This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

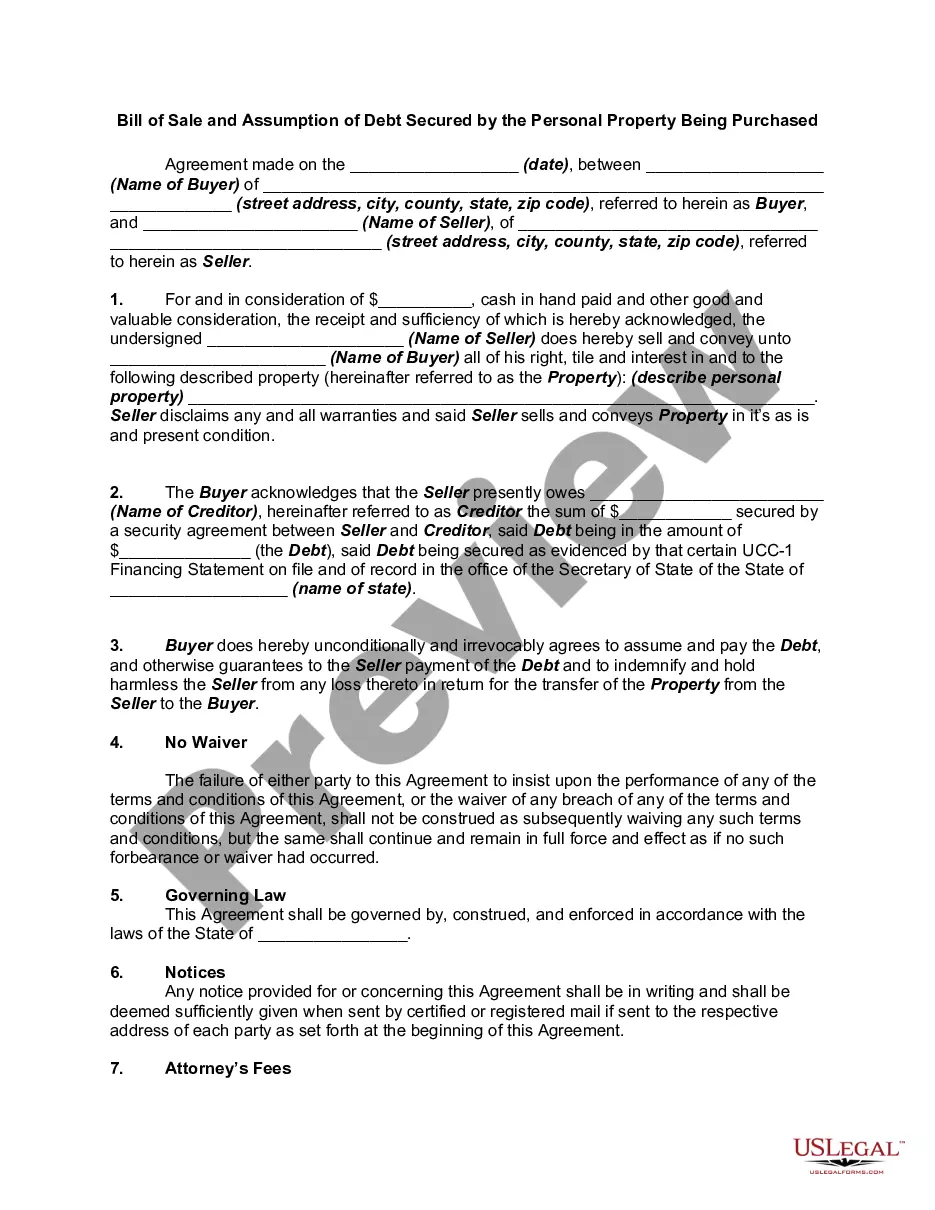

Description: Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased A Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is a legal document used when transferring ownership of personal property in Tennessee while also assuming any outstanding debts secured by the property. This document protects both the buyer and seller by clearly outlining the terms of the sale, debt assumption, and the responsibilities of each party. Keywords: 1. Tennessee Bill of Sale: This refers to a document that legally formalizes the transfer of ownership of personal property in Tennessee. It includes information about the buyer, seller, item description, purchase price, and date of the transaction. 2. Assumption of Debt: This is the act of taking over or becoming responsible for existing debts related to the personal property being purchased. In this context, it means that the buyer agrees to assume any outstanding debts secured by the personal property. 3. Secured Debt: This term refers to a loan or debt that is backed by collateral, in this case, the personal property being purchased. If the buyer fails to fulfill their repayment obligations, the lender may seize the property as collateral. Different Types of Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased: 1. Vehicle Bill of Sale and Assumption of Debt: This type of bill of sale specifically pertains to the sale and assumption of debt related to a motor vehicle, such as a car, truck, motorcycle, or recreational vehicle. It may include additional sections specific to vehicle-related information, such as the vehicle identification number (VIN), make, model, year, and mileage. 2. Real Estate Bill of Sale and Assumption of Mortgage Debt: In the case of real estate transactions, this type of bill of sale is used when purchasing a property while also assuming any outstanding mortgage debt secured by the property. It includes details about the property, purchase price, mortgage information, and the assumption of the mortgage debt. 3. Business Bill of Sale and Assumption of Business Debt: This bill of sale is used when buying or selling a business, where personal property (equipment, inventory, etc.) is included in the sale. It involves assuming any outstanding business debts secured by the personal property being transferred. In summary, a Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is a crucial legal document that protects both buyer and seller during a transfer of personal property ownership while taking on any existing secured debts. The various types mentioned, such as vehicle, real estate, and business bills of sale, cater specifically to different types of purchases and assumptions of debt in Tennessee.Description: Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased A Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is a legal document used when transferring ownership of personal property in Tennessee while also assuming any outstanding debts secured by the property. This document protects both the buyer and seller by clearly outlining the terms of the sale, debt assumption, and the responsibilities of each party. Keywords: 1. Tennessee Bill of Sale: This refers to a document that legally formalizes the transfer of ownership of personal property in Tennessee. It includes information about the buyer, seller, item description, purchase price, and date of the transaction. 2. Assumption of Debt: This is the act of taking over or becoming responsible for existing debts related to the personal property being purchased. In this context, it means that the buyer agrees to assume any outstanding debts secured by the personal property. 3. Secured Debt: This term refers to a loan or debt that is backed by collateral, in this case, the personal property being purchased. If the buyer fails to fulfill their repayment obligations, the lender may seize the property as collateral. Different Types of Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased: 1. Vehicle Bill of Sale and Assumption of Debt: This type of bill of sale specifically pertains to the sale and assumption of debt related to a motor vehicle, such as a car, truck, motorcycle, or recreational vehicle. It may include additional sections specific to vehicle-related information, such as the vehicle identification number (VIN), make, model, year, and mileage. 2. Real Estate Bill of Sale and Assumption of Mortgage Debt: In the case of real estate transactions, this type of bill of sale is used when purchasing a property while also assuming any outstanding mortgage debt secured by the property. It includes details about the property, purchase price, mortgage information, and the assumption of the mortgage debt. 3. Business Bill of Sale and Assumption of Business Debt: This bill of sale is used when buying or selling a business, where personal property (equipment, inventory, etc.) is included in the sale. It involves assuming any outstanding business debts secured by the personal property being transferred. In summary, a Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased is a crucial legal document that protects both buyer and seller during a transfer of personal property ownership while taking on any existing secured debts. The various types mentioned, such as vehicle, real estate, and business bills of sale, cater specifically to different types of purchases and assumptions of debt in Tennessee.