Title: Tennessee Security Agreement Regarding Aircraft and Equipment: A Comprehensive Overview Introduction: The Tennessee Security Agreement Regarding Aircraft and Equipment is a legally binding contract that establishes a debtor-creditor relationship pertaining to the lateralization of aircraft and related equipment in Tennessee. This article provides a detailed description of this agreement, including its purpose, key components, and any variations present within the Tennessee jurisdiction. Key Terms and Components: 1. Collateral: In this agreement, the collateral refers to the aircraft and any associated equipment serving as security for the repayment of a debt. It is essential for debtors and creditors to precisely identify and describe the collateral in the security agreement. 2. Debtor: The debtor is the party that grants a security interest in the aircraft and equipment to a creditor. By entering into this agreement, the debtor consents to the creditor's right to seize and sell the collateral in case of default on the underlying debt. 3. Creditor: The creditor is the party to whom the security interest is granted by the debtor. The creditor may be a financial institution, lender, or any party extending credit or advancing funds to the debtor, usually with an interest in protecting their investment. 4. Security Interest: This refers to the rights and privileges granted to the creditor in the collateral. The Tennessee Security Agreement Regarding Aircraft and Equipment allows the creditor to stake a claim on the aircraft and equipment until the debt is repaid or satisfied. Types of Tennessee Security Agreements Regarding Aircraft and Equipment: While there are no multiple variations exclusive to Tennessee in terms of security agreements regarding aircraft and equipment, it's important to note that different types of security agreements may exist within the broader legal framework: 1. Chattel Mortgage: This type of security agreement involves granting a security interest in movable collateral, such as aircraft and equipment. It establishes a lien on the collateral, allowing the creditor to seize and sell it upon default. 2. Conditional Sales Contract: Upon entering into this agreement, ownership of the aircraft and equipment is initially retained by the seller (creditor), with transfer occurring only upon successful fulfillment of specified conditions. Failure to meet these conditions gives the creditor the right to reclaim the collateral. 3. Fixture Filing: In cases where the aircraft and equipment are attached to real property (land/building), a fixture filing is necessary. This establishes the creditor's security interest in the fixtures, ensuring its priority over potential conflicting claims. Conclusion: The Tennessee Security Agreement Regarding Aircraft and Equipment serves as an important legal instrument to protect creditors' interests in collateralized assets. By understanding the key components and variations that may exist within this agreement, debtors and creditors can protect their rights while fostering a secure financial environment in Tennessee.

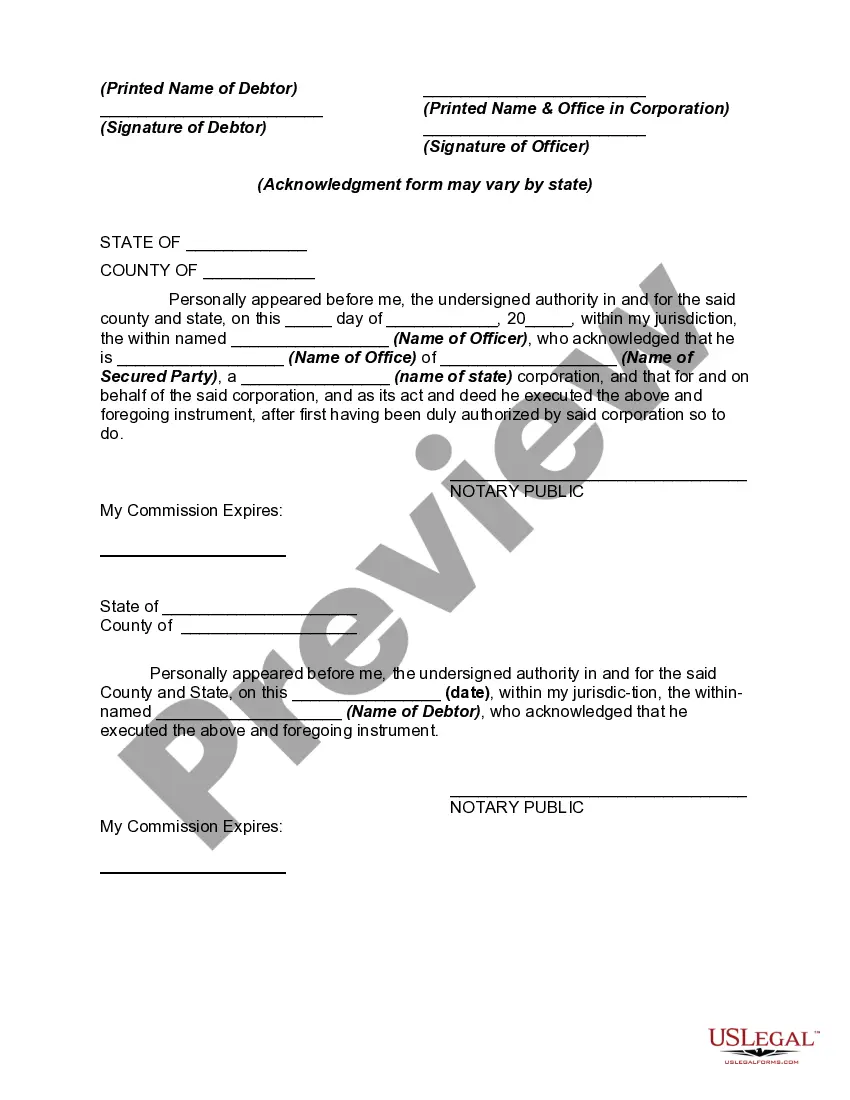

Tennessee Security Agreement Regarding Aircraft and Equipment

Description

How to fill out Tennessee Security Agreement Regarding Aircraft And Equipment?

Choosing the best authorized document format can be quite a struggle. Of course, there are a lot of layouts accessible on the Internet, but how will you discover the authorized type you need? Utilize the US Legal Forms web site. The service provides a large number of layouts, including the Tennessee Security Agreement Regarding Aircraft and Equipment, which can be used for business and private needs. All the types are examined by professionals and satisfy state and federal needs.

In case you are already listed, log in in your account and click on the Download button to find the Tennessee Security Agreement Regarding Aircraft and Equipment. Use your account to look through the authorized types you have acquired formerly. Visit the My Forms tab of the account and obtain yet another duplicate of the document you need.

In case you are a fresh user of US Legal Forms, listed below are simple guidelines that you should comply with:

- First, make sure you have selected the proper type for the area/area. You can look through the form making use of the Review button and study the form explanation to ensure this is the right one for you.

- If the type fails to satisfy your requirements, make use of the Seach discipline to discover the correct type.

- When you are positive that the form would work, go through the Acquire now button to find the type.

- Opt for the pricing program you would like and enter the necessary info. Design your account and pay money for your order with your PayPal account or credit card.

- Select the submit format and download the authorized document format in your product.

- Full, revise and print and indicator the obtained Tennessee Security Agreement Regarding Aircraft and Equipment.

US Legal Forms is the biggest library of authorized types in which you will find different document layouts. Utilize the company to download expertly-made papers that comply with condition needs.