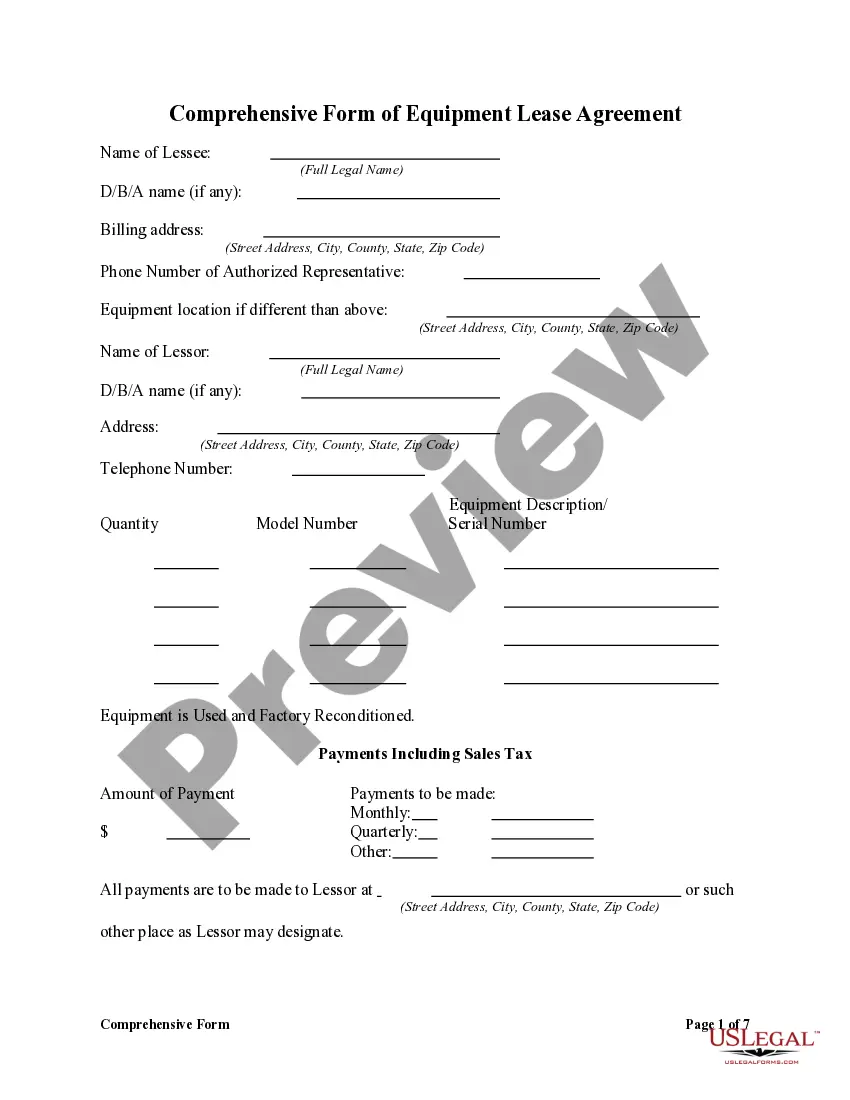

Tennessee Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Comprehensive Equipment Lease With Provision Regarding Investment Tax?

Selecting the best authentic document template can be a challenge.

It goes without saying, there are numerous templates available online, but how can you find the authentic form you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are some simple steps for you to follow.

- The service offers thousands of templates, including the Tennessee Comprehensive Equipment Lease with Provision Regarding Investment Tax, that can be utilized for professional and personal purposes.

- All the forms are verified by professionals and comply with both state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Tennessee Comprehensive Equipment Lease with Provision Regarding Investment Tax.

- Use your account to browse the official documents you have previously acquired.

- Visit the My documents section of your account to access another copy of the document you need.

Form popularity

FAQ

In Tennessee, several income types are not taxed, including wages, most pensions, and certain investment earnings. Additionally, specific goods and services may be exempt from sales tax. Understanding these exemptions can inform your financial planning strategies, especially when structuring a Tennessee Comprehensive Equipment Lease with Provision Regarding Investment Tax.

Yes, in Tennessee, rental transactions, like equipment leases, are usually considered taxable. The sales tax is applied to the rental amount, so you should take this into account as you plan your finances. Utilizing a comprehensive knowledge of your responsibilities in a Tennessee Comprehensive Equipment Lease with Provision Regarding Investment Tax can be advantageous.

Leases are treated as taxable transactions in Tennessee, with sales tax applied to the payments. As you navigate a Tennessee Comprehensive Equipment Lease with Provision Regarding Investment Tax, be aware of any potential deductions available to you. Proper handling of tax requirements can lead to significant savings.

In Tennessee, investment income is not subject to state income tax, except for certain exceptions. For instance, interest from bonds and stocks generally remains untaxed. This is beneficial when considering your investment strategies with leases or other financial tools.

Yes, in Tennessee, leases are generally subject to sales tax. The sales tax applies to most leases and rental agreements, impacting the total amount you owe. Exploring how a Tennessee Comprehensive Equipment Lease with Provision Regarding Investment Tax is structured can clarify your tax responsibilities.

In Tennessee, the sales tax on a lease is based on the total value of the lease agreement. Typically, the state sales tax of 9.75% applies to rental payments incurred throughout the lease. Understanding the implications of a Tennessee Comprehensive Equipment Lease with Provision Regarding Investment Tax will help you budget more accurately.

The 9.75% refers to the state sales tax rate applied to purchases in Tennessee. This sales tax includes both the statewide rate and local taxes. When you lease equipment, remembering how this tax applies can significantly impact your overall financial planning.

When you enter into a Tennessee Comprehensive Equipment Lease with Provision Regarding Investment Tax, the leased equipment is generally treated as personal property. This means that it can be subject to property taxes based on its value. For your financial reporting, it's crucial to understand how these leases affect your overall tax obligations.

In Tennessee, most types of income are subject to taxation, except for certain items like wages, pensions, and specific investment income. The state does not impose a personal income tax on wages earned. However, if you engage in business or receive capital gains, these may still attract taxation under specific conditions.

Eligibility for the Foreign-Derived Intangible Income (FDII) deduction is primarily for U.S. corporations generating income from foreign sources. This incentive can significantly affect your tax outcomes. If your business engages in a Tennessee Comprehensive Equipment Lease with Provision Regarding Investment Tax and international sales, consider how these deductions might be applicable.