Tennessee Line of Credit Promissory Note is a legal document that outlines the terms and conditions of a line of credit extended to the borrower by a lender in the state of Tennessee. This financial agreement represents a binding contract between the two parties, ensuring compliance with the agreed-upon loan terms. In Tennessee, there are various types of Line of Credit Promissory Notes available to meet different borrowing needs. Some of these include: 1. Unsecured Line of Credit Promissory Note: This type of promissory note does not require the borrower to provide collateral as security for the loan, allowing greater flexibility and accessibility for individuals or businesses in need of financing. 2. Secured Line of Credit Promissory Note: In contrast to the unsecured option, this type of promissory note necessitates the borrower to pledge collateral (such as real estate, vehicles, or other valuable assets) to secure the line of credit. This provides the lender with added protection in case of default. 3. Business Line of Credit Promissory Note: Designed specifically for businesses, this type of promissory note provides a line of credit to support ongoing operations, inventory purchases, or other necessary business expenses. It offers a convenient source of financing and flexible repayment terms. 4. Personal Line of Credit Promissory Note: This type of promissory note caters to individual borrowers seeking financial flexibility for personal expenses, such as home improvements, education costs, or medical bills. Regardless of the specific type, a Tennessee Line of Credit Promissory Note typically includes crucial details such as the principal amount of the line of credit, the interest rate charged, the repayment terms, any associated fees, the consequences of default or late payment, and provisions for dispute resolution. It is important for both lenders and borrowers in Tennessee to thoroughly understand the terms outlined in the Line of Credit Promissory Note before entering into the agreement. Seeking legal counsel or professional advice is highly recommended ensuring compliance with applicable Tennessee laws and to protect the rights and interests of both parties involved.

Tennessee Line of Credit Promissory Note

Description

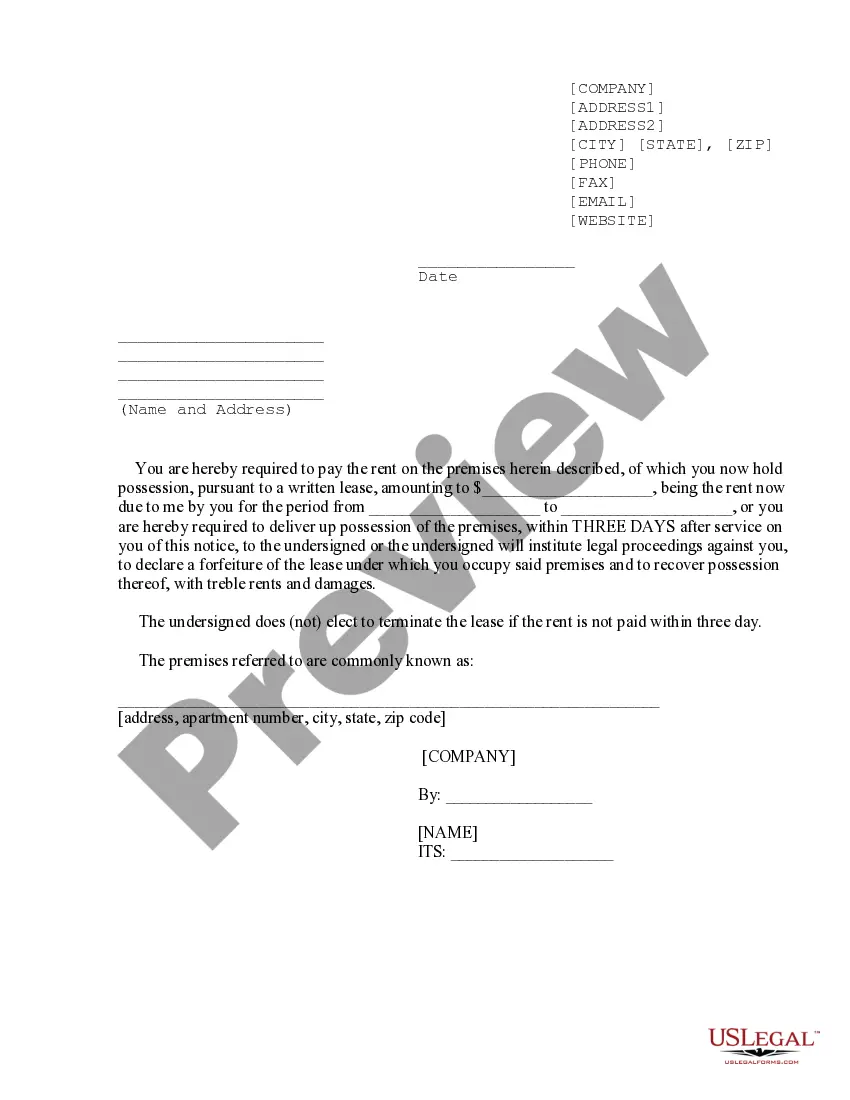

How to fill out Tennessee Line Of Credit Promissory Note?

If you want to complete, down load, or produce authorized document themes, use US Legal Forms, the biggest assortment of authorized varieties, which can be found on the web. Make use of the site`s simple and practical lookup to obtain the files you require. Different themes for organization and personal functions are sorted by groups and states, or search phrases. Use US Legal Forms to obtain the Tennessee Line of Credit Promissory Note in just a few click throughs.

When you are presently a US Legal Forms client, log in to the bank account and then click the Down load option to have the Tennessee Line of Credit Promissory Note. You may also accessibility varieties you previously downloaded inside the My Forms tab of your own bank account.

If you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form to the appropriate city/region.

- Step 2. Take advantage of the Preview method to check out the form`s information. Never neglect to read the description.

- Step 3. When you are unhappy with the form, use the Look for industry towards the top of the screen to find other types of your authorized form format.

- Step 4. Upon having identified the form you require, click the Acquire now option. Select the costs prepare you prefer and put your credentials to sign up to have an bank account.

- Step 5. Method the deal. You may use your bank card or PayPal bank account to perform the deal.

- Step 6. Find the structure of your authorized form and down load it on the device.

- Step 7. Complete, edit and produce or signal the Tennessee Line of Credit Promissory Note.

Each and every authorized document format you purchase is the one you have eternally. You may have acces to every single form you downloaded with your acccount. Go through the My Forms segment and select a form to produce or down load again.

Contend and down load, and produce the Tennessee Line of Credit Promissory Note with US Legal Forms. There are thousands of expert and express-particular varieties you can use for the organization or personal needs.