Tennessee Marketing and Participating Internet Agreement

Description

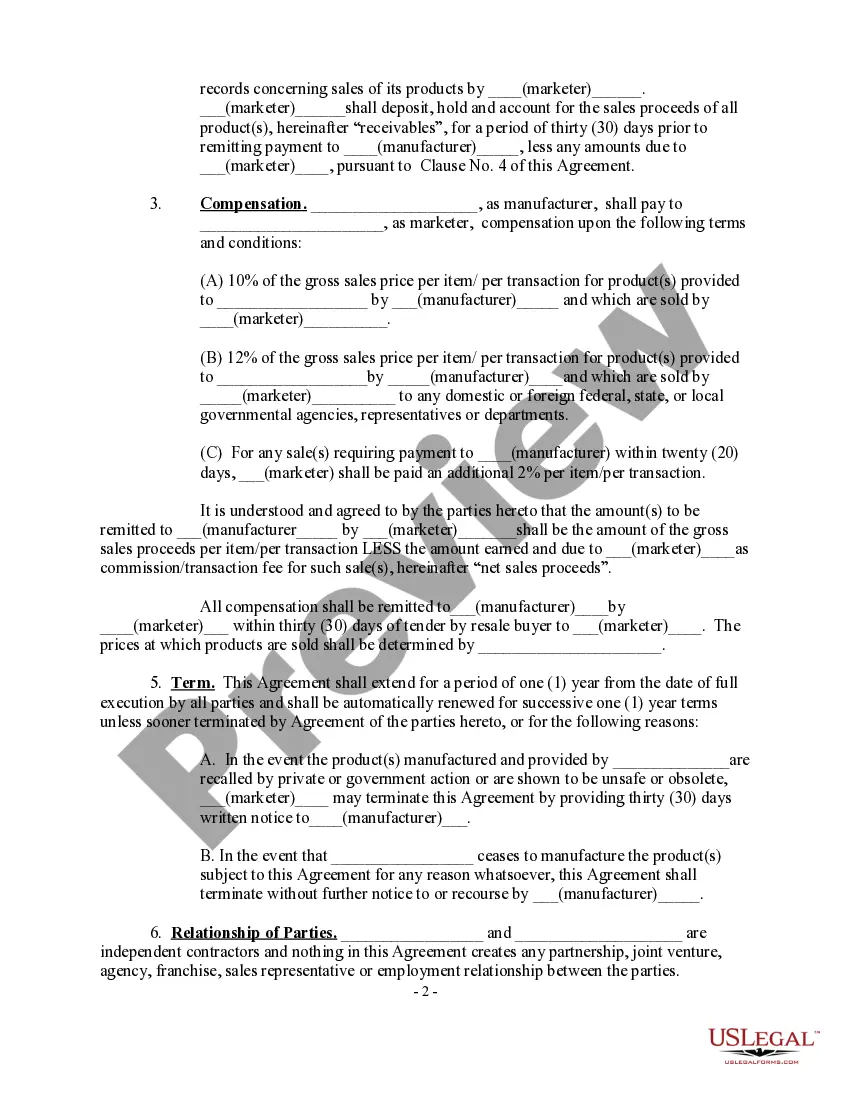

How to fill out Marketing And Participating Internet Agreement?

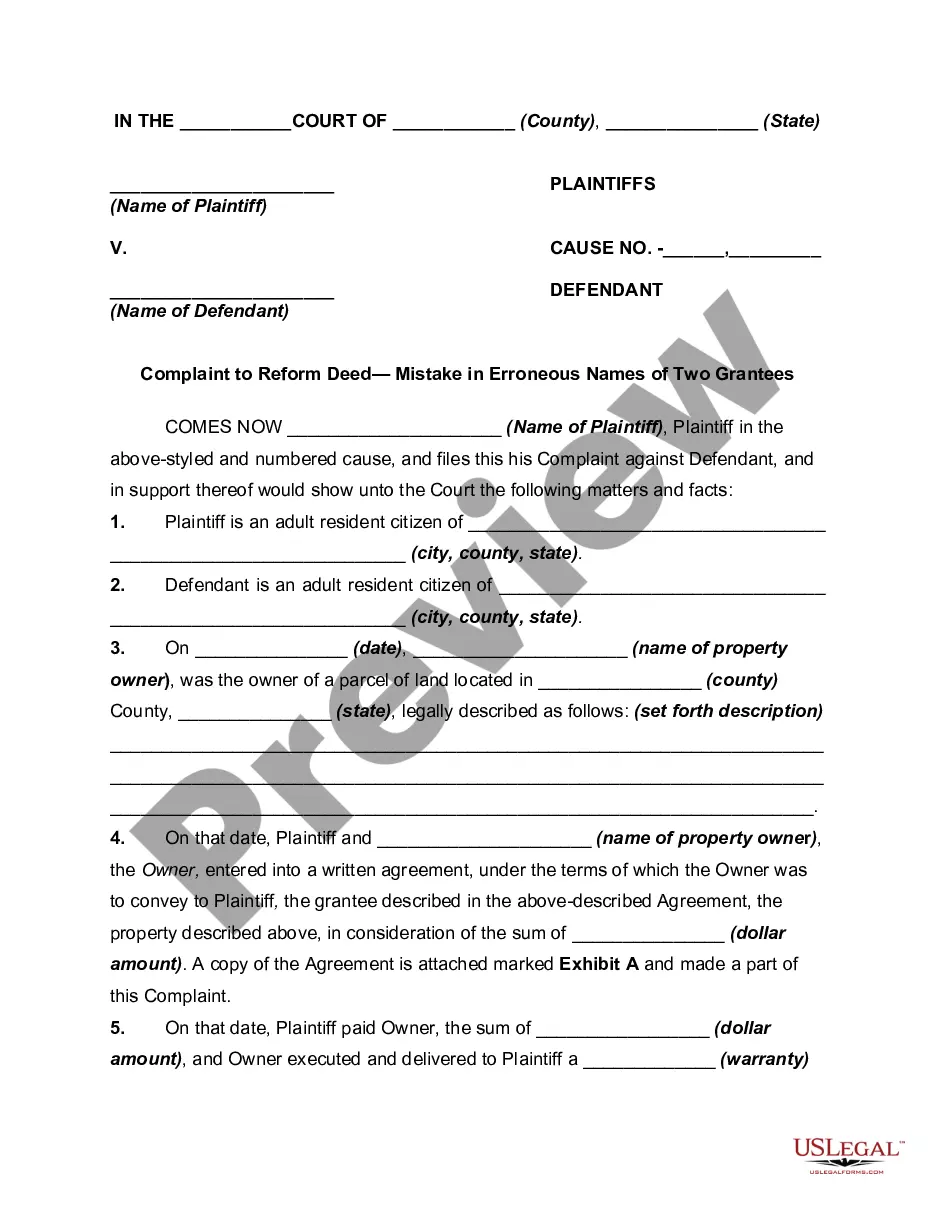

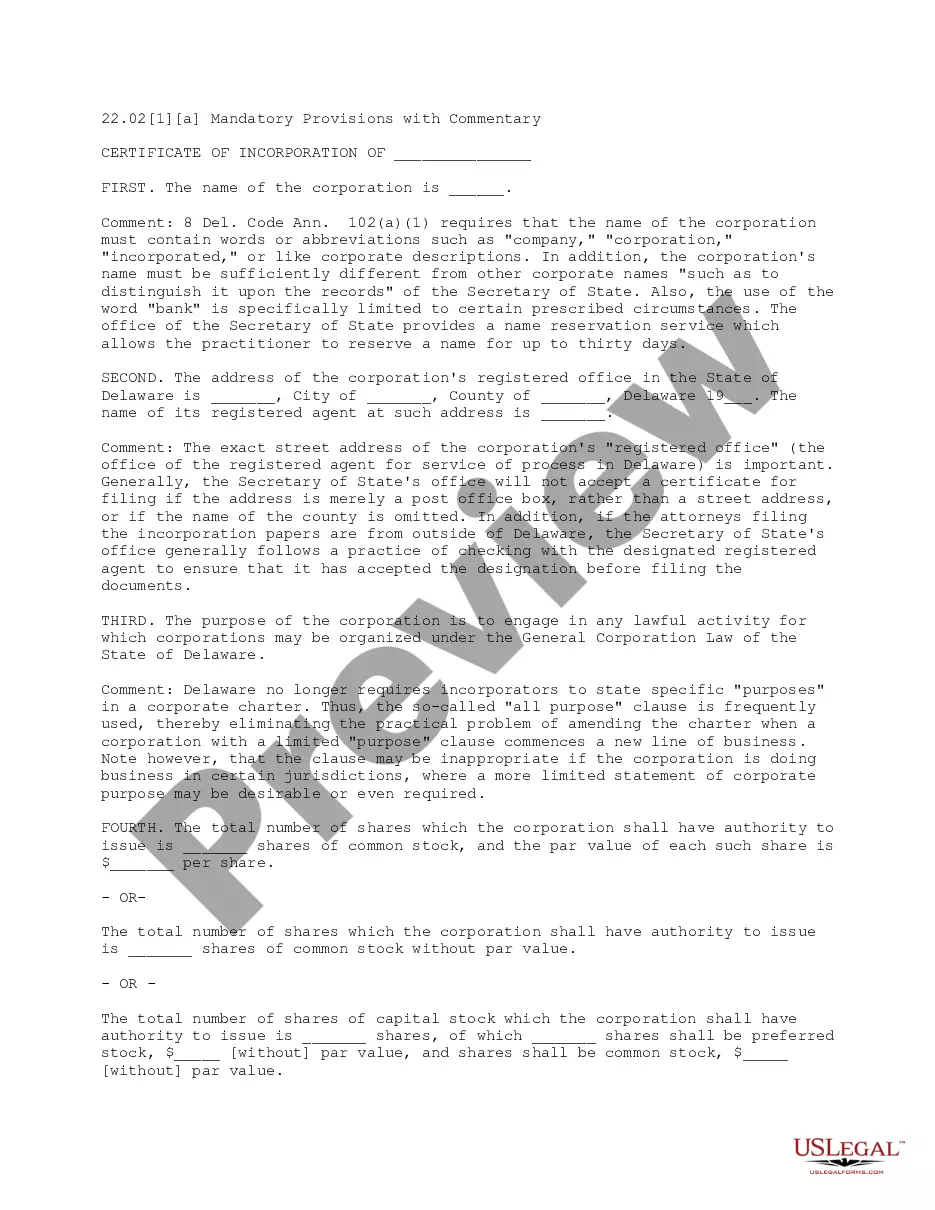

Finding the correct legitimate document template can be challenging. Naturally, there is an abundance of templates accessible online, but how do you secure the genuine form you require? Visit the US Legal Forms website. The platform offers thousands of templates, including the Tennessee Marketing and Participating Internet Agreement, which can be utilized for both business and personal purposes. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to get the Tennessee Marketing and Participating Internet Agreement. Use your account to browse through the legal documents you have previously acquired. Navigate to the My documents tab in your account to obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions that you can follow: First, ensure that you have selected the correct document for your locality/county. You can review the document using the Preview option and examine the document outline to confirm it fits your needs. If the document does not meet your requirements, utilize the Search field to find the appropriate form.

- When you are confident the form is suitable, click the Buy Now button to purchase the document.

- Choose the pricing plan you prefer and input the necessary details.

- Create your account and pay for your order using your PayPal account or credit card.

- Select the file format and download the legitimate document template to your device.

- Complete, modify, print, and sign the acquired Tennessee Marketing and Participating Internet Agreement.

- US Legal Forms is the largest repository of legal documents where you can find numerous file templates. Utilize the service to acquire professionally crafted paperwork that adheres to state requirements.

Form popularity

FAQ

Your business may be tax-exempt if it meets specific criteria, such as being a non-profit organization, engaging in exempt sales, or operating below the tax threshold. Each situation varies, so you should evaluate your business's structure and operations accordingly. Leveraging the Tennessee Marketing and Participating Internet Agreement can guide you in ensuring your business stays compliant while optimizing tax benefits.

In Tennessee, specific businesses, including sole proprietors without employees and certain service professionals, may be exempt from obtaining a business license. It’s essential to check the criteria to ensure compliance and avoid penalties. The Tennessee Marketing and Participating Internet Agreement provides valuable resources to help you determine whether your business qualifies for these exemptions.

In Tennessee, certain entities such as non-profit organizations, some agricultural operations, and businesses with low gross receipts may qualify for business tax exemptions. Understanding your eligibility can help you manage tax obligations more effectively. Utilizing insights from the Tennessee Marketing and Participating Internet Agreement may further clarify these exemptions.

A class 4 business license in Tennessee is typically required for certain businesses that engage in sales or services. This license is crucial for ensuring compliance with local regulations. To streamline the licensing process, consider leveraging resources from the Tennessee Marketing and Participating Internet Agreement, which can guide you through necessary steps.

Tennessee provides a small business tax exemption for businesses that generate a modest amount of gross receipts. This exemption allows eligible businesses to avoid paying local business taxes up to a specific threshold. By understanding the details of the Tennessee Marketing and Participating Internet Agreement, you can optimize your business's tax position.

Tennessee sales tax exemptions apply to various items, such as certain food and medical supplies, agricultural products, and services rendered by professionals. Additionally, items purchased for resale are also exempt from sales tax. Familiarizing yourself with the Tennessee Marketing and Participating Internet Agreement will aid you in leveraging these exemptions wisely.

In Tennessee, most professional services are considered non-taxable under the sales tax law. However, if services include tangible goods or are considered a part of a sale, those transactions might incur tax. Understanding the nuances of the Tennessee Marketing and Participating Internet Agreement can help you navigate these regulations effectively.

In Tennessee, certain individuals and businesses may qualify for exemptions from needing a business license. Common exemptions often include certain non-profits and businesses that operate on a very small scale. If you think you might be eligible for an exemption, check with local authorities or seek guidance from uslegalforms to ensure compliance with the Tennessee Marketing and Participating Internet Agreement.

The TN digital opportunity plan aims to enhance digital equity and expand internet access across the state. It focuses on providing resources and support for businesses and individuals to thrive in the digital economy. For online entrepreneurs, understanding this plan is crucial for aligning with the Tennessee Marketing and Participating Internet Agreement and tapping into further business opportunities.

Yes, to sell online in Tennessee, you generally need a business license. This license is a requirement for both physical and online sales to ensure compliance with state and local laws. Engaging with platforms like uslegalforms can simplify the process of obtaining the necessary permits while adhering to the Tennessee Marketing and Participating Internet Agreement.