This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Tennessee Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of All Of Expected Interest In Estate In Order To Pay Indebtedness?

If you have to full, down load, or print legitimate file templates, use US Legal Forms, the greatest collection of legitimate varieties, which can be found on the web. Take advantage of the site`s easy and practical lookup to get the documents you require. Various templates for organization and person purposes are sorted by types and claims, or keywords. Use US Legal Forms to get the Tennessee Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness within a handful of click throughs.

If you are currently a US Legal Forms customer, log in in your accounts and click the Obtain switch to obtain the Tennessee Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. You can also entry varieties you earlier downloaded in the My Forms tab of your respective accounts.

Should you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have selected the form to the right town/nation.

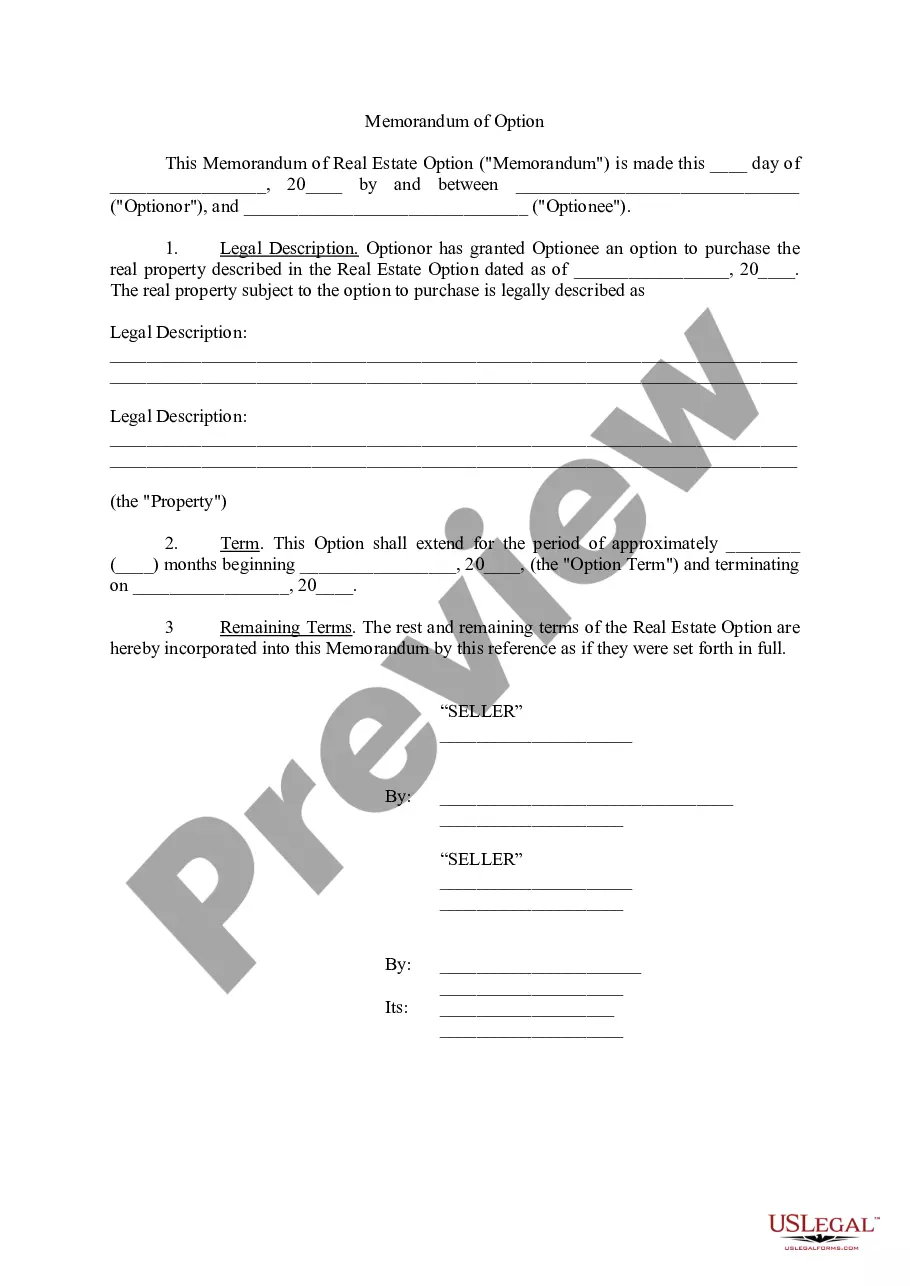

- Step 2. Make use of the Review method to look over the form`s content. Do not forget to read the description.

- Step 3. If you are not satisfied with all the form, use the Research field on top of the screen to find other types in the legitimate form format.

- Step 4. When you have found the form you require, click on the Purchase now switch. Opt for the prices program you choose and add your qualifications to sign up to have an accounts.

- Step 5. Method the deal. You should use your charge card or PayPal accounts to finish the deal.

- Step 6. Pick the file format in the legitimate form and down load it in your system.

- Step 7. Comprehensive, change and print or indication the Tennessee Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness.

Each legitimate file format you purchase is your own property permanently. You might have acces to each form you downloaded within your acccount. Click on the My Forms portion and select a form to print or down load again.

Contend and down load, and print the Tennessee Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness with US Legal Forms. There are millions of specialist and status-distinct varieties you can use for the organization or person demands.

Form popularity

FAQ

The grantee or transferee to the county Register of Deeds pay the realty transfer tax. Mortgage tax is imposed on the recordation of instruments evidencing indebtedness such as mortgages, deeds of trust, conditional sales contracts, and financing statements.

However, any asset that has a joint owner or a beneficiary designation (or a payable/transferable on death designation), will not have to go through the probate process, so long as that designee is still alive. For any assets in the decedent's estate that were individually owned, the probate process will begin.

If a person passes away without leaving a will in Tennessee, the real property they owned is immediately transferred to their heirs.

In Tennessee, if no estate is opened, a creditor has 12 months after someone dies to file a claim against the estate of the deceased person. However, that deadline is shortened to 4 months or less if an estate is opened.

Who Pays Real Estate Transfer Taxes In Tennessee? The law in Tennessee suggests either the buyer or seller can pay the transfer tax on the property. However, in practice, the buyer typically pays this tax as part of their closing costs.

Deed Transfer Taxes and Documentary Stamps in Tennessee - The current deed transfer tax is $0.37 per every hundred dollars of consideration (sales price). The purchaser customarily pays the deed transfer tax.

If you own property as an individual or a business, you are required to pay Tennessee property tax. Even if the property was given to you through an estate or you own a rental property, you will still be held accountable for paying Tennessee property taxes.

The rate of the mortgage tax is $. 115 on each one hundred dollars ($100.00) over two thousand dollars ($2,000.00) of indebtedness. The incidence of the tax is declared to be on the mortgagor, grantor or debtor, as evidenced by the instrument offered for recording.