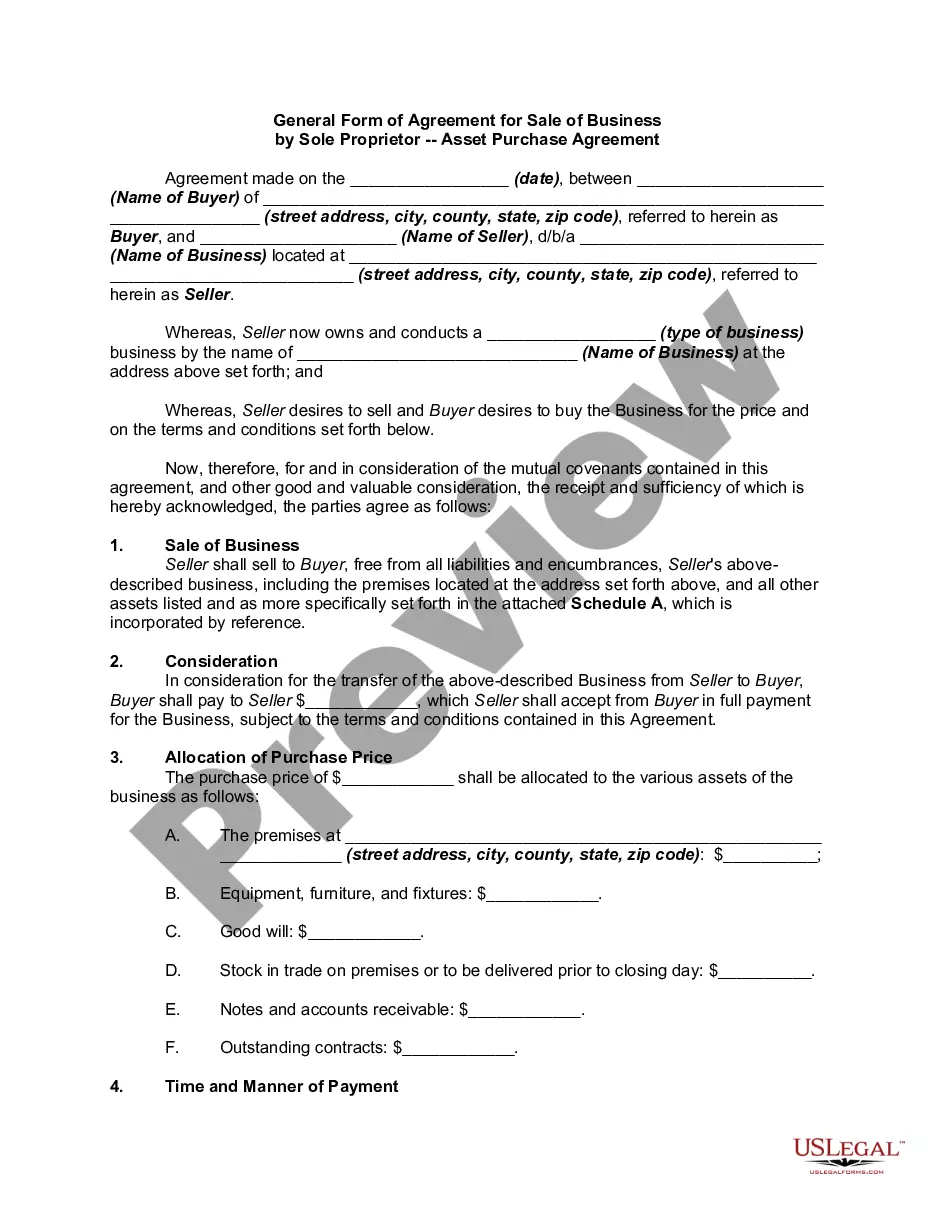

Tennessee Agreement for Sale of Business - Sole Proprietorship - Asset Purchase

Description

How to fill out Agreement For Sale Of Business - Sole Proprietorship - Asset Purchase?

If you need to finalize, retrieve, or print legitimate document templates, utilize US Legal Forms, the most extensive array of official forms available online.

Employ the site's user-friendly and convenient search feature to find the documents you need.

Various templates for business and personal purposes are categorized by types and regions, or keywords.

Step 4. Once you have found the form you need, select the Get now button. Choose the payment plan you prefer and provide your details to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to obtain the Tennessee Agreement for Sale of Business - Sole Proprietorship - Asset Purchase within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Get button to acquire the Tennessee Agreement for Sale of Business - Sole Proprietorship - Asset Purchase.

- You can also find forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Utilize the Preview mode to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find alternate versions of the legal form template.

Form popularity

FAQ

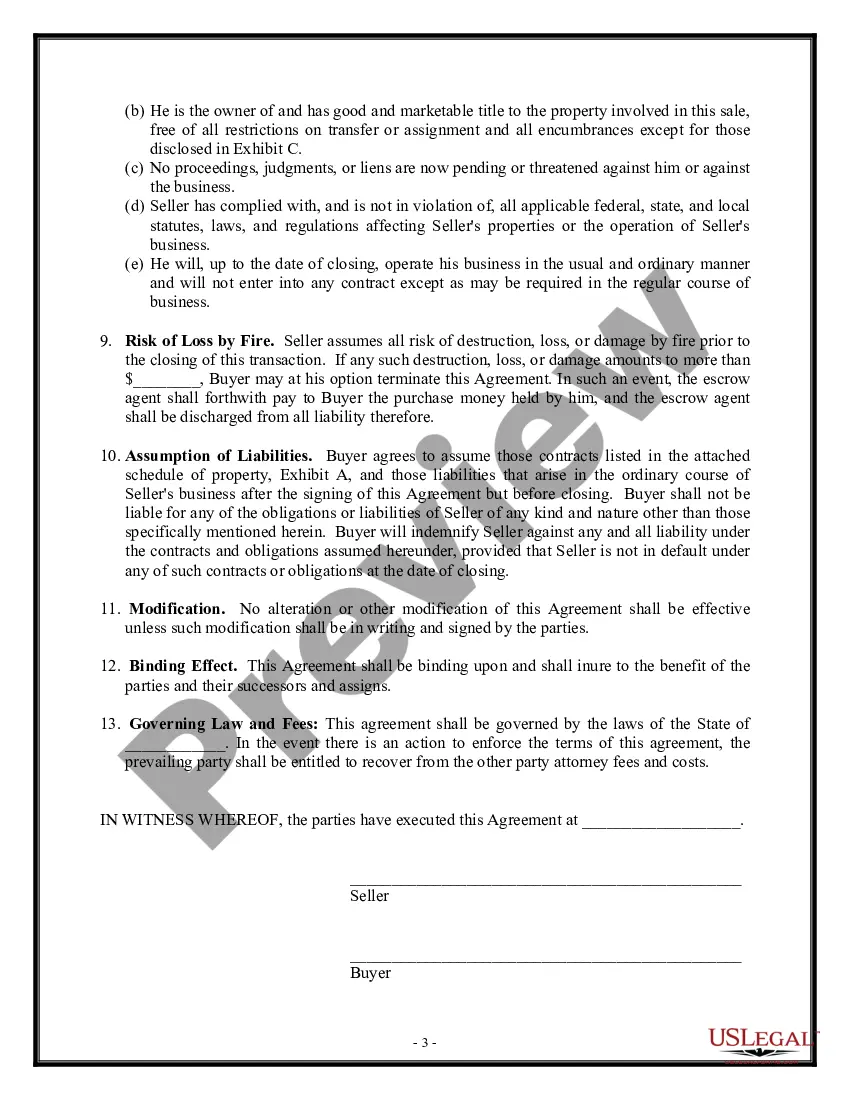

What to include in a business sales contract.Name the parties. Clearly state the names and locations of the buyer and seller.List the assets.Define liabilities.Set sale terms.Include other agreements.Make your sales agreement digital.

For a contract to be legally binding it must contain four essential elements:an offer.an acceptance.an intention to create a legal relationship.a consideration (usually money).

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

How to Draft a Sales ContractIdentity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties.Description of Goods and/or Services. A sales contract should also address what is being bought or sold.Payment.Delivery.Miscellaneous Provisions.Samples.

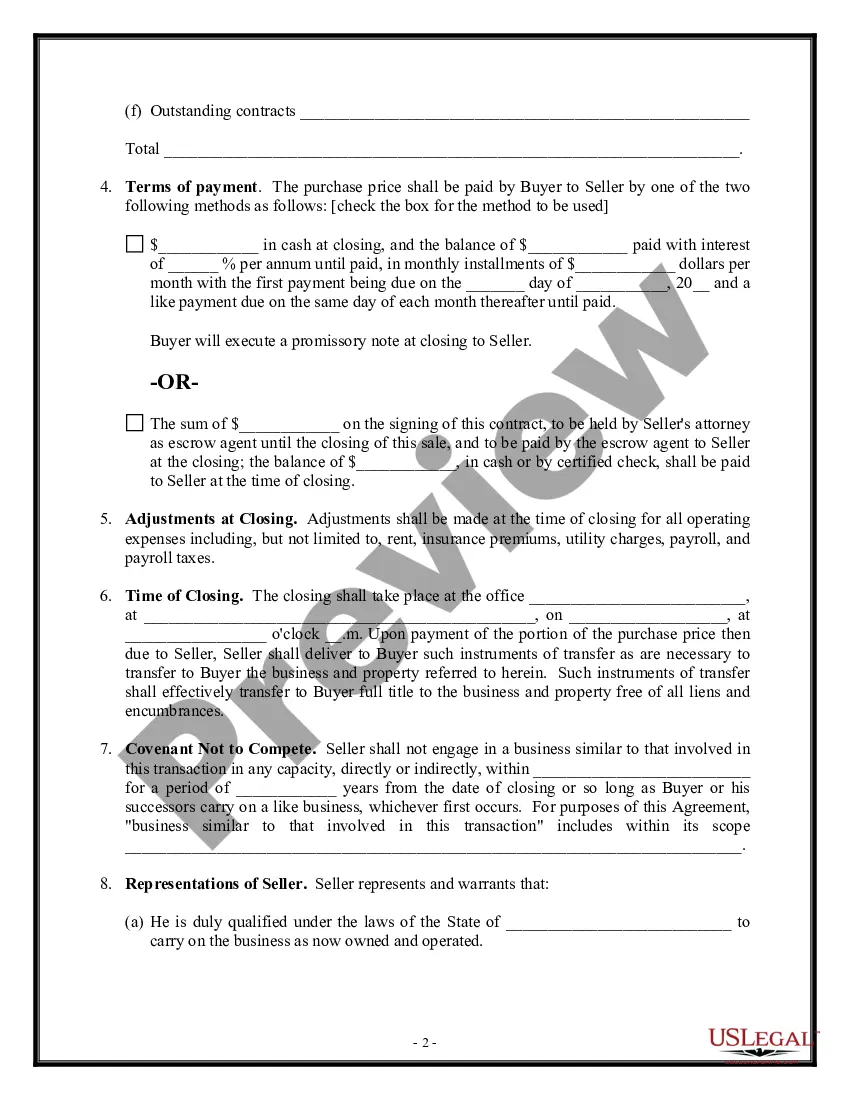

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

The acquired assets usually include all fixed assets (usually supported by a detailed list), all inventory, all supplies, tools, computers and related software, websites, all social media accounts used in connection with the Business, all permits, patents, trademarks, service marks, trade names (including but not

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...