This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

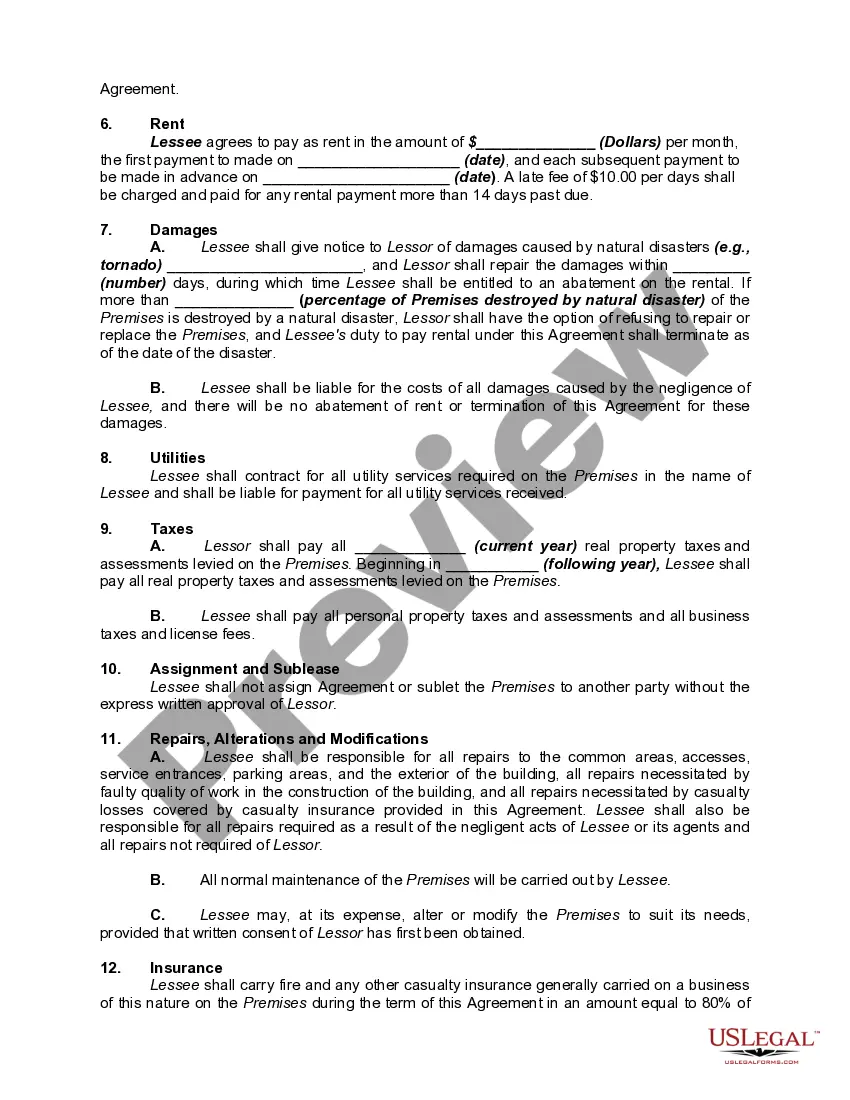

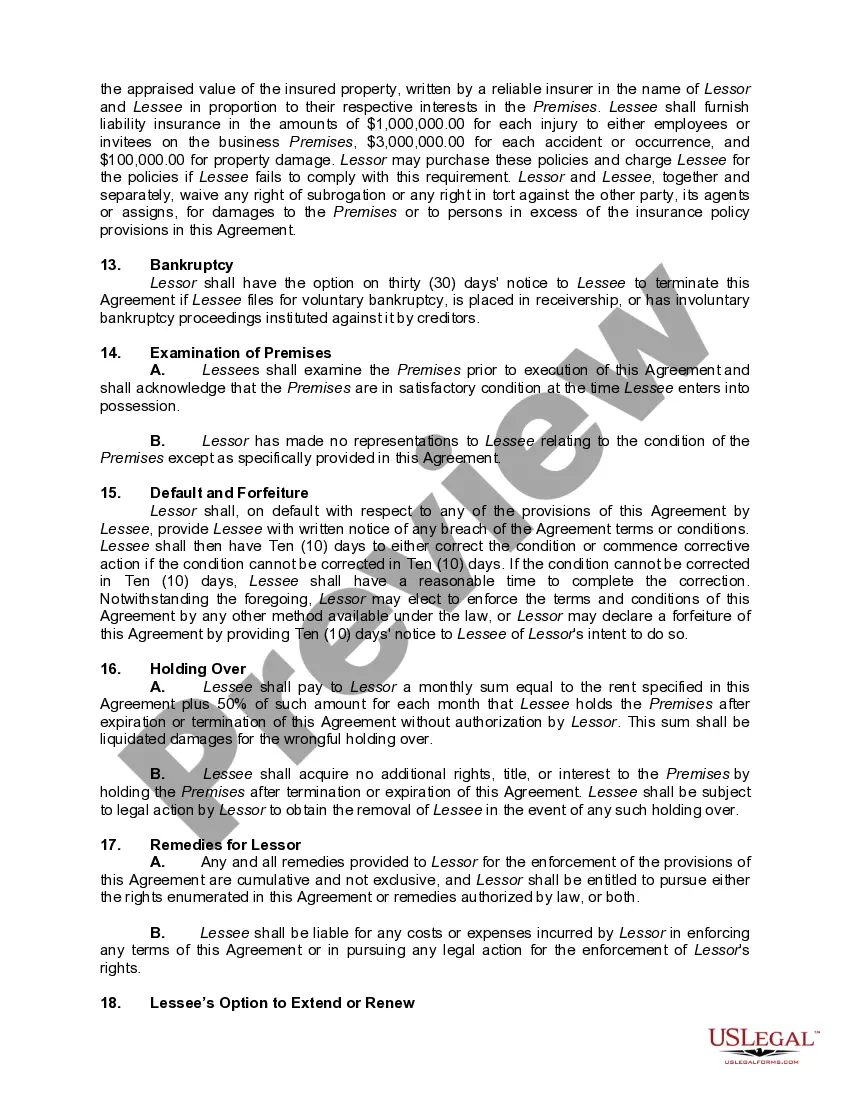

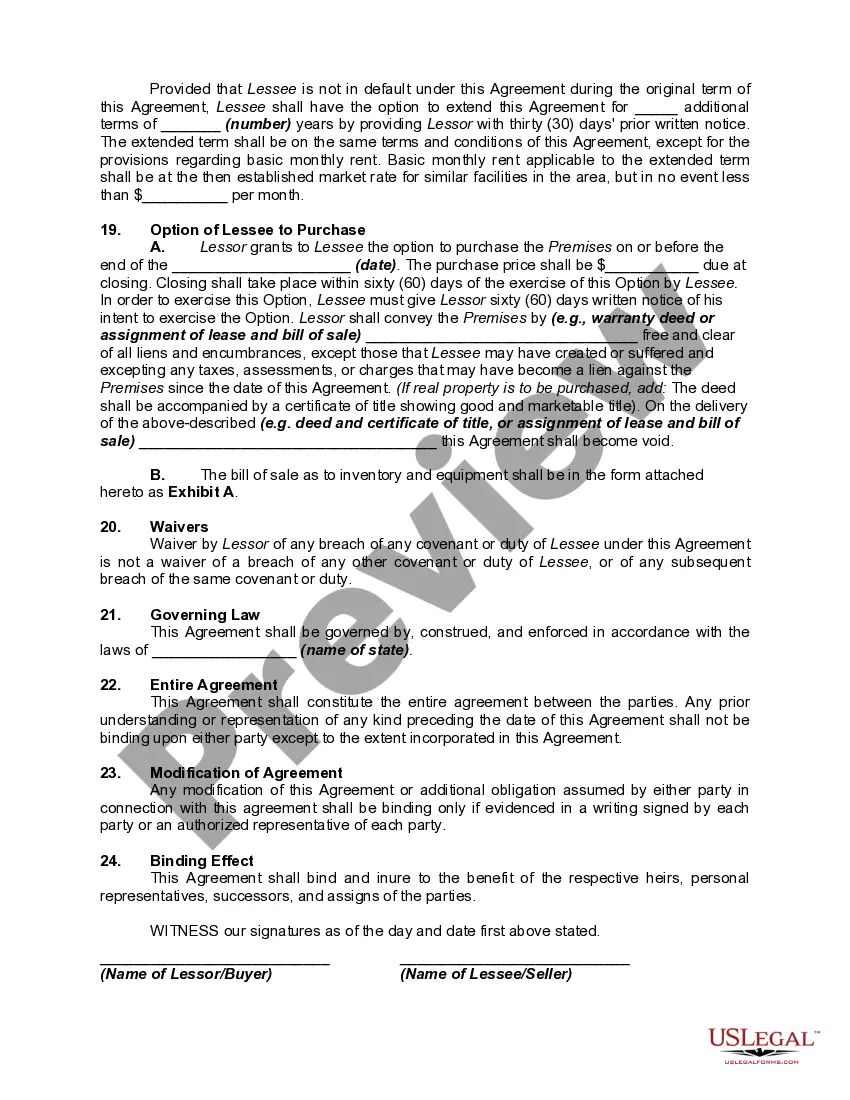

Tennessee Lease Agreement of Store with an Option to Purchase at the End a Certain Period of Time - Lease or Rent to Own

Description

How to fill out Lease Agreement Of Store With An Option To Purchase At The End A Certain Period Of Time - Lease Or Rent To Own?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and individual purposes, organized by types, states, or keywords.

You can find the latest versions of forms such as the Tennessee Lease Agreement for Store with an Option to Purchase at the End of a Specified Period - Lease or Rent to Own within minutes.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose your payment option and provide your details to create an account.

- If you have a monthly subscription, Log In and download the Tennessee Lease Agreement for Store with an Option to Purchase at the End of a Specified Period - Lease or Rent to Own from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can view all previously downloaded forms in the My documents section of your account.

- To start using US Legal Forms for the first time, here are some simple steps to get you going.

- Ensure you have selected the correct form for the city/state.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

It is a binding legal document that states the final sales price for the house and the terms of the purchase, as negotiated between the buyer(s) and the seller(s). Most states rely on a standard purchase agreement form, but some states require attorneys to draft the purchase agreement document.

A Georgia rent-to-own lease agreement is a rental contract that also allows the tenant to purchase the property during its term. The landlord will screen the tenant like a standard lease. If the tenant decides to buy, the lease will convert to a purchase agreement.

A lease purchase agreement in real estate is a rent-to-own contract between a tenant and a landlord for the former to purchase the property at a later point in time. The renter pays the seller an option fee at an agreed-upon purchase price, giving them exclusive rights to buy the property.

When your lease purchase agreement reaches the end of its term, you must take ownership of the vehicle. There is no option to return it. You'll be required to pay the final balloon payment, and then the car will be yours. You will no longer have any obligations to the leasing company.

Lease Purchase is a form of Hire Purchase or Conditional Sale agreement - requiring you to take ownership of the vehicle after all payments have been made - but the regular payments are structured like a lease/rental agreement.

Advantages of Lease Purchases for Sellers ExplainedIncreased return on investment: The upfront option payment can increase the return on investment, and it stays with the owner even if the tenant does not purchase the property.Locked-in sale price: The owner can lock in a reasonable price for the home in advance.More items...?

Benefits Of A Lease Purchase AgreementDown payment: The tenant will finish the lease term with a considerable down payment saved by simply paying rent.Convenience: Rather than move again, the tenant can offset those moving expenses and hassle by simply buying the home they're in.More items...?

optiontobuy arrangement can be a solution for some potential homebuyers, but it's not right for everyone. If you're not certain that you're going to be able to purchase the rental home at the end of the lease period, you might be better served with a standard rental agreement.