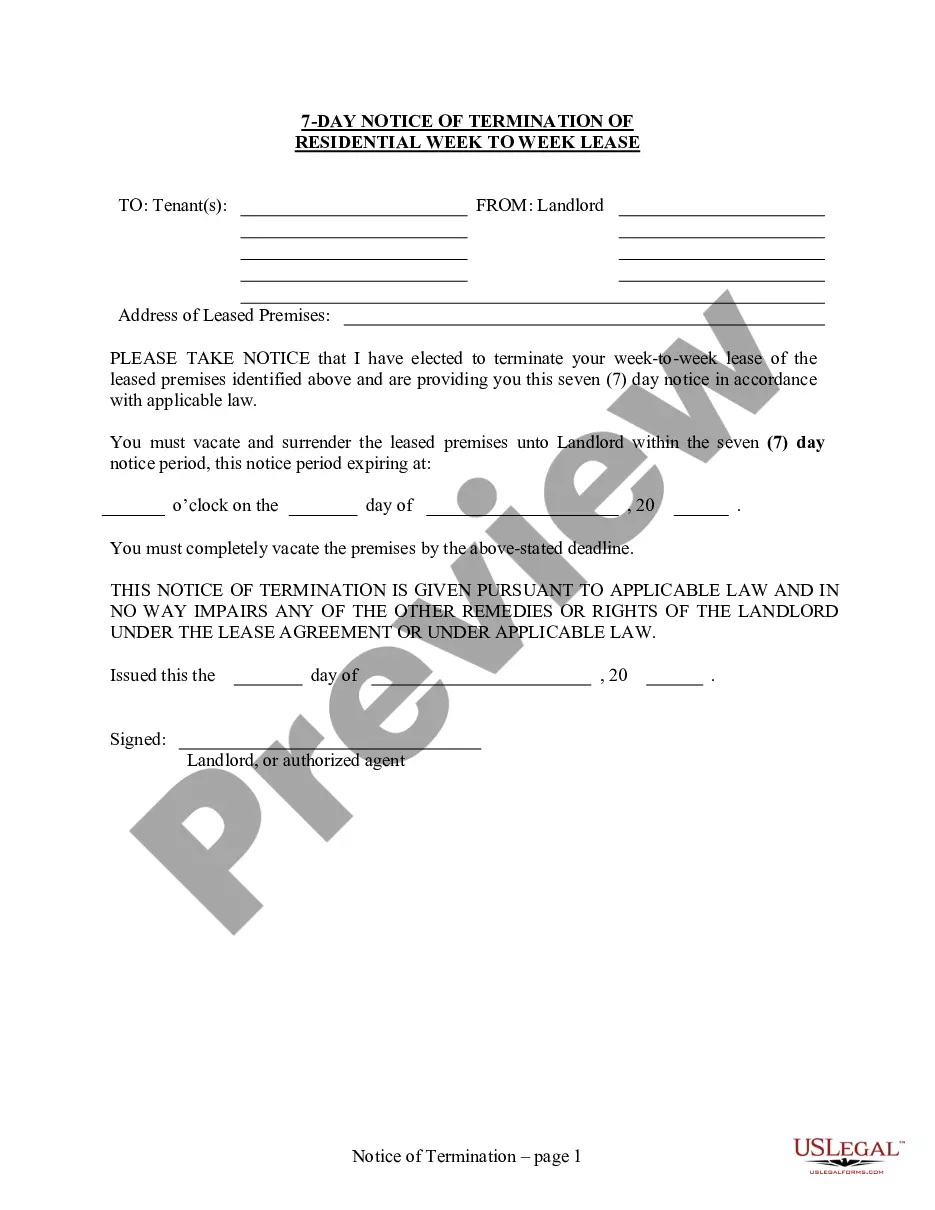

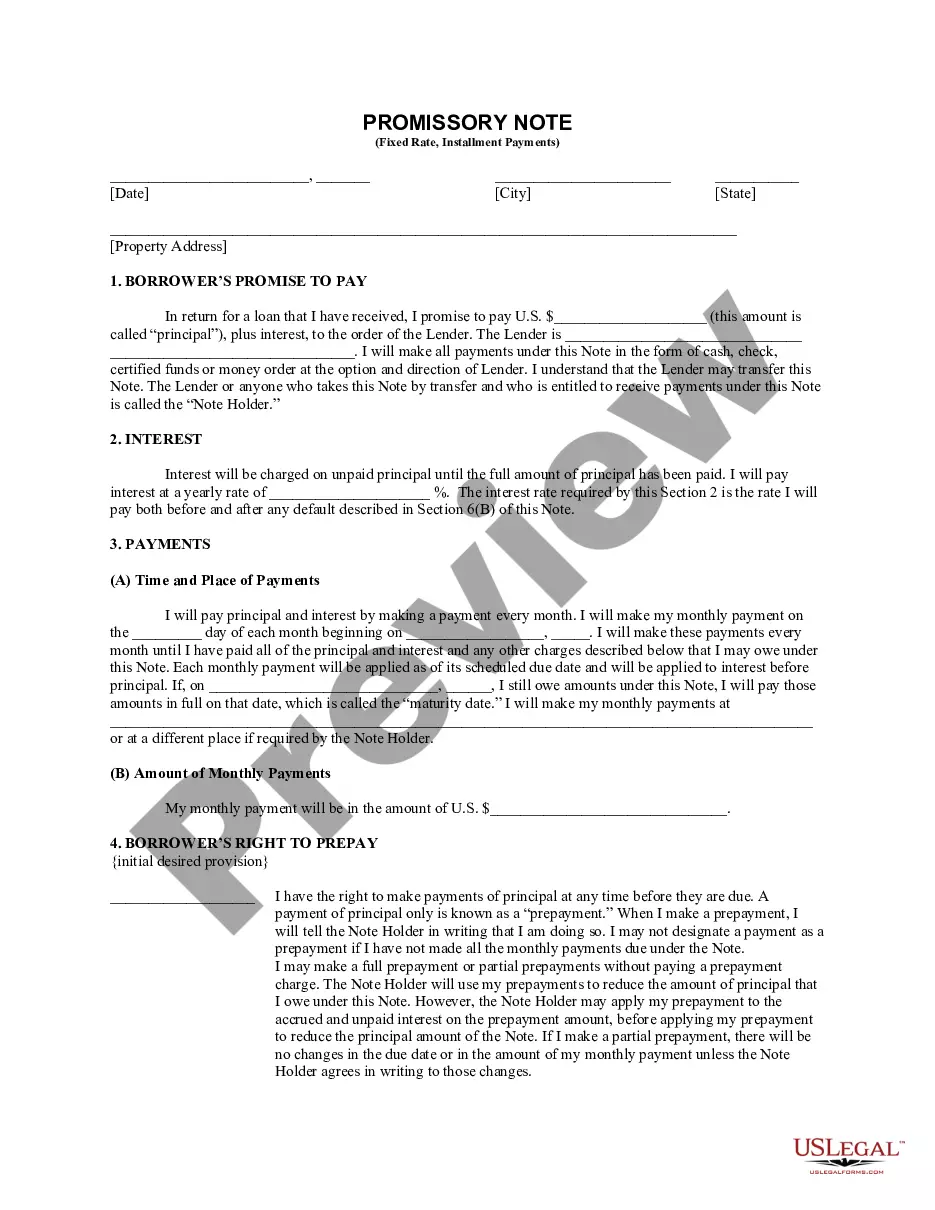

If you are a new user of US Legal Forms, here are simple instructions that you can follow: First, make sure you have selected the correct form for your city/region. You can preview the form using the Preview button and review the form description to confirm it is suitable for your requirements. If the form does not meet your expectations, utilize the Search field to find the appropriate form. Once you are certain the form is acceptable, click on the Buy Now button to acquire the form. Choose the pricing plan you desire and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the Tennessee Sample Letter for Denial of Individual Charge Account you obtained.

- US Legal Forms is the largest collection of legal documents with a variety of file templates.

- Use the service to download properly created paperwork that complies with state requirements.

- Ensure you select the correct form before proceeding.

- Utilize the preview option for better visibility.

- Confirm your purchase through a reliable payment method.

- Retrieve previously purchased forms from your account.

Form popularity

FAQ

A denial letter is a written notification that informs a recipient that their application or request has not been approved. It usually details the reasons for the decision and may suggest steps moving forward. Understanding the content of a denial letter is vital for addressing concerns and exploring alternatives.

A formal rejection is a structured communication that notifies someone that their request or proposal has been declined. It serves to clarify the decision and provide reasoning, thereby helping to prevent misunderstandings. A well-crafted letter can also pave the way for future interactions.

A formal denial letter is a professional correspondence that communicates a decision to reject an application or request. It typically includes essential details such as the reasons for the denial and any necessary information about next steps. This ensures clarity and preserves professional relationships.

A denial letter is a formal document informing a person or organization that their request or application has been denied. It outlines the reasons for the denial and often encourages the recipient to address the issues or to discuss further options. Keeping a professional tone is essential.

Yes, Tennessee is an open record state, which means that many public records are accessible to citizens. This transparency allows individuals to request documents without needing a specific reason. However, certain exemptions do exist, so familiarize yourself with the regulations to navigate these records effectively.

To write a formal denial letter, start by addressing the recipient clearly. State the purpose of your letter in the opening sentence. Use a respectful tone throughout and provide a brief explanation for the denial. Conclude with an offer to discuss further, enhancing relationships, and ensuring clarity.

I am writing to dispute a charge of $ to my credit or debit card account on date of the charge. The charge is in error because explain the problem briefly. For example, the items weren't delivered, I was overcharged, I returned the items, I did not buy the items, etc..

Disputing a credit card charge. Consumers can dispute fraudulent charges on their bill by calling their issuer. This is typically a quick process where the issuer will cancel the credit card in question and reissue a new one. You also have the right to dispute a credit card charge for a purchase you willingly made.

Merchants can take customers to court over fraudulent chargebacks, and many jurisdictions will pursue criminal charges for chargeback-related fraud.

Your dispute letter should include the following information:Your full name.Your date of birth.Your Social Security number.Your current address and any other addresses at which you have lived during the past two years.A copy of a government-issued identification card such as a driver's license or state ID.More items...?