Tennessee Revocable Trust for Property

Description

How to fill out Revocable Trust For Property?

Should you desire to finalize, obtain, or create legitimate document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Employ the site's straightforward and user-friendly search to locate the documents you require. Various templates for commercial and personal purposes are organized by categories and regions, or keywords.

Leverage US Legal Forms to discover the Tennessee Revocable Trust for Property in just a few clicks.

Each legal document template you purchase is yours indefinitely. You have access to every document you downloaded with your account. Browse the My documents section and select a document to print or download again.

Complete and obtain, and print the Tennessee Revocable Trust for Property using US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are an existing US Legal Forms purchaser, sign in to your account and click the Download button to find the Tennessee Revocable Trust for Property.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form relevant to the right city/state.

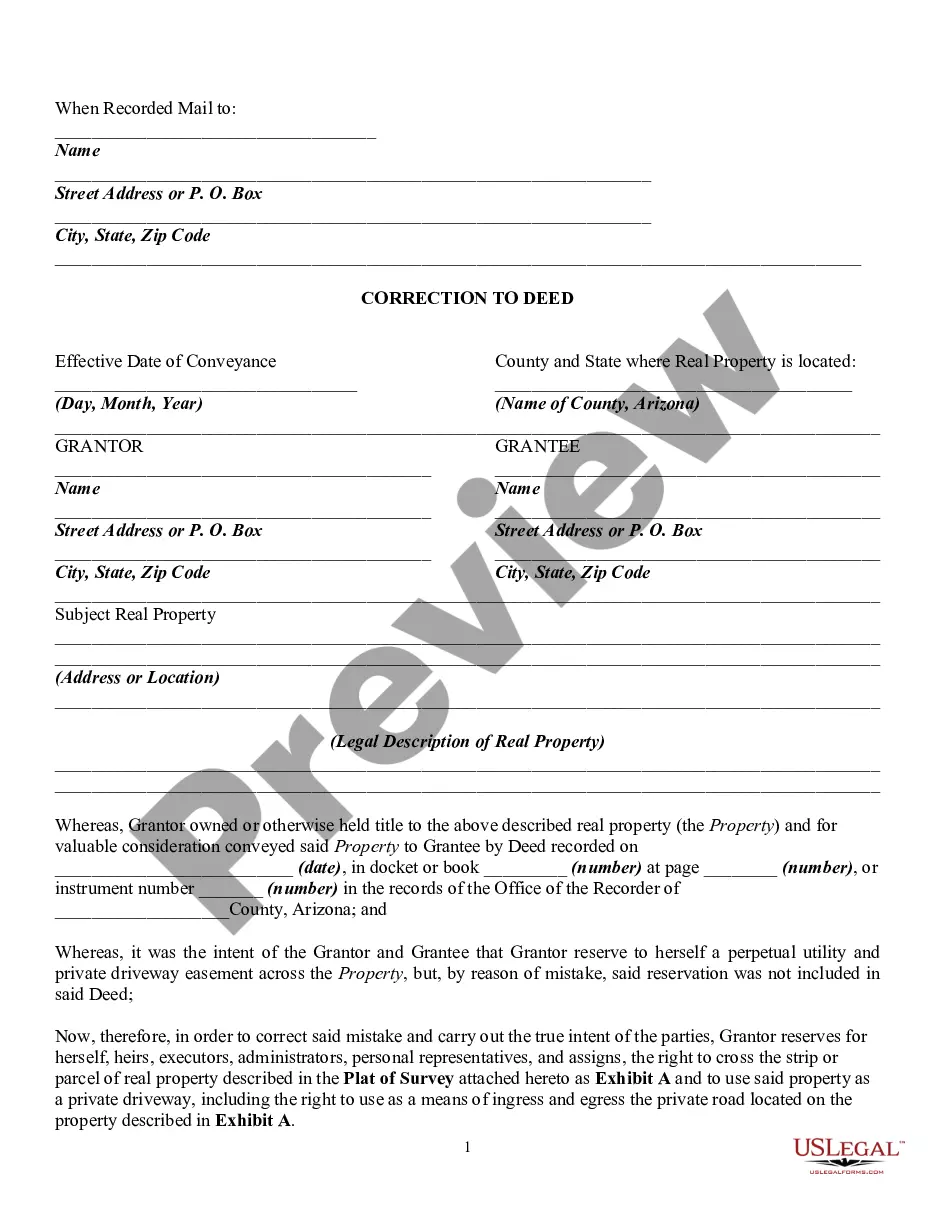

- Step 2. Utilize the Review option to examine the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions in the legal document template.

- Step 4. Once you have found the form you want, click on the Purchase now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Tennessee Revocable Trust for Property.

Form popularity

FAQ

In Tennessee, trusts themselves are not typically recorded, but any real estate held by the trust requires deed recording. When you establish a Tennessee Revocable Trust for Property and transfer real estate into it, you must record the deed that lists the trust as the owner. This process provides clear public notice of your trust’s ownership and helps prevent future disputes regarding the property.

For a trust document to be legal, it must meet specific criteria, including the creator's intent to establish the trust and the proper execution of the document according to state laws. It should clearly define the trust's terms, the trustee's powers, and the beneficiaries. A Tennessee Revocable Trust for Property must also be signed by the grantor and the trustee to be valid, ensuring that all parties involved understand their roles and responsibilities.

Generally, a trust does not have to be recorded in Tennessee, including a Tennessee Revocable Trust for Property. However, if the trust owns real estate, you must record the deed transferring that property to the trust to ensure clear ownership. Proper recording protects your interests and makes it easier for beneficiaries to access trust assets in the future.

In Tennessee, registering a trust is not always necessary, especially for a Tennessee Revocable Trust for Property. Typically, you should create a trust document and keep it in a safe place. If your trust holds real estate or other significant assets, it's wise to work with a legal professional to ensure all necessary transfers and proper titling occur, protecting your interests and the trust's assets.

One significant mistake parents often make when setting up a trust fund is failing to clearly define the trust's terms and the distribution of assets. This lack of clarity can lead to misunderstandings and disputes among beneficiaries. Additionally, parents may overlook the benefits of a Tennessee Revocable Trust for Property, which allows them to maintain control over their assets while providing for their children's future. Proper planning and outlining intentions can help avoid these pitfalls.

To put your property in a trust in Tennessee, first, decide on the type of trust that fits your needs, such as a Tennessee Revocable Trust for Property. Next, you will need to create a trust document, which outlines the terms and conditions of the trust. Finally, you must transfer the property title into the trust by executing a new deed that lists the trust as the owner. This process ensures your property is protected and managed according to your wishes.

One downside of a revocable trust in Tennessee is that the assets within it are still considered part of your estate for tax purposes. This means you may not avoid estate taxes or creditor claims as you would with an irrevocable trust. Additionally, while your property can be easily transferred, maintaining the trust requires some effort and attention. For tailored guidance, uslegalforms can assist you in understanding your options and optimizing your estate plan.

In Tennessee, a revocable trust allows you to modify or dissolve the trust during your lifetime, making it a flexible option for managing your assets. On the other hand, an irrevocable trust typically cannot be altered once established, which means you relinquish control over the assets placed within it. Choosing a Tennessee Revocable Trust for Property gives you the peace of mind that you can adapt your estate plan as needed. Knowing this difference can help you make informed decisions about your estate planning.

Yes, you can put your house in a trust in Tennessee, specifically in a Tennessee Revocable Trust for Property. This process allows you to maintain control over your property while designating beneficiaries for after your passing. Additionally, you can change the terms of the trust at any time, which provides flexibility as your circumstances change. To ensure that your property is properly transferred, consider using tools from uslegalforms to guide you through the process.

Setting up a revocable trust in Tennessee involves creating a trust document that outlines your wishes regarding the property. You will name yourself as the trustee, allowing you to manage the assets while you are alive. Consider using platforms like US Legal Forms to simplify the process and ensure you meet all legal requirements for a Tennessee Revocable Trust for Property.