The Tennessee sale of partnership to corporation refers to the process of transferring ownership and assets from a partnership to a corporation in the state of Tennessee. This transaction allows a partnership to convert into a corporation, thus changing its legal structure and providing additional benefits. The sale can occur for various reasons, such as tax advantages, liability protection, or fundraising purposes. One type of Tennessee sale of partnership to corporation is a statutory conversion. This method involves filing a conversion plan with the Tennessee Secretary of State and obtaining the necessary approvals from the partners and shareholders. Through statutory conversion, the partnership's assets, liabilities, contracts, and legal rights are automatically transferred to the newly formed corporation without the need for a separate entity transfer. Another type of Tennessee sale of partnership to corporation is a statutory merger. In this scenario, the partnership merges with an existing corporation, resulting in a single entity. The partnership ceases to exist, and its assets and liabilities are transferred to the corporation. This process requires drafting a merger agreement, obtaining shareholder approval, and filing the necessary documents with the appropriate authorities. It's important to note that both statutory conversion and merger require compliance with Tennessee's laws and regulations, including payment of fees, submission of forms, and adherence to specific procedural requirements. Additionally, partnerships considering this sale should consult with legal and financial professionals to ensure a smooth transition and to determine the most suitable option based on their specific circumstances. The Tennessee sale of partnership to corporation offers several advantages. By converting to a corporation, partners can limit their personal liability, as the corporation becomes a separate legal entity responsible for its obligations. This can provide peace of mind and protect personal assets from being at risk. Additionally, corporations often enjoy favorable tax treatment, including deductions and lower tax rates, potentially resulting in significant savings. Furthermore, converting to a corporation can enhance the partnership's ability to raise capital through the issuance of stocks or other securities. In conclusion, the Tennessee sale of partnership to corporation involves the transfer of ownership and assets from a partnership to a corporation, typically through statutory conversion or merger. This process offers liability protection, tax advantages, and fundraising opportunities. Proper legal and financial guidance is crucial to ensuring a successful transition.

Tennessee Sale of Partnership to Corporation

Description

How to fill out Tennessee Sale Of Partnership To Corporation?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You will find the latest versions of documents like the Tennessee Sale of Partnership to Corporation in moments.

If you currently possess a monthly subscription, Log In and download the Tennessee Sale of Partnership to Corporation from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents tab in your account.

If you are satisfied with the form, confirm your selection by clicking the Buy Now button. Then, select your preferred pricing plan and provide your credentials to register for the account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Tennessee Sale of Partnership to Corporation document. Each template you added to your account has no expiration date and is yours forever. So, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the Tennessee Sale of Partnership to Corporation with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you would like to use US Legal Forms for the first time, here are simple steps to help you get started.

- Make sure you have selected the correct form for your city/state.

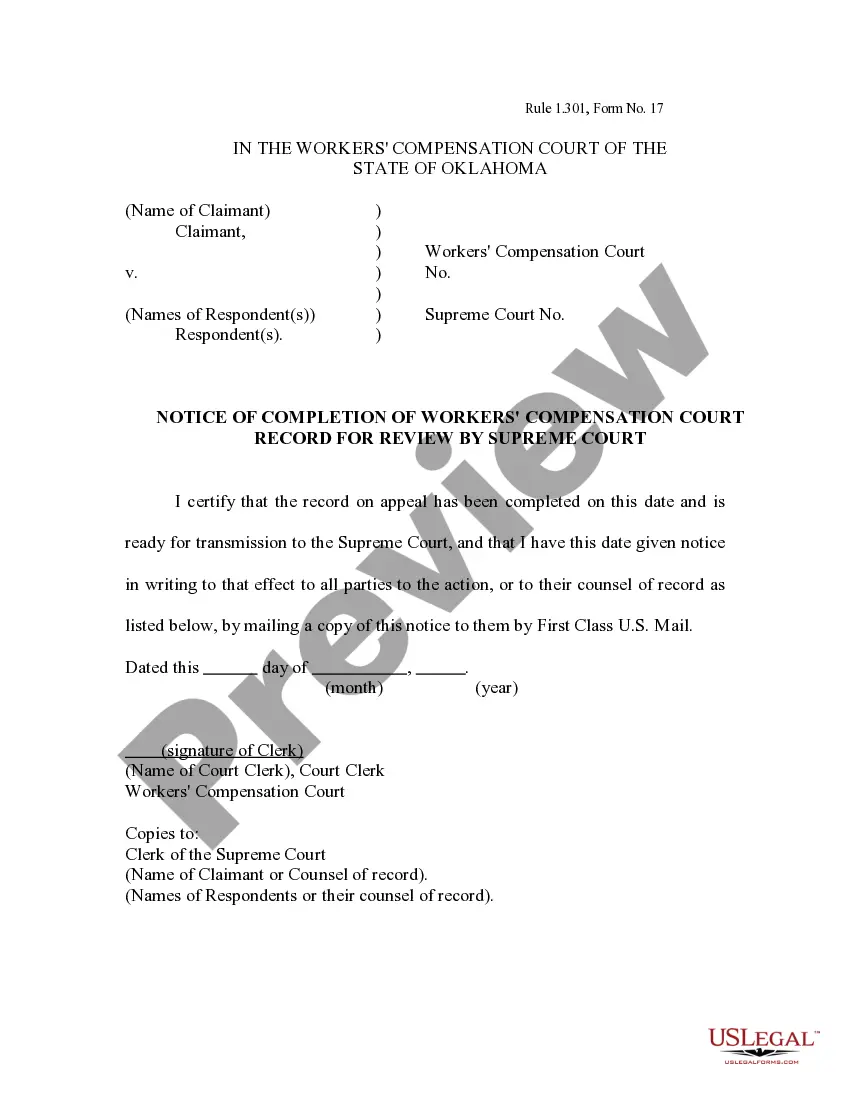

- Click the Preview button to review the content of the form.

- Check the form summary to confirm that you have chosen the right document.

- If the form does not meet your requirements, use the Search section at the top of the screen to find one that does.

Form popularity

FAQ

Tennessee FAE170 is the form used by corporations and certain entities to file for franchise and excise tax in the state. If your business is reorganized through a Tennessee Sale of Partnership to Corporation, you will likely need to use this form to report your taxes. US Legal Forms provides helpful resources and templates to guide you through this filing process.

Tennessee does not impose a state income tax on partnerships, which distinguishes it from many other states. However, partnerships that convert to corporations, as seen in a Tennessee Sale of Partnership to Corporation, may face different tax obligations. It's always wise to consult a tax professional to understand these dynamics fully.

Excise tax in Tennessee is imposed on the income of corporations and certain limited liability companies. If your business engages in a Tennessee Sale of Partnership to Corporation, you may need to understand how this tax applies to your entity after the sale. It's important to review the specific criteria and ensure compliance with state regulations.

To change your LLC to an S Corporation in Tennessee, you need to file Form 2553 with the IRS after meeting certain eligibility criteria. Additionally, you may want to consider the implications of a Tennessee Sale of Partnership to Corporation, which may change how your entity is taxed. Consulting with a legal professional or an expert from US Legal Forms can simplify this process.

In Tennessee, any corporation and limited liability company (LLC) that conducts business within the state must file a franchise tax return. This includes businesses formed as a result of a Tennessee Sale of Partnership to Corporation. To comply with this requirement, ensure that your entity is registered with the Tennessee Secretary of State and meets the minimum financial standards set by the state.

Partnerships in Tennessee are generally subject to pass-through taxation. Each partner reports their earnings, losses, deductions, and credits on their individual tax returns. This structure is especially relevant when considering financial transitions such as a Tennessee Sale of Partnership to Corporation, where tax implications can affect overall strategy.

Form FAE 174 must be filed by all entities that owe Franchise and Excise taxes in Tennessee. This includes partnerships and corporations that qualify under state tax regulations. If you're navigating the path of a Tennessee Sale of Partnership to Corporation, ensuring timely and accurate filing of this form is crucial.

LLCs in Tennessee are taxed depending on their structure. If treated as a partnership, profits pass through to members without facing entity-level taxation. However, for those considering a Tennessee Sale of Partnership to Corporation, understanding LLC taxation can significantly influence your decisions and strategies.

The 9.75% tax in Tennessee refers to the combined Franchise and Excise (F&E) tax rate applicable to businesses operating in the state. It applies to the net earnings of corporations, including those resulting from a Tennessee Sale of Partnership to Corporation. Businesses should plan for this tax to avoid surprises and ensure proper compliance.

To register for Tennessee Franchise and Excise (F&E) tax, you need to complete the appropriate application through the Tennessee Department of Revenue. The application requires you to provide information about your business structure and activities. For those considering a Tennessee Sale of Partnership to Corporation, understanding the registration process is vital for ensuring compliance with state tax laws.