Tennessee Sample Letter for Expense Account Statement

Description

How to fill out Sample Letter For Expense Account Statement?

Have you ever been in a scenario where you require documents for regular business or specific tasks nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the Tennessee Sample Letter for Expense Account Statement, which are designed to comply with federal and state regulations.

Once you have the correct form, click Get now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the payment with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Tennessee Sample Letter for Expense Account Statement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

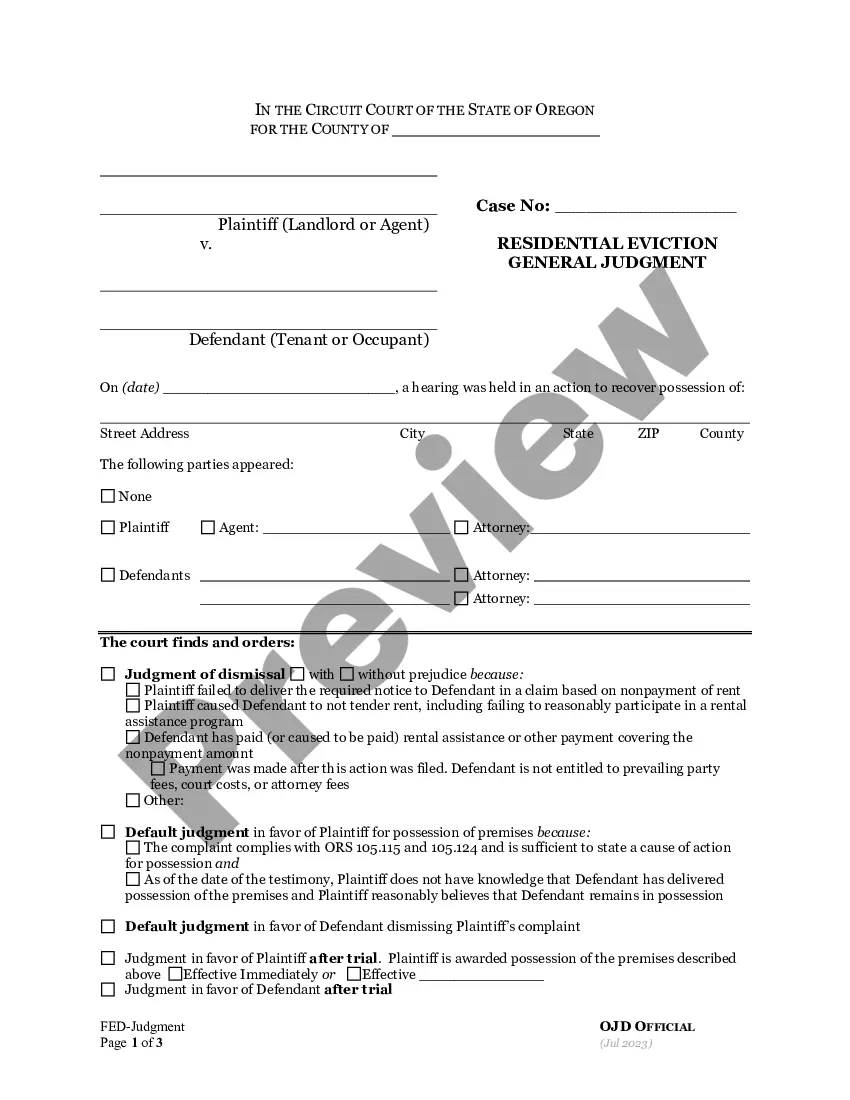

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the right form.

- If the form isn’t what you are looking for, use the Search section to find the form that meets your needs and requirements.

Form popularity

FAQ

In Tennessee, the tax clearance certificate is provided by the Tennessee Department of Revenue. This certificate confirms that you have no outstanding tax obligations. When applying for one, you may find it helpful to refer to a Tennessee Sample Letter for Expense Account Statement to properly relay your request.

To obtain a Tennessee tax exempt certificate, you must complete the application process through the Tennessee Department of Revenue. This process involves verifying your eligibility and providing necessary documents. Using a Tennessee Sample Letter for Expense Account Statement can help ensure that your application is written clearly and comprehensively.

To secure an IRS tax clearance certificate, you must be current on all federal tax obligations. You can request this certificate by contacting the IRS directly and providing any necessary information about your account. It's often beneficial to maintain a Tennessee Sample Letter for Expense Account Statement for clarity when discussing financial matters with the IRS.

To close a business in Tennessee, you must file the appropriate dissolution documents with the Secretary of State. Ensure that all tax obligations are settled, and all permits are canceled. If you need documentation for any remaining accounts, a Tennessee Sample Letter for Expense Account Statement can help outline your final financial activities.

In Tennessee, you can submit unclaimed property by filing a report with the Tennessee Department of Treasury. The process involves identifying the property, submitting the necessary documentation, and following the guidelines provided by the treasury. Keeping records of your submissions, perhaps with a Tennessee Sample Letter for Expense Account Statement, ensures a smooth communication with the state.

To write an email to your manager for reimbursement, begin with a courteous greeting followed by a concise statement of your request. Clearly outline the expenses you're claiming, including any relevant details and documentation. Using a Tennessee Sample Letter for Expense Account Statement can assist in structuring your email effectively.

When writing an email for expense approval, start with a suitable subject line indicating the request. Provide a brief overview of the expenses, explaining their relevance to your work. Citing a Tennessee Sample Letter for Expense Account Statement can enhance clarity and improve your chances of getting approval.

An effective expense claim email includes a subject line that clearly states the purpose of your communication. In the body, detail the expenses incurred, attach any receipts, and request the total amount needed for reimbursement. Referencing a Tennessee Sample Letter for Expense Account Statement can help you stay organized and professional.

Writing a letter for reimbursement of expenses involves outlining the nature of your expenses and their purpose. Clearly list each item, along with the amounts, and attach relevant receipts. A Tennessee Sample Letter for Expense Account Statement can serve as a valuable guide to format your request properly.

To ask for a claim in an email, begin with a polite greeting and specify the claim you are requesting. Be concise in your explanation and provide any necessary background information. Utilizing a Tennessee Sample Letter for Expense Account Statement can assist in framing your request effectively.