Tennessee Triple Net Lease for Residential Property

Description

How to fill out Triple Net Lease For Residential Property?

You might spend countless hours online trying to locate the legal document template that satisfies the state and federal requirements you require.

US Legal Forms provides a vast selection of legal documents that are vetted by professionals.

You can download or print the Tennessee Triple Net Lease for Residential Property through their service.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- Following that, you can complete, modify, print, or sign the Tennessee Triple Net Lease for Residential Property.

- Every legal document template you buy is yours indefinitely.

- To obtain a duplicate of any purchased form, visit the My documents section and select the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have chosen the correct document template for your state/city of choice. Review the form information to confirm your selection.

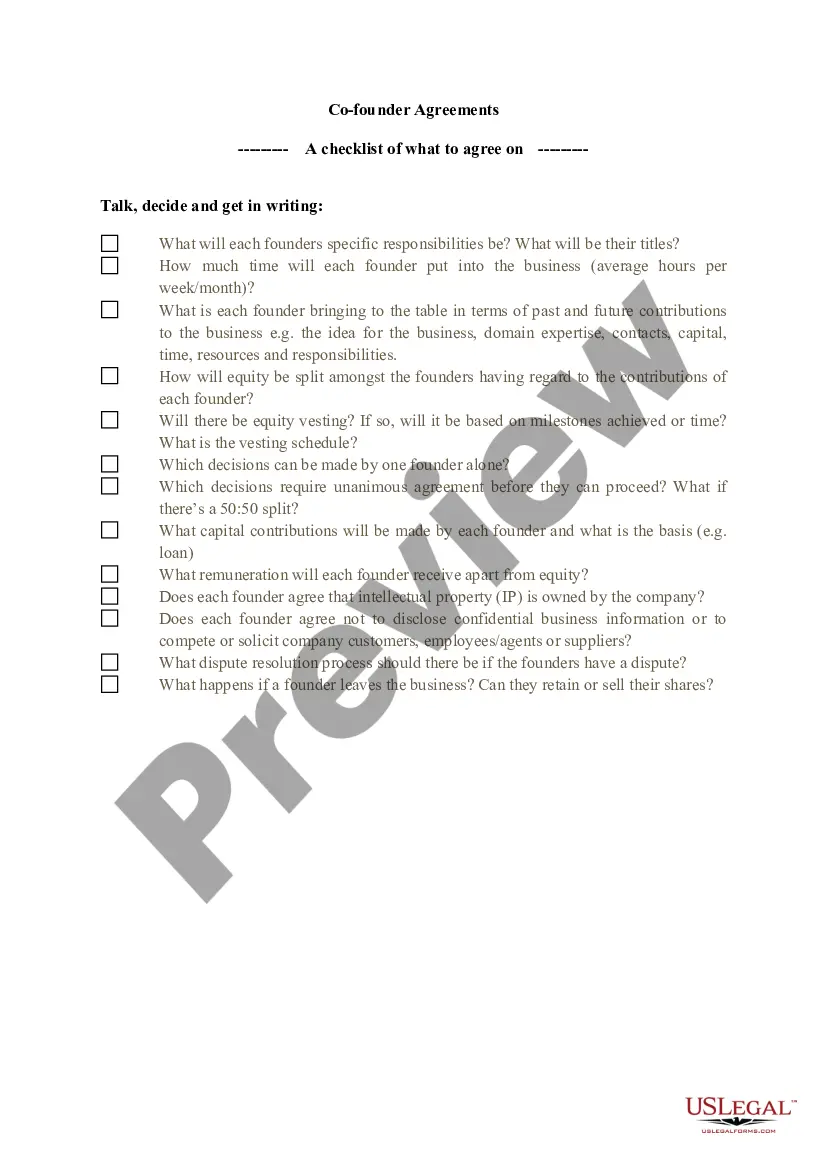

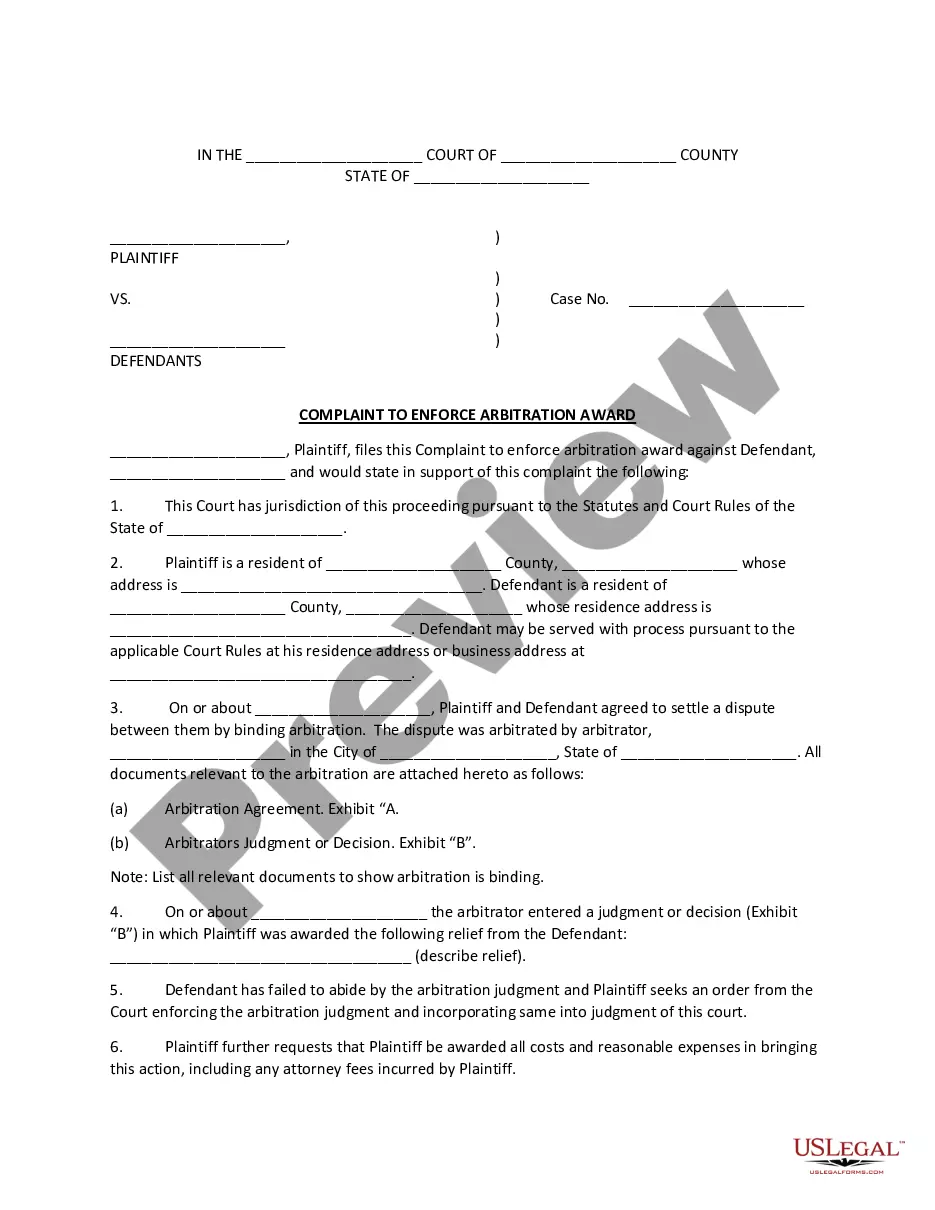

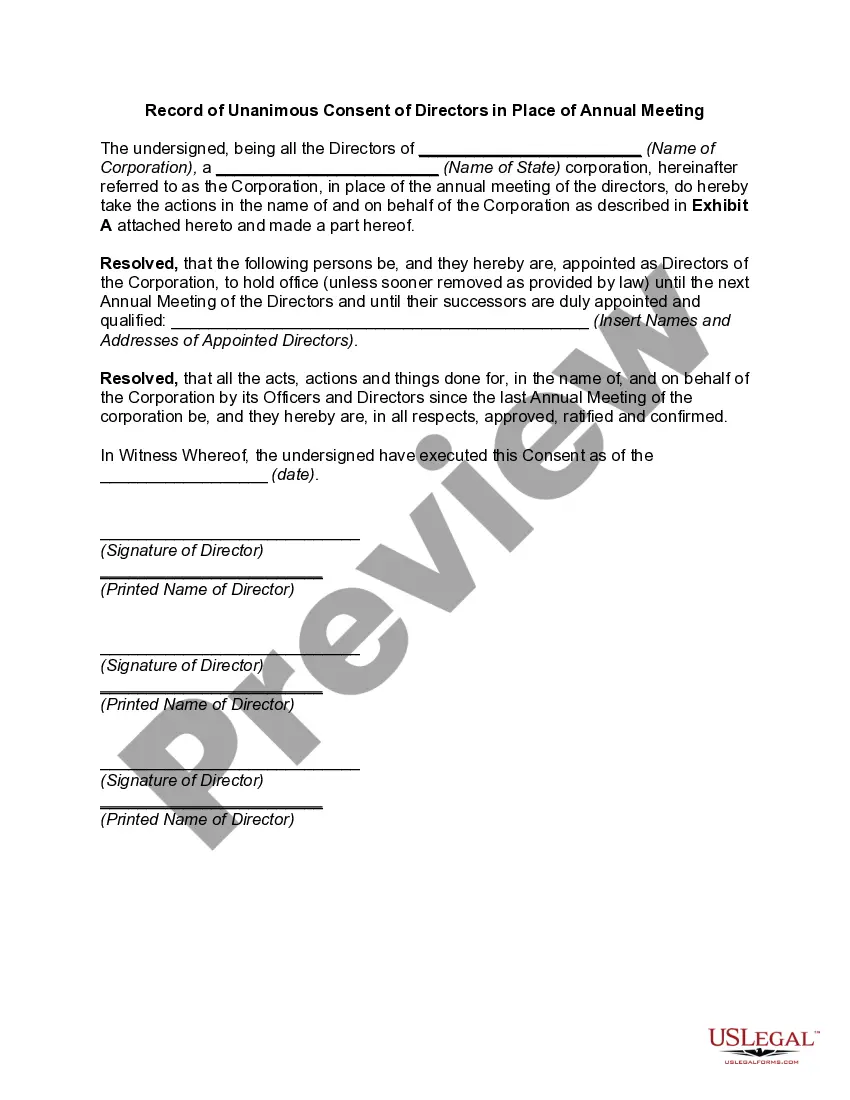

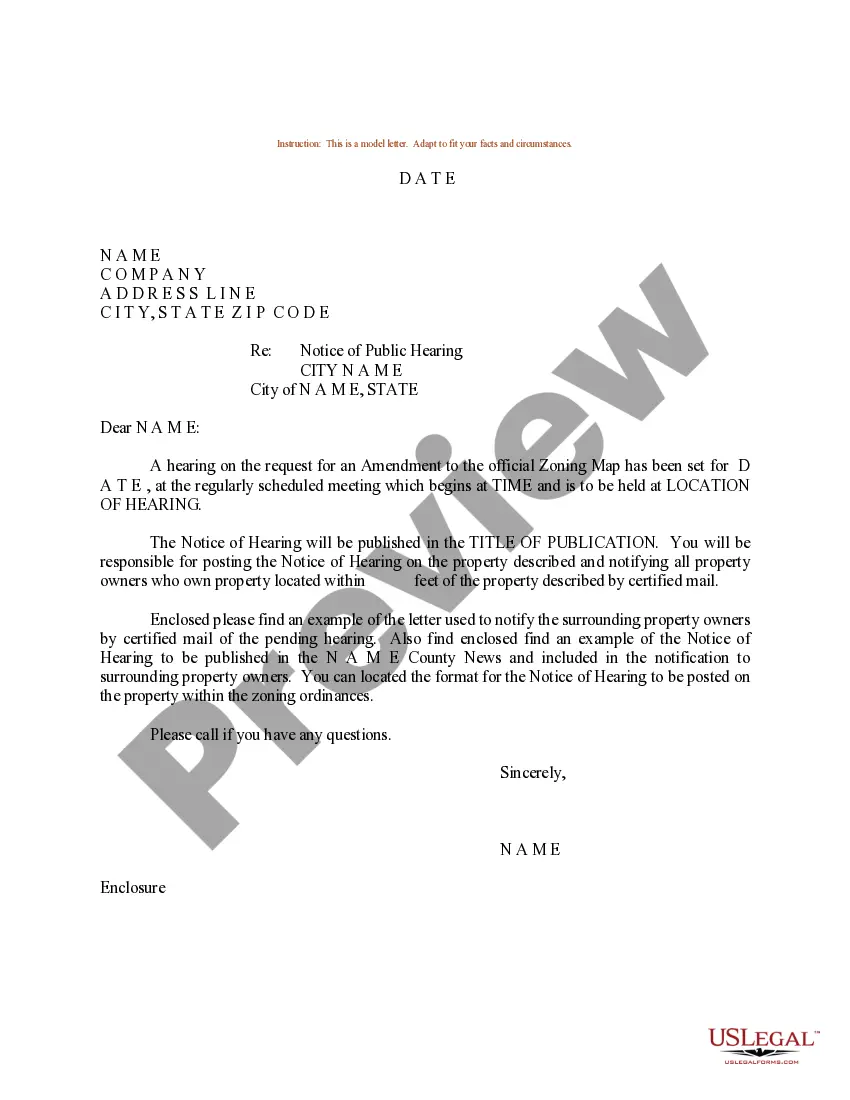

- If available, utilize the Preview option to examine the document template as well.

Form popularity

FAQ

To qualify for a Tennessee Triple Net Lease for Residential Property, you typically need to demonstrate financial stability and a reliable income source. Landlords often require rental references and a credit check to assess your capability to cover additional expenses. Being prepared with necessary financial documents can streamline the process and enhance your application. Using resources like U.S. Legal Forms can provide guidance and templates to help you effectively navigate this qualification process.

The downside of a Tennessee Triple Net Lease for Residential Property includes the potential for higher out-of-pocket expenses. Tenants are responsible for property taxes, insurance, and maintenance costs, which can add up quickly. Moreover, if these costs increase, your monthly expenses may rise unexpectedly. It is essential to analyze these factors before entering into such an agreement.

Structuring a Tennessee Triple Net Lease for Residential Property involves defining the responsibilities of both parties clearly. The lease should outline the base rent amount, payment terms, and the specific costs that the tenant must cover, such as property taxes, insurance, and maintenance fees. It is essential to include renewal terms, conditions for terminating the lease, and any additional clauses that may apply. Using a reliable platform like US Legal Forms can help you create well-structured leases that meet legal standards.

To calculate a Tennessee Triple Net Lease for Residential Property, start by determining the base rent agreed upon by both tenant and landlord. Next, calculate the estimated costs for property taxes, insurance, and maintenance, as these are typically passed on to the tenant. Finally, sum these costs and add them to the base rent to find the total monthly payment. This approach ensures clarity and fairness in the leasing process.

A standard residential lease agreement in Tennessee outlines the terms and conditions under which a property is rented. This agreement typically includes details such as rent amount, payment schedule, and responsibilities for maintenance. In the context of a Tennessee Triple Net Lease for Residential Property, the agreement may also specify who is responsible for taxes, insurance, and maintenance, providing clarity for both landlords and tenants. This structured agreement helps ensure a smooth rental experience, protecting the interests of both parties.

The criteria for a Tennessee Triple Net Lease for Residential Property usually include a responsible tenant, a good credit score, and an understanding of the lease terms. Additionally, the tenant should be prepared to cover expenses such as property taxes, insurance, and maintenance costs. These factors help landlords assess the suitability of a tenant for this type of lease. For comprehensive resources and templates, consider using the US Legal Forms platform, which offers insights tailored to triple net leases.

Getting approved for a Tennessee Triple Net Lease for Residential Property involves several key steps. First, ensure that your financial documents, such as income statements and credit reports, are organized and accurate. Next, landlords typically look for stable income and a reliable rental history. Lastly, provide any necessary references or endorsements that demonstrate your responsibility as a tenant.