Tennessee Triple Net Lease for Industrial Property

Description

How to fill out Triple Net Lease For Industrial Property?

Are you in a circumstance where you require documents for various organizational or personal tasks almost every day.

There are numerous valid document templates accessible online, but locating reliable versions isn't straightforward.

US Legal Forms provides an extensive array of form templates, including the Tennessee Triple Net Lease for Industrial Property, which can be customized to fulfill both state and federal requirements.

If you find the correct form, click on Purchase now.

Choose the pricing plan you prefer, enter the required details to create your account, and complete the purchase using your PayPal, Visa, or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Tennessee Triple Net Lease for Industrial Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it's for the correct city/area.

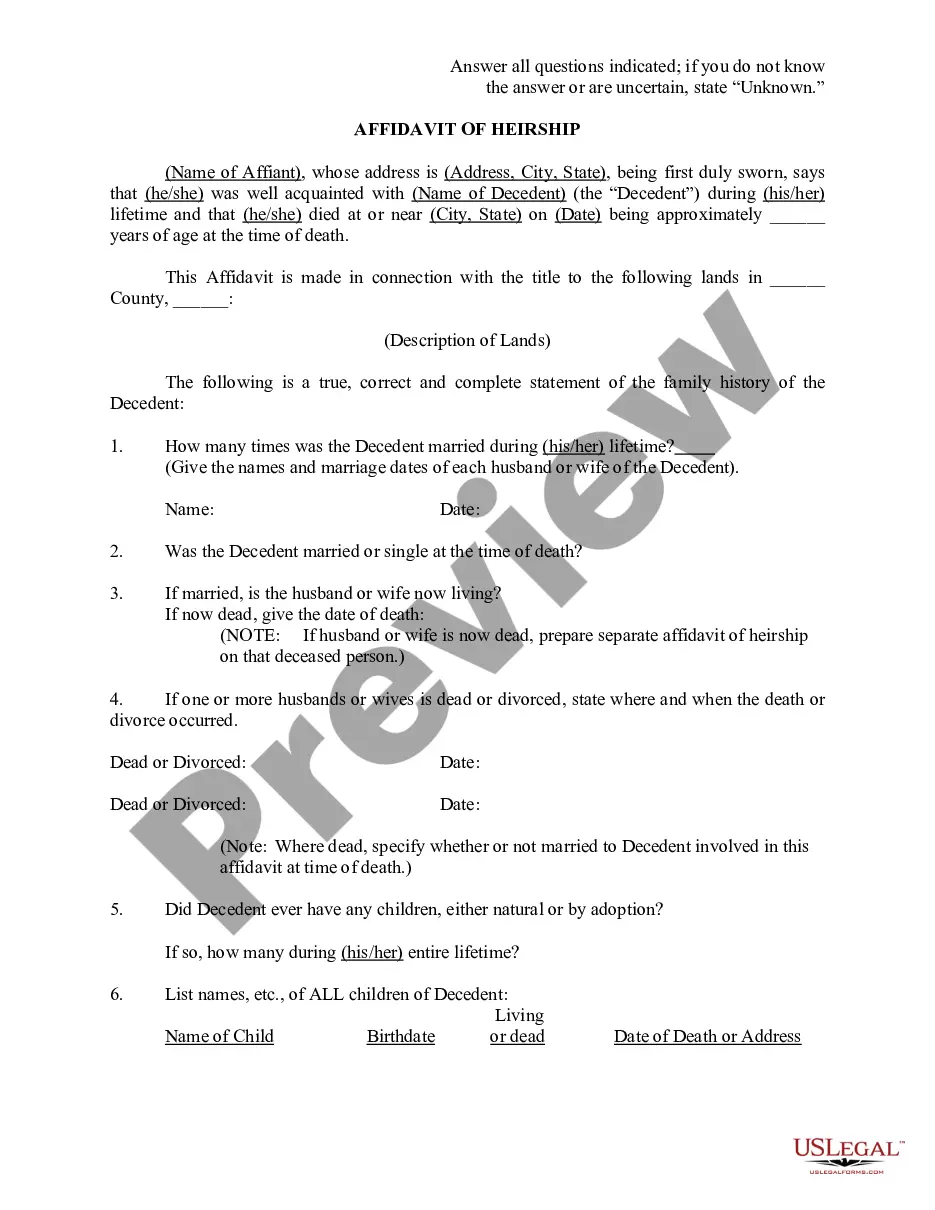

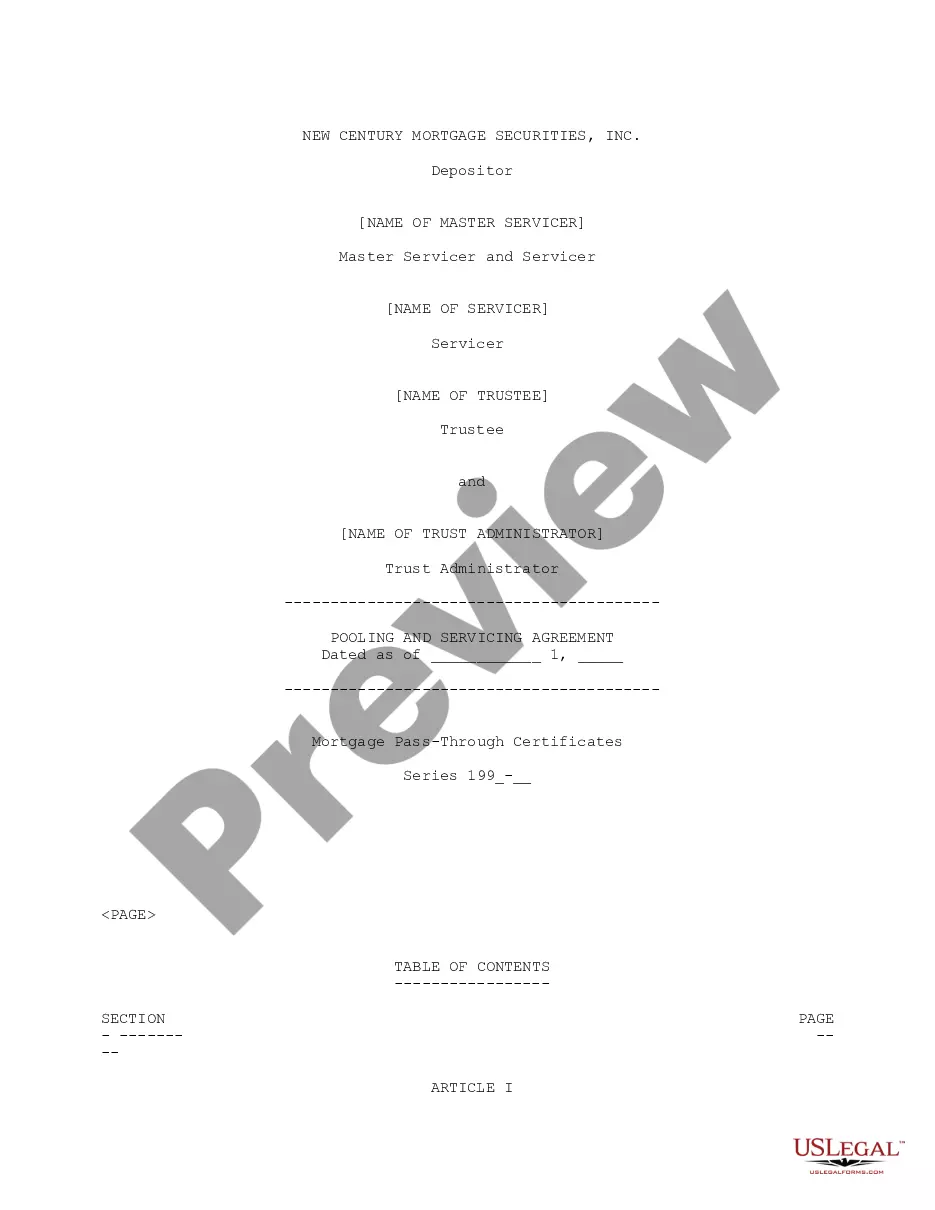

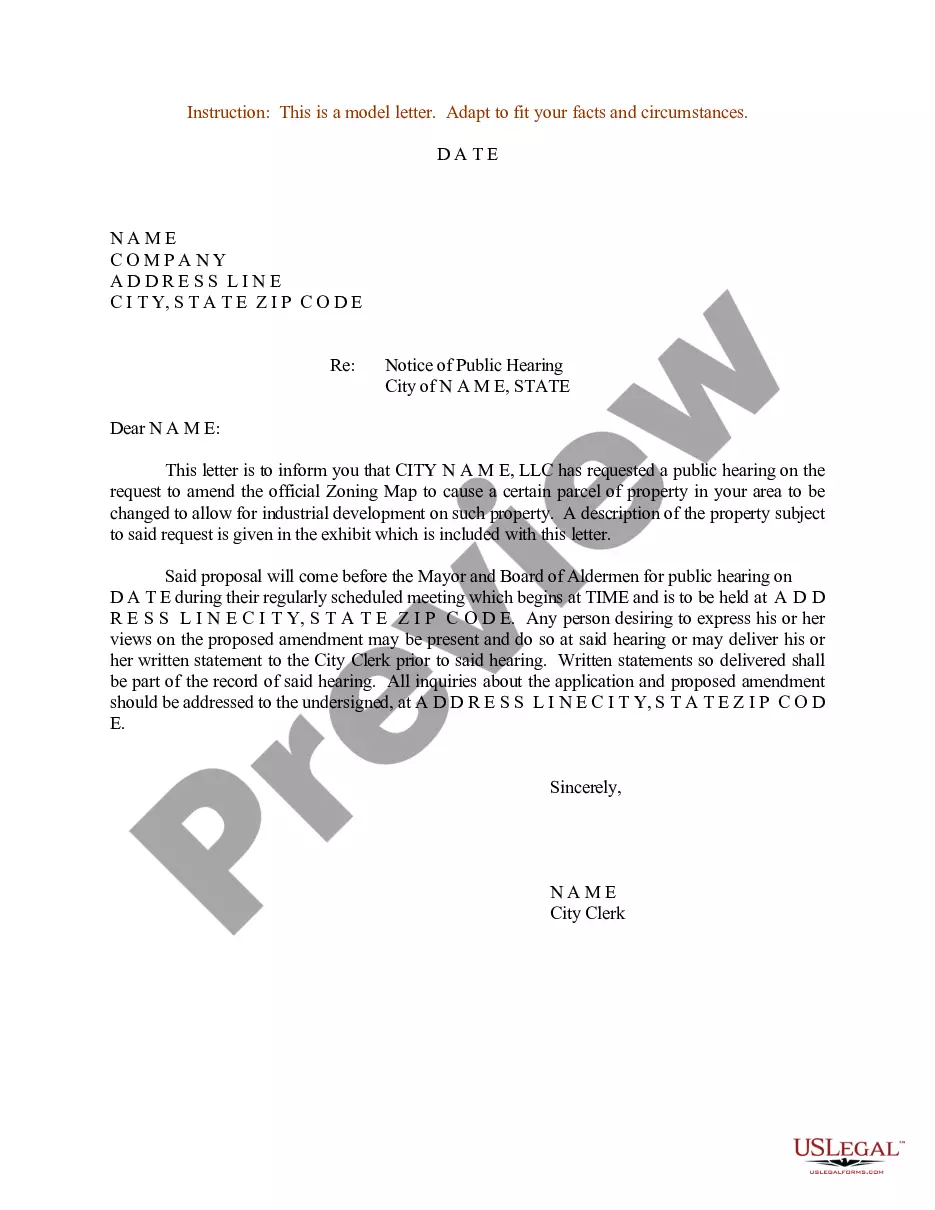

- Use the Review option to scrutinize the document.

- Check the description to ensure you have selected the proper form.

- If the form isn’t what you’re looking for, utilize the Search field to find a form that suits your needs.

Form popularity

FAQ

In a Tennessee Triple Net Lease for Industrial Property, certain items are typically not included in the lease agreement. For instance, the tenant usually pays for property taxes, insurance, and maintenance, but items like structural repairs or significant capital improvements are often the landlord's responsibility. Additionally, utilities and landscaping may fall outside of the lease's scope, leading to potential confusion. To avoid misunderstandings, it's crucial for both landlords and tenants to clarify these details in their lease discussions.

Yes, many commercial leases are structured as Tennessee Triple Net Leases for Industrial Property. This lease type means that tenants take on responsibility for property expenses besides the base rent, offering landlords a stable income. It is beneficial for landlords seeking predictable revenue and for tenants who want more control over property expenditures. If you're considering a triple net lease, US Legal Forms provides templates to make the leasing process straightforward.

To calculate commercial rent for a Tennessee Triple Net Lease for Industrial Property, you start with the base rent and then add the property taxes, insurance, and maintenance costs. These additional expenses typically vary based on the property and its location. Therefore, it's essential to review these costs carefully to ensure you understand the total financial commitment. US Legal Forms can guide you in drafting a comprehensive lease that details these calculations.

The main downside of a triple net lease is the additional financial responsibility placed on the tenant. In a Tennessee Triple Net Lease for Industrial Property, unexpected costs such as major repairs can significantly impact a tenant’s budget. As a tenant, it’s vital to assess potential expenses that may arise. Using platforms like uslegalforms can help you navigate and understand lease obligations better, ensuring you’re well-prepared for every scenario.

Triple net on a commercial lease refers to the financial responsibilities that a tenant takes on, which include property tax, insurance, and maintenance costs. In the realm of Tennessee Triple Net Lease for Industrial Property, understanding this concept is crucial for both parties involved in the lease. This structure often makes leases more appealing due to potentially lower base rent. However, it's essential to ensure that all obligations are documented within the lease.

To calculate commercial rent in a Tennessee Triple Net Lease for Industrial Property, first determine the base rent and then add estimated property expenses. These expenses usually cover taxes, insurance, and maintenance. For accuracy, it's advisable to review historical costs or consult a real estate professional. This approach ensures that both landlords and tenants have a clear understanding of total occupancy costs.

In a Tennessee Triple Net Lease for Industrial Property, the structure typically includes the tenant paying for property taxes, insurance, and maintenance costs in addition to the base rent. This arrangement shifts many financial responsibilities from the landlord to the tenant. Such a lease ensures the landlord receives a predictable income while the tenant may benefit from lower base rents. It's essential to clearly outline each party's obligations in the lease agreement.

To get approved for a Tennessee Triple Net Lease for Industrial Property, focus on presenting a strong financial profile and a solid lease proposal. Landlords look for reliable tenants, so providing detailed financial records and demonstrating industry experience can boost your credibility. Additionally, online platforms like uslegalforms can help you find necessary forms and resources to prepare a comprehensive application, ensuring you meet all requirements.

To qualify for a Tennessee Triple Net Lease for Industrial Property, a tenant typically needs to demonstrate a stable income, a solid credit history, and a suitable business model. Landlords often look for tenants who can cover long-term lease obligations while managing property expenses like insurance, maintenance, and taxes. Providing a thorough rental application and financial documents can significantly improve your chances of approval.