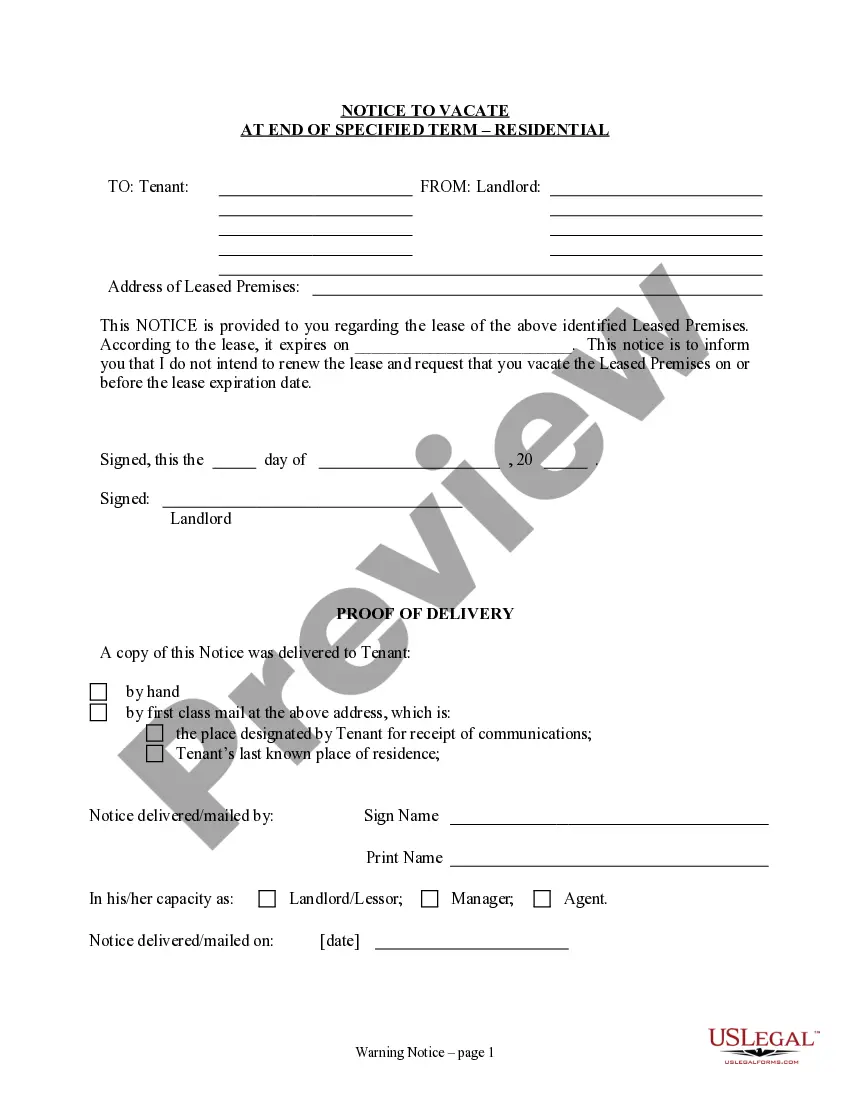

This form involves the sale of a small business where the real estate on which the Business is located is leased from a third party. This form assumes that the Seller has received the right to assign the lease from the lessor/owner.

Keywords: Tennessee, agreement for sale of business, sole proprietorship, leased premises Description: The Tennessee Agreement for Sale of Business by Sole Proprietorship with Leased Premises is a legal document that outlines the terms and conditions for transferring ownership of a sole proprietorship business located on leased premises in the state of Tennessee. This agreement is designed to protect both the buyer and the seller by providing a clear understanding of the rights, obligations, and responsibilities of each party involved in the sale. The agreement includes various crucial elements such as the identification of the buyer and seller, the detailed description of the business being sold, the terms of the lease agreement for the premises, and the purchase price and payment terms. It also covers the allocation of assets, liabilities, and inventory, as well as any specific conditions or contingencies associated with the sale. There are different types of Tennessee Agreement for Sale of Business by Sole Proprietorship with Leased Premises, depending on the specific nature of the business being sold. Some common variations include agreements for retail businesses, restaurants, service-based businesses, or any other type of sole proprietorship with leased premises. Regardless of the type, these agreements play a vital role in facilitating the smooth transfer of a business from one owner to another. They ensure transparency and protect the interests of both parties involved, preventing any future disputes. When entering into a Tennessee Agreement for Sale of Business by Sole Proprietorship with Leased Premises, it is recommended to consult with an attorney specializing in business law to ensure compliance with state laws and regulations.