Tennessee Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements

Description

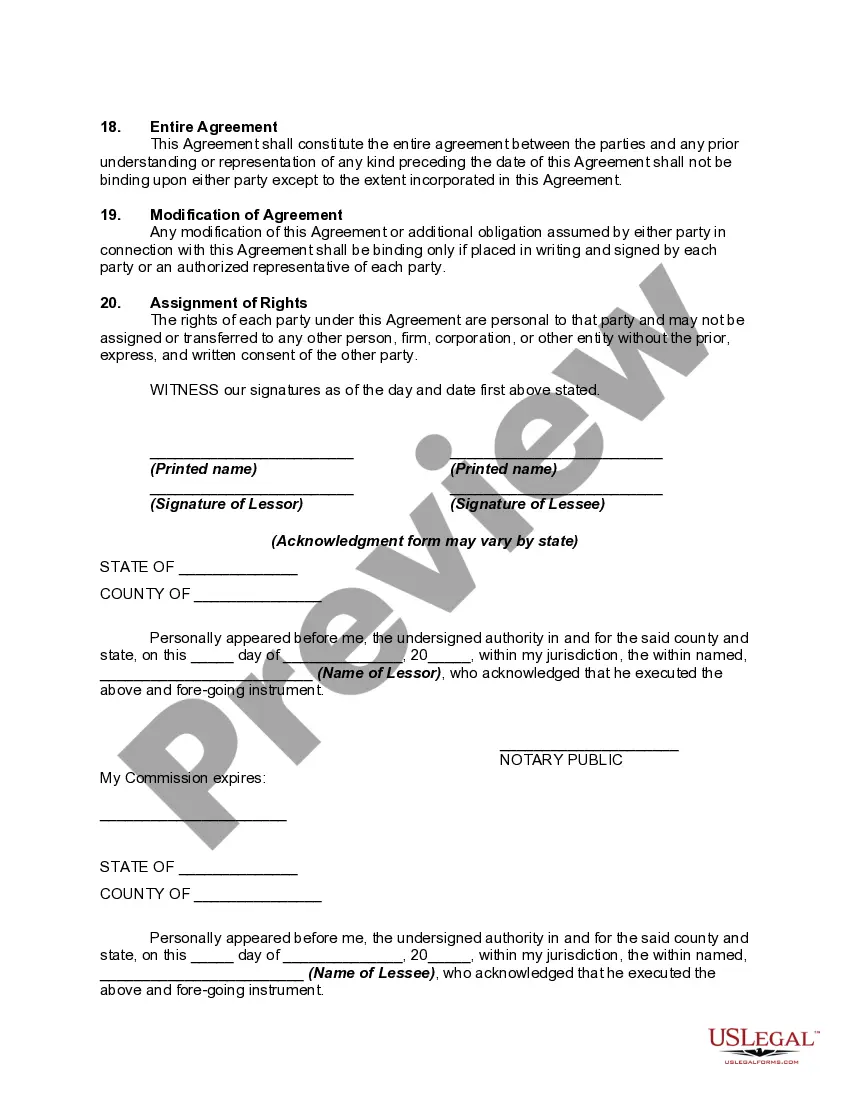

How to fill out Farm Lease Or Rental With Right To Make Improvements And Receive Reimbursements?

Are you in a scenario where you require documents for both commercial or personal purposes almost every time.

There are numerous legal document templates available online, but locating versions you can trust isn't simple.

US Legal Forms offers thousands of form templates, such as the Tennessee Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, which are designed to satisfy federal and state regulations.

When you find the right form, click Purchase now.

Choose the pricing plan you want, fill in the necessary details to create your account, and complete your purchase with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Tennessee Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct area/region.

- Use the Review button to evaluate the form.

- Read the description to confirm you have selected the correct form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that meets your needs and requirements.

Form popularity

FAQ

Yes, farm land rent is generally considered taxable income under a Tennessee Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements. Whenever you receive rental payments, you must report this income to the IRS. However, you may also be able to deduct certain expenses associated with your rental activities. Utilizing resources from US Legal Forms can help guide you through the nuances of tax obligations related to your farm rental.

Reporting farm rental income under a Tennessee Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements involves a few straightforward steps. First, you need to keep detailed records of all rental payments received throughout the year. Next, you will include this income on your tax return, typically on Schedule F, which is specifically designed for farm income. By accurately reporting your rental income, you can ensure compliance with tax regulations and potentially take advantage of any eligible deductions.

The Farmland Protection Policy Act aims to protect farmland from urban development and maintain agricultural viability. This act supports farmers looking to engage in sustainable practices under programs like Tennessee Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements. By preserving farmland, we ensure that future generations continue to benefit from agricultural resources.

The Tennessee Farm Act encompasses various regulations and supports aimed at promoting agriculture and protecting farm operations. It offers guidelines for rental agreements, including leases with rights to make improvements. Understanding the Tennessee Farm Act is crucial for anyone interested in a Tennessee Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, as it outlines entitlements and responsibilities.

While there is no strict minimum for acreage in Tennessee, many consider at least 10 acres as a general guideline to qualify as a farm. This size allows farmers to engage in significant agricultural activities, making it practical for a Tennessee Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements. It's essential to assess your farming goals when determining the suitable size for your needs.

In Tennessee, a farm is typically defined as a parcel of land that produces agricultural products for sale. This includes crops, livestock, and other forms of agricultural income. If you're considering a Tennessee Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, it's important to understand this definition, as it impacts what improvements you might want to make on the property.

In Tennessee, the ability to back out of a lease after signing can depend on the terms laid out in the agreement. Generally, if your lease includes specific provisions for cancellation or if both parties agree, you may have options. However, most leases are legally binding, so reviewing the Tennessee Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements is essential. Consulting legal resources can help clarify your rights and responsibilities.

Leasing farmland can be a smart investment, offering predictable income streams and potential tax benefits. With the rising demand for agricultural products, a well-negotiated lease, specifically a Tennessee Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, provides opportunities for landowners to enhance their property value and gain financial security.

While the minimum requirement is often considered to be 15 acres for tax purposes in Tennessee, many agricultural operations can be sustained on smaller plots, depending on the type of crops or livestock raised. If you work with a well-drafted Tennessee Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, you might discover new opportunities to maximize small acreage for farming effectively.

The Tennessee Farm Protection Act is legislation designed to safeguard farmland and promote agricultural operations within the state. It provides protections for farmers against nuisance lawsuits and encourages responsible land usage. A solid understanding of this Act can be crucial when negotiating a Tennessee Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, ensuring both parties understand their rights and responsibilities.