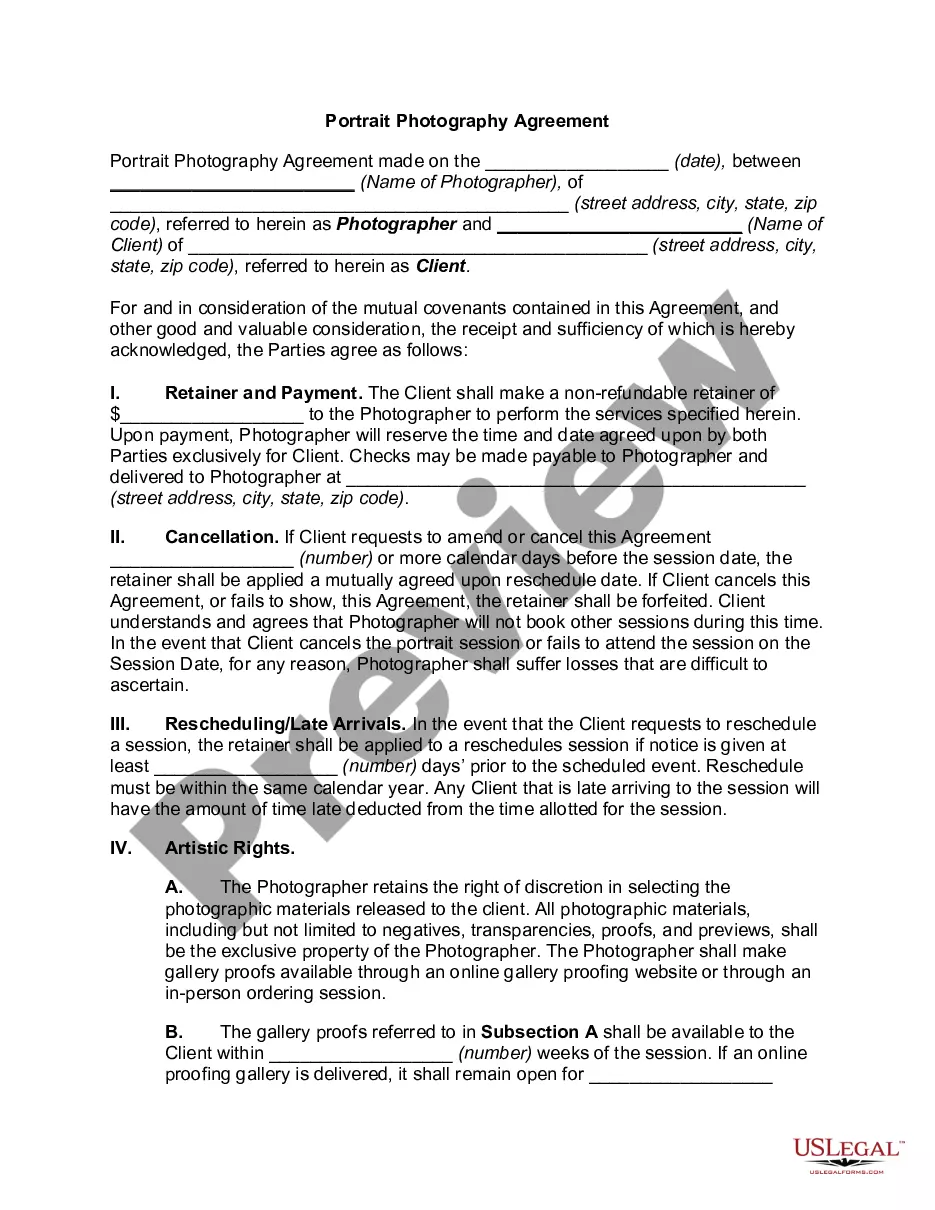

Dear [Tax Department/Organization], I am writing to submit the payment for our corporate income and franchise taxes and annual report filing fees for [year]. As a registered corporation in the state of Tennessee, we understand the importance of fulfilling our financial obligations and proactively adhering to the requirements set forth by the Tennessee Department of Revenue. Firstly, I would like to provide details regarding the payment for our corporate income and franchise taxes. These taxes are integral for supporting critical state functions, infrastructure development, and various public services that benefit our community. Tennessee ensures a fair and transparent taxation system, allowing us to contribute our fair share towards the state's progress. As a responsible corporation, we have assessed our taxable income and calculated the amount owed for corporate income tax. We have also evaluated our franchise tax liability, which is based on the net worth of our company. These taxes play a crucial role in sustaining Tennessee's economy and the overall financial stability of the state. Secondly, I am enclosing the payment for our annual report filing fees. Tennessee's law mandates that all corporations operating within the state must submit an annual report to the Tennessee Secretary of State. This report serves as a comprehensive overview of our company's activities, including financial details and registered agent information. By fulfilling our annual reporting requirement, we help ensure transparency and maintain our compliance with state regulations. It is important to note that failure to file our corporate income and franchise taxes on time may result in penalties, interest, or even the suspension of our business license. Therefore, we take this matter seriously and strive to submit our payment promptly and accurately. We have included our payment for all appropriate fees and any applicable penalties or interest accrued. We understand that Tennessee offers various methods for submitting payments, including online platforms and traditional mail. Furthermore, we have chosen [preferred payment method] and have enclosed a [check/electronic payment receipt] for the full amount due. In conclusion, we appreciate the opportunity to fulfill our financial obligations as a valued corporate citizen of Tennessee. By submitting this payment for our corporate income and franchise taxes and annual report filing fees, we demonstrate our commitment to meeting our responsibilities as well as supporting the continued growth and success of our state. Thank you for your attention to this matter, and please feel free to contact our company should you require any further information or clarification. Sincerely, [Your Name] [Your Title/Position] [Company Name] [Company Address] [City, State, ZIP]

Tennessee Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees

Description

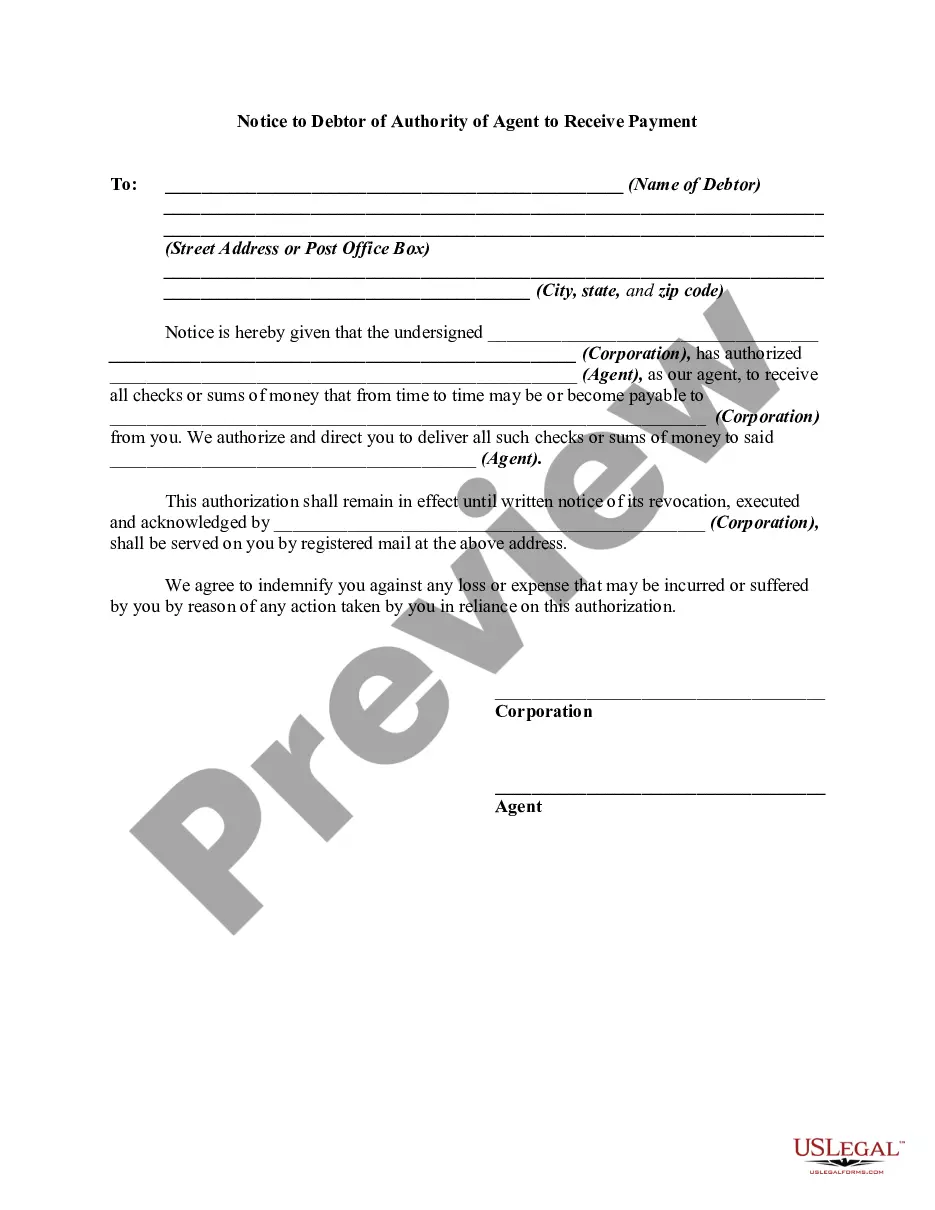

How to fill out Tennessee Sample Letter For Payment Of Corporate Income And Franchise Taxes And Annual Report Filing Fees?

US Legal Forms - one of several greatest libraries of authorized types in the USA - offers an array of authorized file web templates you can obtain or produce. Utilizing the website, you may get thousands of types for organization and person functions, sorted by categories, says, or keywords.You will find the most recent versions of types like the Tennessee Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees within minutes.

If you have a subscription, log in and obtain Tennessee Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees from your US Legal Forms catalogue. The Download option will appear on each and every form you see. You have access to all earlier acquired types inside the My Forms tab of your respective account.

If you would like use US Legal Forms for the first time, listed below are easy recommendations to get you began:

- Ensure you have chosen the proper form for your metropolis/state. Go through the Preview option to examine the form`s content material. Read the form description to ensure that you have chosen the proper form.

- In case the form doesn`t satisfy your needs, take advantage of the Research discipline towards the top of the monitor to get the one who does.

- If you are happy with the shape, validate your selection by clicking on the Buy now option. Then, pick the costs plan you like and provide your credentials to register to have an account.

- Method the deal. Make use of credit card or PayPal account to finish the deal.

- Find the format and obtain the shape on your gadget.

- Make changes. Load, change and produce and signal the acquired Tennessee Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees.

Every design you included in your account does not have an expiry day and it is your own property forever. So, in order to obtain or produce yet another duplicate, just check out the My Forms area and click on in the form you need.

Obtain access to the Tennessee Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees with US Legal Forms, probably the most substantial catalogue of authorized file web templates. Use thousands of specialist and express-particular web templates that fulfill your organization or person demands and needs.

Form popularity

FAQ

The taxes apply to corporations, limited partnerships, limited liability companies (LLCs), and business trusts that are chartered, qualified, or registered in Tennessee or are doing business in the state. Sole proprietors and general partnerships aren't subject to either tax.

State Business Taxes in Tennessee By default, LLCs themselves don't pay income taxes, only their members do. Tennessee, unlike most other states, doesn't treat LLCs as pass-through entities. Instead, LLCs are subject to the same taxes as corporations.

All sales and use tax returns and associated payments must be submitted electronically. Sales and use tax, television and telecommunications sales tax, and consumer use tax can be filed and paid on the Tennessee Taxpayer Access Point (TNTAP). A TNTAP logon should be created to file this tax.

With a few exceptions, all businesses that sell goods or services must pay the state business tax. This includes businesses with a physical location in the state as well as out-of-state businesses performing certain activities in the state.

Certain entities under specific circumstances are exempt from paying the business tax. These may include, but are not limited to, people acting as employees, manufacturers, religious and charitable entities selling donated items, direct-to-home satellite providers, and movie theaters.

Overview. If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

Business name and registration Register your business name with the county clerk where your business is located. If you are a corporation, you will also need to register with the Secretary of State.

Pay while logged into TNTAP: Log into TNTAP. Select your FAE Account and Period, then select the ?Make a Payment? link in the ?I Want To? section. Choose ACH Debit or Credit Card, and then fill in the information requested. Once completed, click the ?Submit? button.