Tennessee Assignment or Sale of Interest in Limited Liability Company (LLC)

Description

How to fill out Assignment Or Sale Of Interest In Limited Liability Company (LLC)?

Have you been in the placement in which you require paperwork for possibly business or specific functions nearly every time? There are tons of lawful document themes available on the Internet, but getting kinds you can rely is not easy. US Legal Forms gives a huge number of form themes, like the Tennessee Assignment or Sale of Interest in Limited Liability Company (LLC), which can be written to meet state and federal needs.

In case you are currently acquainted with US Legal Forms web site and get a merchant account, just log in. Afterward, you can download the Tennessee Assignment or Sale of Interest in Limited Liability Company (LLC) design.

If you do not come with an account and wish to begin to use US Legal Forms, follow these steps:

- Get the form you need and make sure it is for that correct city/state.

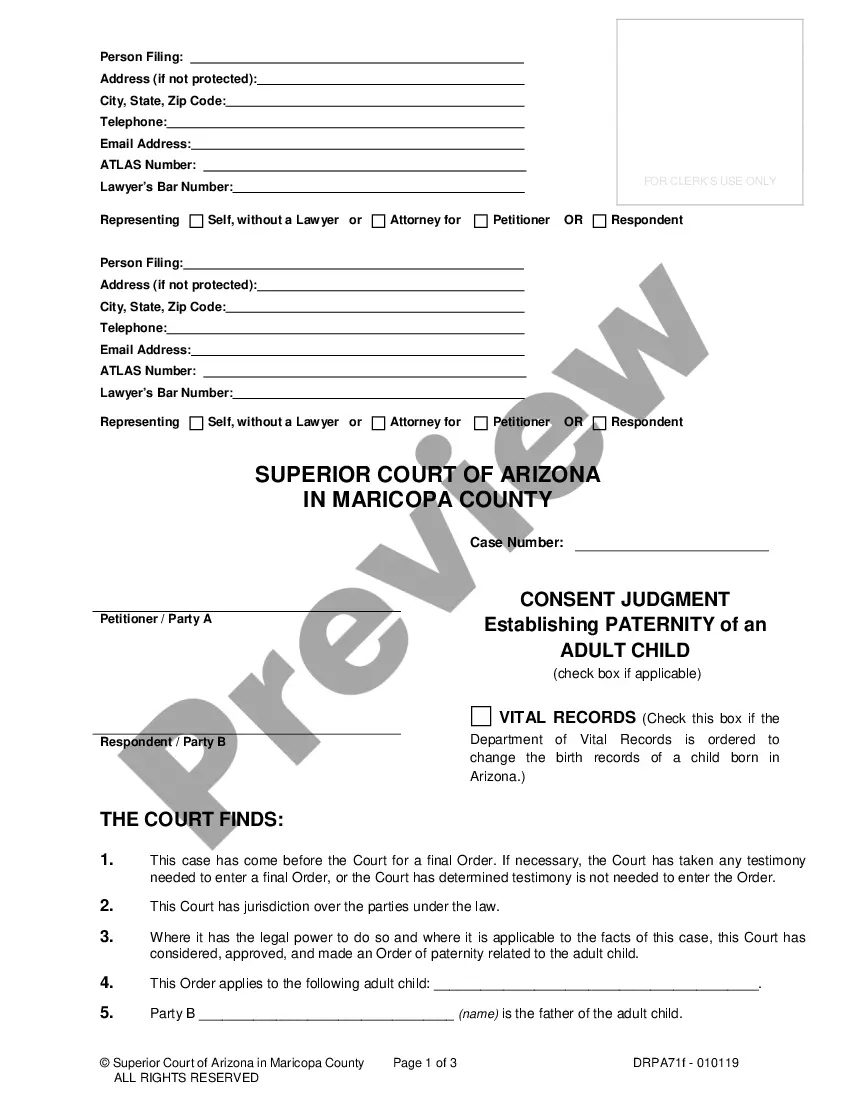

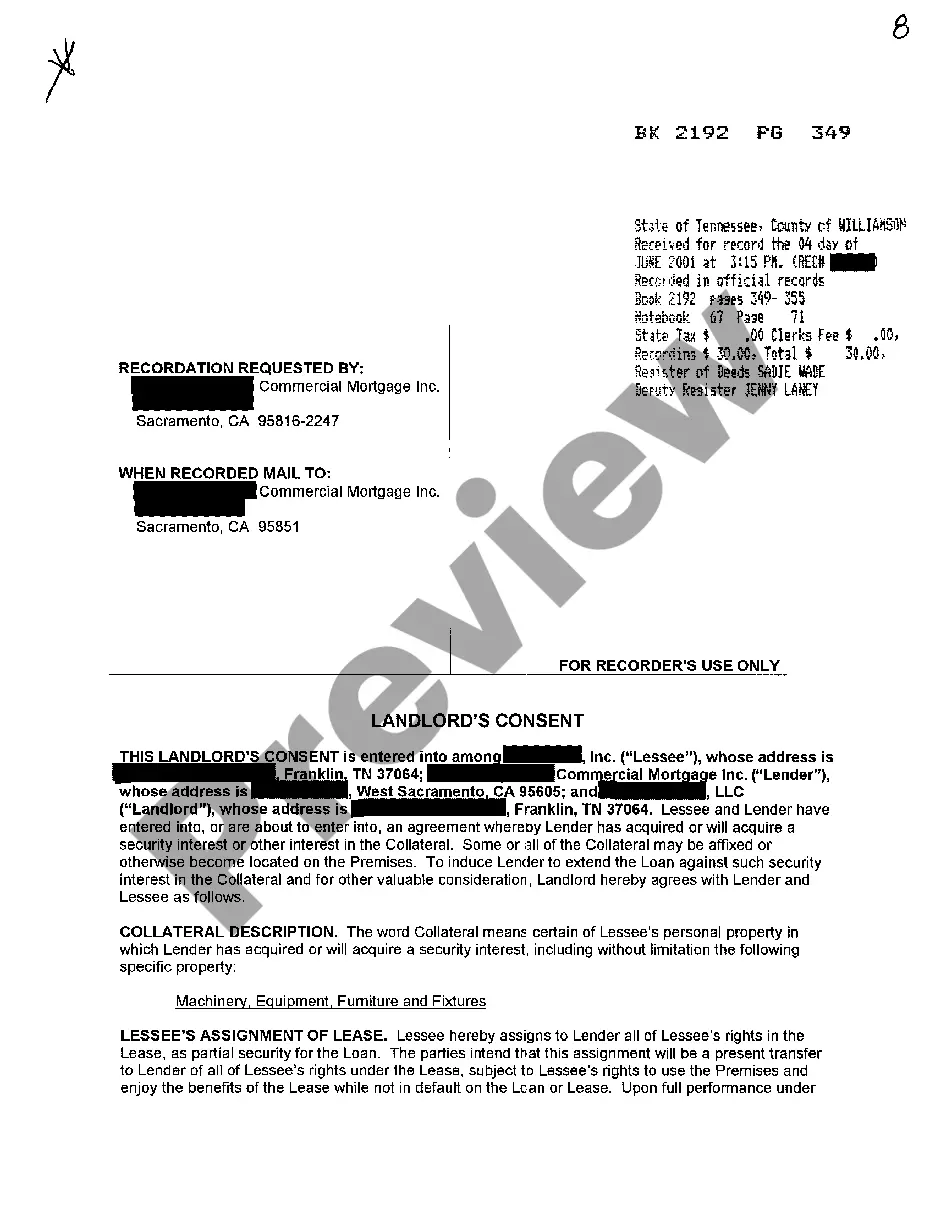

- Make use of the Preview option to analyze the shape.

- See the description to actually have chosen the right form.

- In the event the form is not what you are seeking, take advantage of the Research area to discover the form that meets your requirements and needs.

- Whenever you find the correct form, click on Buy now.

- Opt for the prices prepare you need, fill out the desired information to create your bank account, and purchase the order using your PayPal or charge card.

- Decide on a convenient data file structure and download your duplicate.

Discover all of the document themes you have purchased in the My Forms food list. You may get a more duplicate of Tennessee Assignment or Sale of Interest in Limited Liability Company (LLC) anytime, if needed. Just go through the essential form to download or print the document design.

Use US Legal Forms, by far the most substantial variety of lawful varieties, to save lots of time as well as prevent blunders. The service gives professionally manufactured lawful document themes that you can use for a selection of functions. Produce a merchant account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

It costs $20 to change your LLC name in Tennessee. This is the filing fee for the Articles of Amendment form.

After the terms of sale are negotiated, a written membership interest sales agreement can be created to record the transaction. This agreement should detail the new member's ownership percentage, the amount of the buy-in, and require that the new member agree to be bound by the existing Operating Agreement of the LLC.

The most common way is to sell the business to another person or company. If you own the business along with partners, you may reapportion ownership among the multiple partners. Another way is to gift the business to someone else. You can also transfer ownership through a merger or acquisition.

How to Transfer Tennessee LLC Ownership Step 1: Review the LLC's Operating Agreement. ... Step 2: Obtain Consent From Other Members. ... Step 3: Determine the Value of the Ownership Interest. ... Step 4: Draft and Sign a Transfer Agreement. ... Step 5: Update the LLC's Operating Agreement and Membership Records.

A transfer of an LLC interest where compensation is being paid is treated as a sale or exchange. The selling member will usually have a taxable gain or loss on the sale.

You need to complete Form 8822-B and send it to the IRS to change the EIN Responsible Party for your LLC. If the Responsible Party for your LLC has changed, you'll need to update the IRS as soon as possible, as per their requirements. Note: Form 8822-B can also be used to change your LLC address with the IRS.

An assignment and assumption of membership interests used when a member of a limited liability company (LLC) wants to transfer its membership interest in the LLC to another entity. This Standard Document has integrated notes with important explanations and drafting and negotiating tips.

Full Transfer: Selling Your Tennessee LLC Your LLC's Operating Agreement needs to provide detailed information for initiating a full transfer of your LLC, including information such as: Classifying whether the purchaser wants the entire entity or just the business's assets. Terms to include in the buy/sell agreement.