This form is an amendment or modification to a partnership agreement

Tennessee Amendment or Modification to Partnership Agreement

Description

How to fill out Amendment Or Modification To Partnership Agreement?

Are you currently in a position where you often need documents for either business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding reliable ones isn't easy.

US Legal Forms offers thousands of document templates, like the Tennessee Amendment or Modification to Partnership Agreement, which are created to comply with state and federal regulations.

Once you find the correct form, simply click Acquire now.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Tennessee Amendment or Modification to Partnership Agreement template.

- If you don't have an account and want to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it is for the correct city/state.

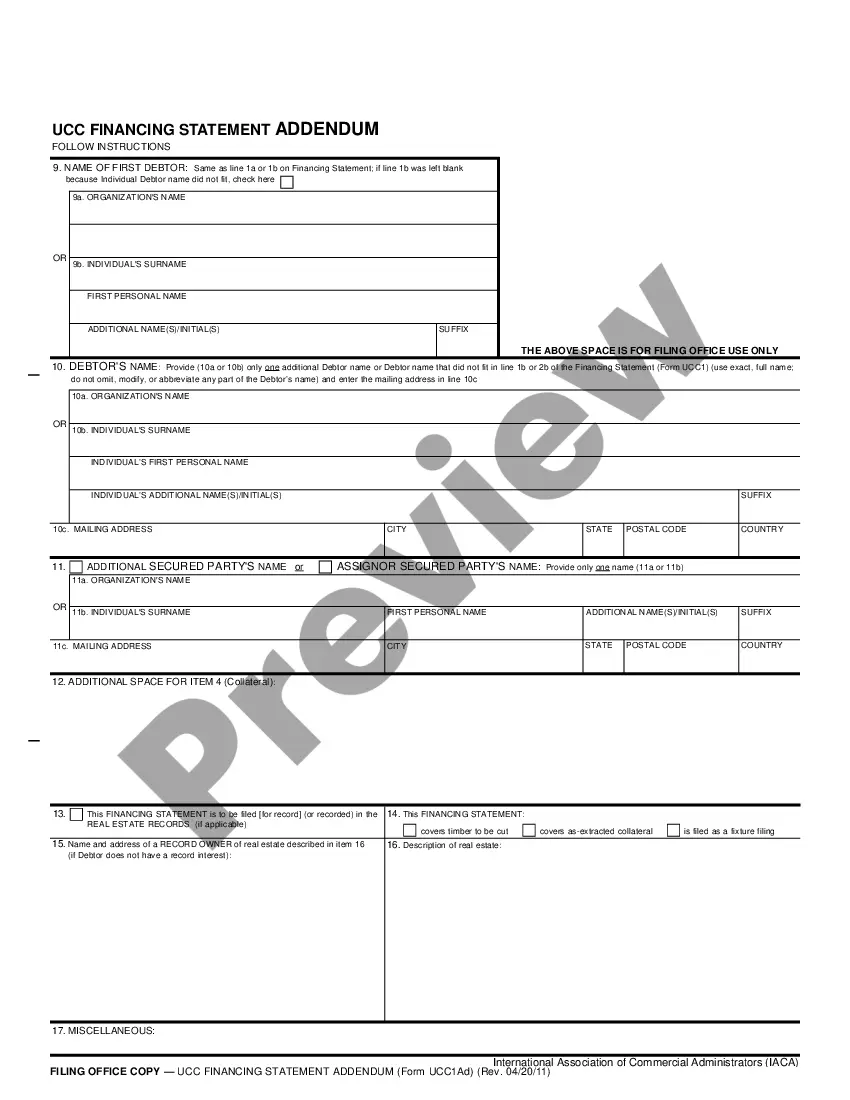

- Use the Review button to examine the form.

- Read the description to confirm that you have chosen the right form.

- If the form isn’t what you’re looking for, use the Search bar to find the form that meets your needs.

Form popularity

FAQ

To establish a domestic partnership in Tennessee, you first need to research your local laws and procedures, as the process may vary by county. Typically, partners fill out an application and submit supporting documents. While filing a Tennessee Amendment or Modification to Partnership Agreement is not necessary for domestic partnerships, it can add a layer of security and clarity regarding each partner's rights and responsibilities.

Partnerships in Tennessee generally do not need to file with the Secretary of State unless they choose to form a limited liability partnership (LLP). Nevertheless, documenting a Tennessee Amendment or Modification to Partnership Agreement can provide legal clarity and protection for partners. This document lays out responsibilities and the operational procedure of the partnership. It’s a strategic move for partnership continuity.

In Tennessee, a General Partnership does not need to formally register with the state. However, creating a Tennessee Amendment or Modification to Partnership Agreement can clarify the partnership's structure and responsibilities among partners. It's advisable to document the agreement in writing to protect all parties involved. Thus, while registration is not mandatory, having a clear agreement is beneficial.

To amend a partnership agreement, draft an amendment document that clearly specifies the changes being made to the original agreement. Ensure all partners review and sign the amendment to solidify the changes. It is wise to document the amendment alongside the original agreement for transparency. For ease, consider using UsLegalForms to access templates and expert advice for successfully amending your partnership agreement.

Yes, a partnership agreement can be modified or changed through a formal process, which typically includes creating an amendment. It is important to have all partners agree to the changes and sign the amendment to maintain legal validity. Always consult the existing agreement for guidelines on making modifications. UsLegalForms offers helpful resources for navigating partnership changes in Tennessee.

Writing an amendment to an agreement involves clearly stating the modifications you wish to make. Begin by referencing the original agreement and listing the specific amendments in a straightforward manner. All concerned parties must sign this amendment to confirm their acceptance. Utilizing a platform like UsLegalForms can help streamline this process with templates and guidelines tailored to your agreement's needs.

Yes, you can change partners in a partnership, but it typically requires a formal amendment to the partnership agreement. The existing partners must agree to the change and document it appropriately to avoid future disputes. Always follow the procedures laid out in the original agreement for transitioning partners. Using UsLegalForms can provide templates to facilitate this amendment process smoothly.

To write an amendment to a partnership agreement, start by referencing the original agreement and clearly state the changes. Use clear, concise language, and include the effective date of the amendment. All partners must sign the amendment to ensure it is legally binding. For assistance, UsLegalForms offers a variety of resources to help you craft a proper amendment to meet Tennessee requirements.

Changing the terms of a partnership agreement is best done through a formal amendment. You should draft an amendment that clearly outlines the changes you wish to make and obtain signatures from all partners. It is essential to follow the specified process outlined in the original agreement. Consider using UsLegalForms for templates that suit your needs when creating an amendment to your partnership agreement in Tennessee.

To change the members of an LLC in Tennessee, you typically need to amend your operating agreement. This process may also require filing specific documents with the state. A Tennessee Amendment or Modification to Partnership Agreement will be beneficial to outline the changes in membership clearly. Platforms like uslegalforms can assist you in preparing the necessary documentation to ensure compliance and accuracy.