The term homestead embraces a variety of concepts with different meanings when applied to different factual situations. Generally, a homestead is deemed to be the dwelling house in which a family resides, with the usual and customary appurtenances, including outbuildings that are necessary and convenient for the family use, and lands that are devoted to the same use.

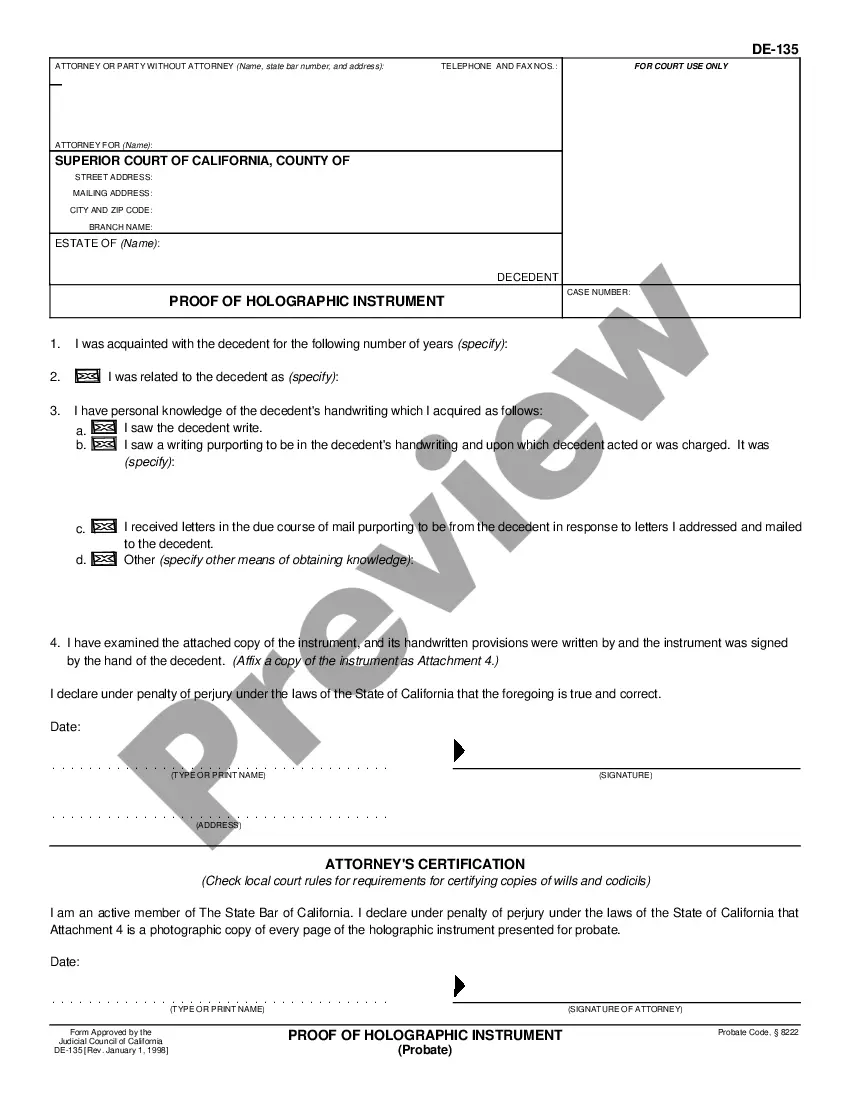

Local law must, of course, be checked to determine if a formal declaration of homestead is required by statute to be executed and recorded. In order that a claim of a declaration of homestead must be executed and filed exactly as provided in the law of the state where the property is located. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Tennessee Claim of Homestead Rights in Form of Affidavit is a legal document used to establish and protect a homeowner's homestead exemption rights in the state of Tennessee. Homestead exemption is a legal provision that allows homeowners to protect a portion of their property's value from creditors and certain legal actions. This affidavit is an important tool for homeowners in Tennessee as it serves as a declaration of their intent to claim the homestead exemption, which can offer significant protections during financial hardships or legal proceedings. The Tennessee Claim of Homestead Rights in Form of Affidavit typically requests various details, including the homeowner's full name, address, as well as a complete description of the property being claimed as a homestead. This description should include key information such as the property's legal description, identification numbers, and other relevant details that accurately identify the location and boundaries of the property. Furthermore, the affidavit may require information about the homeowner's marital status, as well as the names and ages of any dependents residing on the property. This information helps facilitate a comprehensive assessment of the homeowner's situation and can strengthen the claim for homestead exemption. It is essential to note that there are different types of Tennessee Claim of Homestead Rights in Form of Affidavits, depending on the specific circumstances of the homeowner. Some common variations include: 1. Initial Claim: This type of affidavit is typically filed when a homeowner first establishes a homestead exemption, indicating their intent to protect a portion of their property's value from creditors. 2. Upgrading Claim: When a homeowner wishes to increase their homestead exemption due to changes in personal circumstances or property value, they would file an upgrading claim affidavit. This form allows the homeowner to update their previous homestead exemption claim to reflect the new circumstances accurately. 3. Renewal Claim: Homestead exemption rights in Tennessee typically last for a specific period, and therefore, homeowners may be required to periodically renew their claim to maintain the protection. The renewal claim affidavit helps homeowners declare their continued intent to claim the homestead exemption and ensure ongoing safeguarding of their property. It is crucial for homeowners in Tennessee to familiarize themselves with the specific requirements and guidelines outlined by the local county or municipality governing their homestead exemption rights. Consulting with legal professionals when preparing and filing a Claim of Homestead Rights in Form of Affidavit is advisable to ensure compliance and maximize the benefits offered by this essential legal protection.