A Tennessee Revocable Trust for Estate Planning is a legal arrangement that allows individuals to retain control over their assets while ensuring a smooth transfer of their estate upon their death. This type of trust is revocable, meaning it can be modified or revoked by the granter during their lifetime, providing flexibility and adaptability to changing circumstances. One of the main benefits of a Tennessee Revocable Trust is the ability to avoid probate. Probate is the legal process through which a deceased person's assets are distributed, which can be time-consuming, expensive, and subject to public scrutiny. By placing assets in a revocable trust, they do not pass through probate, allowing for a more efficient and private transfer of wealth to beneficiaries. There are various types of Tennessee Revocable Trusts available for estate planning purposes, depending on individual needs and goals. Some common types include: 1. Revocable Living Trust: This type of trust is created during the granter's lifetime and can be modified or revoked at any time. It allows individuals to maintain control over their assets while designating beneficiaries to receive the assets upon their death. A revocable living trust can also provide provisions for management of assets in the event of incapacity. 2. Marital Deduction Trust: This trust is often used by married couples to ensure the seamless transfer of assets between spouses while reducing estate taxes. It allows the surviving spouse to maintain control and benefit from the assets in the trust while preserving their availability for the final beneficiaries. 3. Irrevocable Life Insurance Trust: Although not revocable, this type of trust is commonly used in conjunction with estate planning to exclude life insurance proceeds from the estate for tax purposes. It provides a means to support beneficiaries with tax-free life insurance proceeds and offers potential estate tax savings. 4. Qualified Personnel Residence Trust: This trust allows individuals to transfer their primary residence or vacation home to the trust, removing the property's value from their taxable estate. While maintaining the right to live in the home for a specific period, the granter can pass the property to beneficiaries at a reduced gift tax value. In summary, a Tennessee Revocable Trust for Estate Planning offers individuals a versatile tool to manage and distribute their assets while minimizing probate, maintaining privacy, and potentially reducing estate taxes. Whether considering a revocable living trust, a marital deduction trust, an irrevocable life insurance trust, or a qualified personnel residence trust, consulting with an experienced estate planning attorney is essential to ensure the trust aligns with individual goals and legal requirements.

Tennessee Revocable Trust for Estate Planning

Description

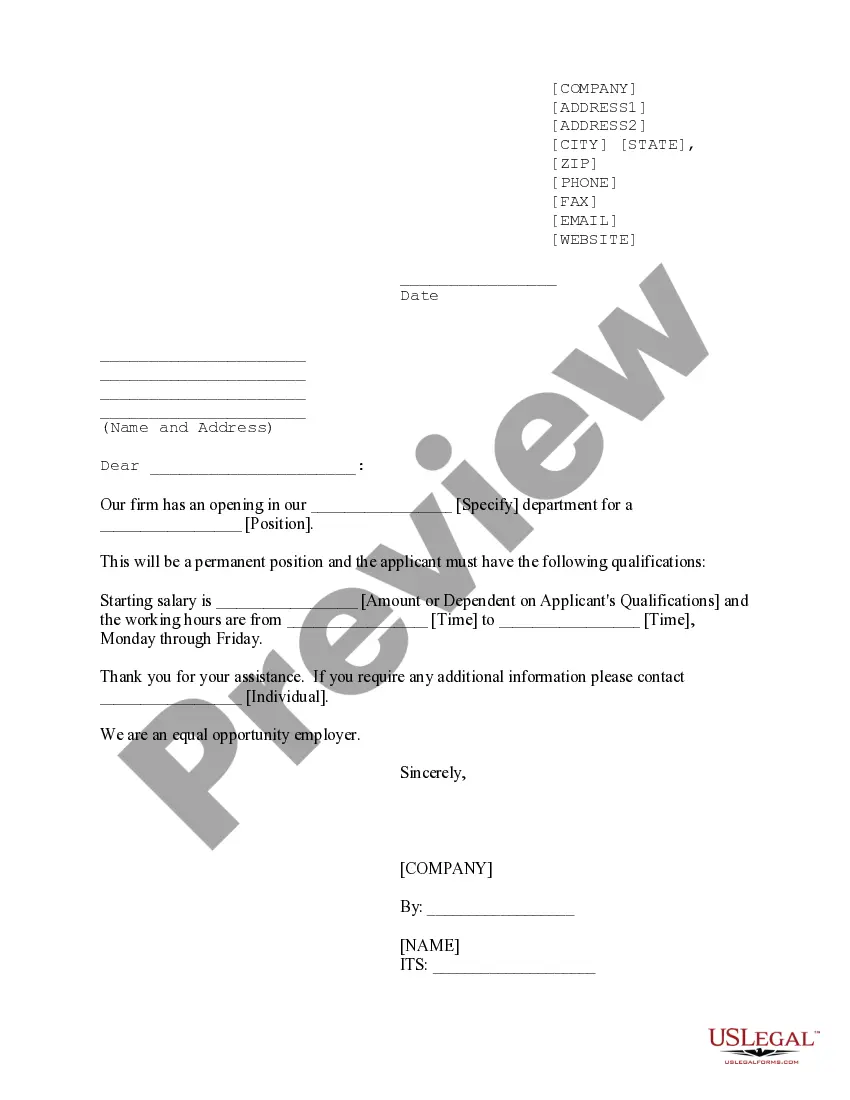

How to fill out Tennessee Revocable Trust For Estate Planning?

US Legal Forms - one of several greatest libraries of authorized varieties in the States - offers a wide array of authorized file layouts you may obtain or print out. Making use of the web site, you can get thousands of varieties for enterprise and specific uses, categorized by categories, claims, or keywords.You can get the most up-to-date versions of varieties much like the Tennessee Revocable Trust for Estate Planning in seconds.

If you already have a monthly subscription, log in and obtain Tennessee Revocable Trust for Estate Planning from your US Legal Forms collection. The Acquire switch can look on every single form you look at. You get access to all previously acquired varieties within the My Forms tab of the accounts.

If you would like use US Legal Forms the very first time, listed here are straightforward instructions to obtain started off:

- Ensure you have picked out the right form to your city/area. Click the Preview switch to analyze the form`s content material. Browse the form explanation to actually have chosen the proper form.

- In case the form doesn`t satisfy your requirements, take advantage of the Look for area on top of the display screen to discover the one which does.

- Should you be pleased with the shape, verify your selection by clicking on the Purchase now switch. Then, opt for the pricing plan you like and supply your qualifications to register to have an accounts.

- Process the deal. Make use of your Visa or Mastercard or PayPal accounts to accomplish the deal.

- Pick the format and obtain the shape in your system.

- Make modifications. Load, edit and print out and indicator the acquired Tennessee Revocable Trust for Estate Planning.

Every single template you put into your bank account does not have an expiration particular date and is also your own property for a long time. So, if you would like obtain or print out one more duplicate, just visit the My Forms segment and click on the form you need.

Get access to the Tennessee Revocable Trust for Estate Planning with US Legal Forms, by far the most extensive collection of authorized file layouts. Use thousands of expert and condition-distinct layouts that satisfy your organization or specific demands and requirements.