A Tennessee Settlement Agreement Regarding Property Damages due to an Automobile Accident is a legal document that outlines the terms and conditions by which the parties involved in an accident can resolve their property damage claims. This agreement is typically reached between the responsible party, the injured party, and their respective insurance companies. In Tennessee, there are typically two types of settlement agreements that can address property damages resulting from an automobile accident: 1. Total Loss Settlement Agreement: In cases where the vehicle is deemed a total loss, the settlement agreement will establish the fair market value of the vehicle at the time of the accident. This value is often determined by considering factors such as the age, make, model, mileage, condition, and any pre-existing damage to the vehicle. The agreement will outline the amount of compensation to be paid by the responsible party's insurance company to cover the cost of the total loss. 2. Repairs Settlement Agreement: If the vehicle involved in the accident is repairable, the settlement agreement will stipulate the extent of the damage and outline the necessary repairs. The agreement will provide a detailed list of required repairs, estimated costs, and potential additional charges that may arise during the repair process. It will also specify the insurance company's responsibility for financing the repair expenses. While these are the main types of settlement agreements relevant to property damages in Tennessee, it is crucial to note that each case is unique, and the terms of the agreement may vary based on the circumstances of the accident. Additionally, the settlement agreement may also include provisions for rental vehicles, towing expenses, storage fees, and any other associated costs incurred due to the accident. In conclusion, a Tennessee Settlement Agreement Regarding Property Damages due to an Automobile Accident is a legally binding document that aims to resolve property damage claims resulting from a car accident. It ensures that all parties involved reach a mutually acceptable agreement regarding vehicle valuation, repair costs, and other related expenses, enabling the affected individuals to move forward from the accident and restore their property to its pre-accident condition.

Tennessee Settlement Agreement Regarding Property Damages due to an Automobile Accident

Description

How to fill out Tennessee Settlement Agreement Regarding Property Damages Due To An Automobile Accident?

If you wish to total, download, or print legal document templates, use US Legal Forms, the most important selection of legal forms, that can be found on the web. Utilize the site`s basic and hassle-free research to find the paperwork you need. A variety of templates for organization and individual reasons are sorted by classes and says, or keywords and phrases. Use US Legal Forms to find the Tennessee Settlement Agreement Regarding Property Damages due to an Automobile Accident within a handful of mouse clicks.

Should you be previously a US Legal Forms consumer, log in to your accounts and click on the Acquire button to obtain the Tennessee Settlement Agreement Regarding Property Damages due to an Automobile Accident. You can also accessibility forms you formerly downloaded inside the My Forms tab of your respective accounts.

If you are using US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for your proper metropolis/nation.

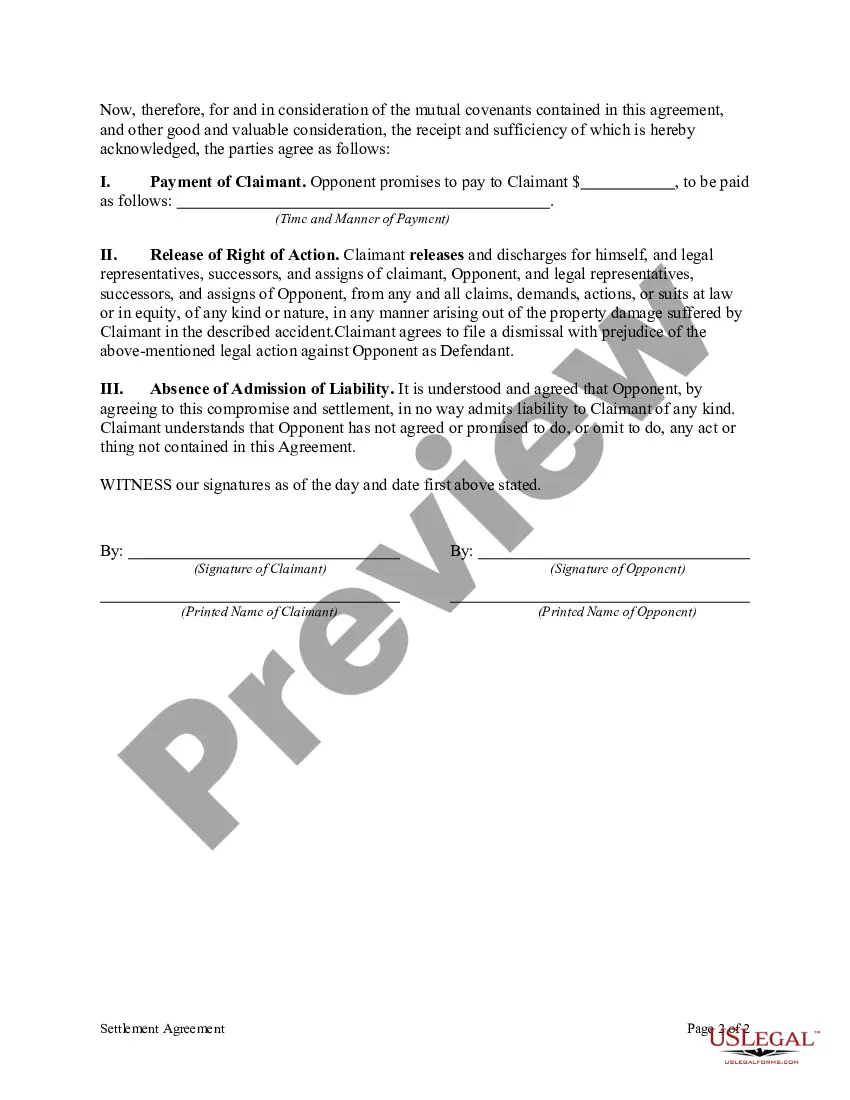

- Step 2. Take advantage of the Preview option to examine the form`s content material. Never forget to see the outline.

- Step 3. Should you be not satisfied with all the form, use the Look for industry near the top of the display screen to get other types of your legal form web template.

- Step 4. Once you have discovered the shape you need, go through the Buy now button. Opt for the prices plan you like and add your accreditations to sign up on an accounts.

- Step 5. Procedure the purchase. You can use your charge card or PayPal accounts to finish the purchase.

- Step 6. Pick the file format of your legal form and download it on the device.

- Step 7. Comprehensive, modify and print or indicator the Tennessee Settlement Agreement Regarding Property Damages due to an Automobile Accident.

Each and every legal document web template you acquire is yours permanently. You may have acces to every form you downloaded in your acccount. Go through the My Forms segment and decide on a form to print or download again.

Remain competitive and download, and print the Tennessee Settlement Agreement Regarding Property Damages due to an Automobile Accident with US Legal Forms. There are thousands of professional and state-particular forms you can use for the organization or individual requirements.