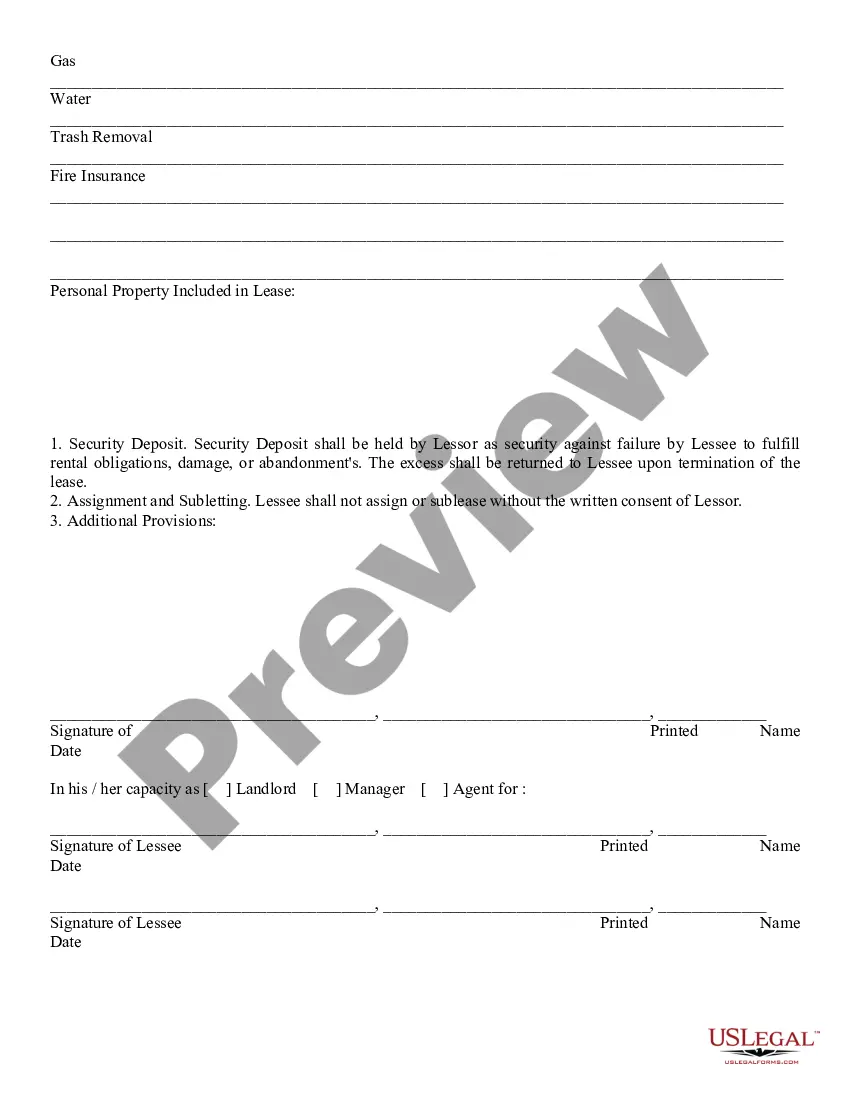

Tennessee Nonresidential Simple Lease

Description

How to fill out Nonresidential Simple Lease?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a broad assortment of legal document formats you can obtain or create.

By utilizing the website, you can access thousands of templates for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents such as the Tennessee Nonresidential Simple Lease in just moments.

If you already have a membership, Log In and obtain the Tennessee Nonresidential Simple Lease from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded templates in the My documents tab of your account.

Process the transaction. Utilize your credit card or PayPal account to finalize the payment.

Select the format and download the document onto your device. Make modifications. Fill out, edit, and print or sign the downloaded Tennessee Nonresidential Simple Lease. Each template you saved in your account has no expiration date and is yours indefinitely. Therefore, to obtain or print another copy, simply navigate to the My documents section and click on the document you desire. Access the Tennessee Nonresidential Simple Lease with US Legal Forms, the most extensive library of legal document formats. Utilize a vast number of professional and state-specific templates that fulfill your business or personal requirements and specifications.

- Ensure you have selected the correct document for your area/county.

- Click the Preview button to review the document's content.

- Read the document description to confirm you have chosen the correct template.

- If the document does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the template, confirm your choice by clicking the Get now button.

- Next, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Living somewhere without a lease can be done through various arrangements, including subletting or month-to-month agreements. However, it is important to ensure that these options meet your needs and legal requirements. A Tennessee Nonresidential Simple Lease can clarify your rights and responsibilities during your stay, making it a safer approach. If you prefer flexibility, consider temporary housing solutions or explore options provided by uslegalforms to create a lease that suits your circumstances.

An example of a non-residential real property includes an office building used for business operations. Other examples are retail storefronts or warehouses. If you are considering a Tennessee Nonresidential Simple Lease, knowing what types of non-residential properties exist can help tailor your investment decisions and business plans. Make sure to choose a space that meets your needs efficiently.

Filling out a condition form for an apartment requires attention to detail. Start by documenting everything you see, noting any existing damages or issues clearly. When dealing with your Tennessee Nonresidential Simple Lease, being thorough can protect you from disputes when moving out. Make sure to take photos and keep a copy of the completed form for your records.

Filling out a rental application without a rental history can feel daunting, but it's possible. Be honest about your situation and highlight your other strengths, such as steady income or good credit. When applying for a place under a Tennessee Nonresidential Simple Lease, consider providing references or documentation that showcase your reliability. This can help landlords see your potential as a responsible tenant.

Kicking someone out who is not on the lease can be complex, especially if the individual is your spouse. In Tennessee, the rights of individuals living together can differ based on state laws and marital status. If you find yourself in such a situation, consider seeking advice on your Tennessee Nonresidential Simple Lease to understand the best course of action. Legal guidance can help protect your rights and interests.

residential property is any real estate that is not used for dwelling purposes. This includes spaces like offices, retail shops, and industrial buildings. When dealing with a Tennessee Nonresidential Simple Lease, understanding what classification applies to your property is important. Such distinctions can affect legal obligations and property management.

Living somewhere without being on the lease can lead to legal complications. Generally, the leaseholder may have specific rights to evict someone not officially listed on the Tennessee Nonresidential Simple Lease. It is best to communicate openly with the leaseholder about your situation to avoid misunderstandings. Remember, each case can vary based on lease terms and local laws.

In Tennessee, a lease agreement does not need to be notarized to be legally binding. However, having a notary can add a layer of security and clarity to the agreement. If you are dealing with a Tennessee Nonresidential Simple Lease, it might be beneficial to have it notarized, especially if disputes arise later. Always consider consulting a legal professional to ensure your lease is properly executed.

An assignment of lease in Tennessee does not require notarization to be legally valid. It must, however, be properly executed and typically needs the consent of the original landlord. To protect your interests effectively, consider incorporating clear terms regarding the assignment in your lease. For guidance, US Legal Forms offers tools to help you create comprehensive Tennessee Nonresidential Simple Lease documents.

Yes, a handwritten lease agreement can be legally binding in Tennessee as long as it includes the necessary terms and signatures from both parties. The agreement must clearly outline the obligations and rights of each party. However, using official templates can enhance clarity and mitigate potential disputes. The US Legal Forms platform provides resources for creating a strong Tennessee Nonresidential Simple Lease.