Tennessee General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

Closed-end transactions involve a fixed amount to be paid back over a period of time such as a note or a retail installment contract.

How to fill out General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures?

If you wish to finalize, download, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you require.

Many templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After locating the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Employ US Legal Forms to obtain the Tennessee General Disclosures Mandatory By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and press the Acquire button to download the Tennessee General Disclosures Mandatory By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

- You can also find forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

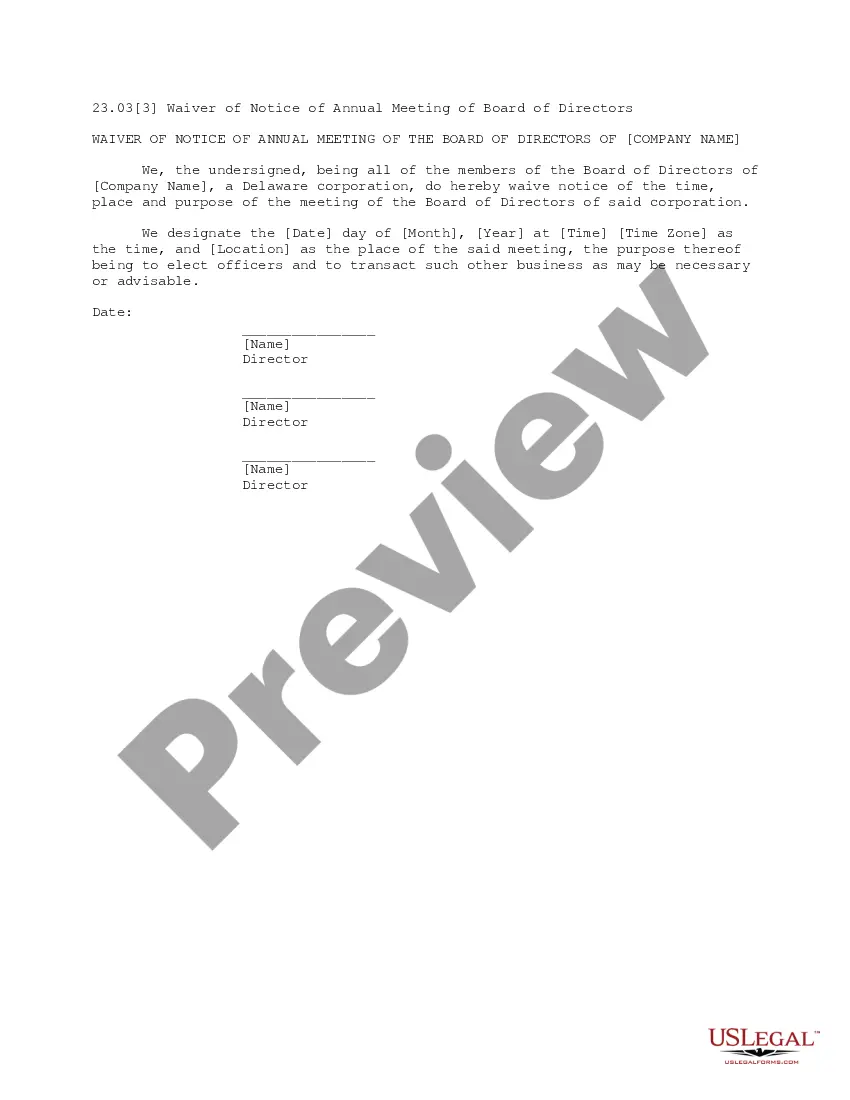

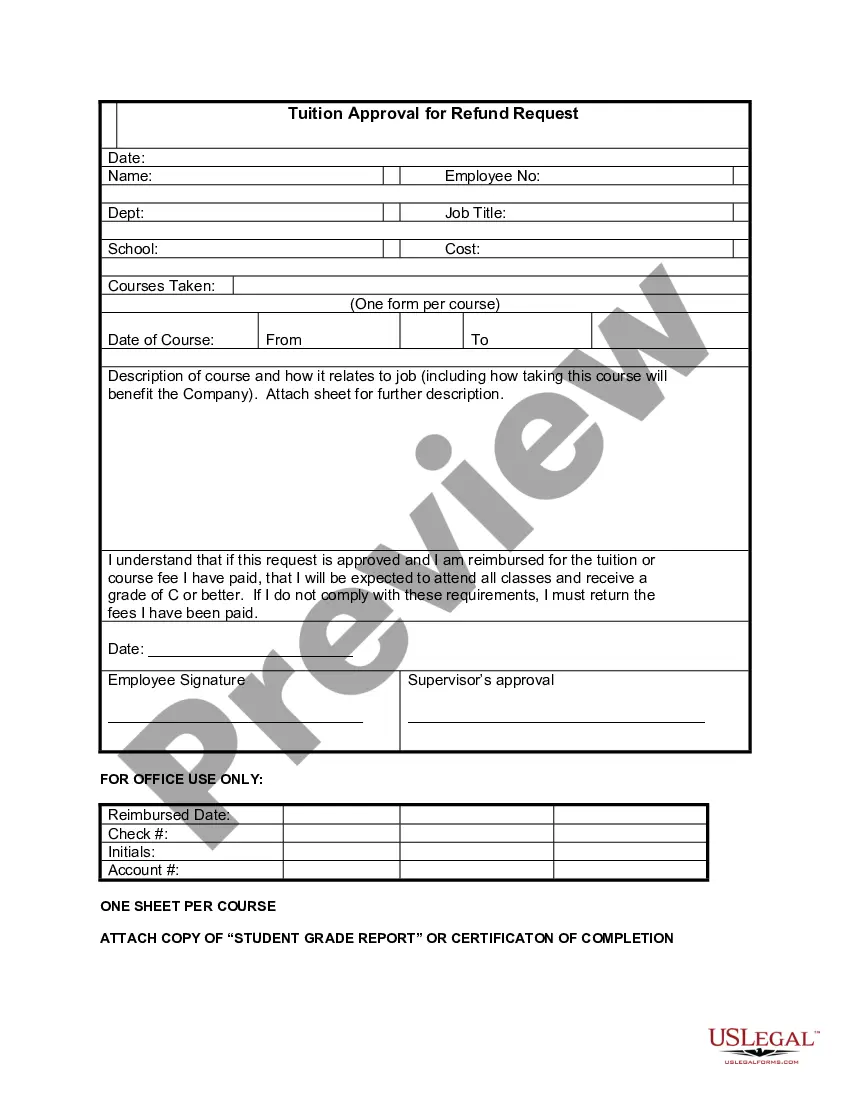

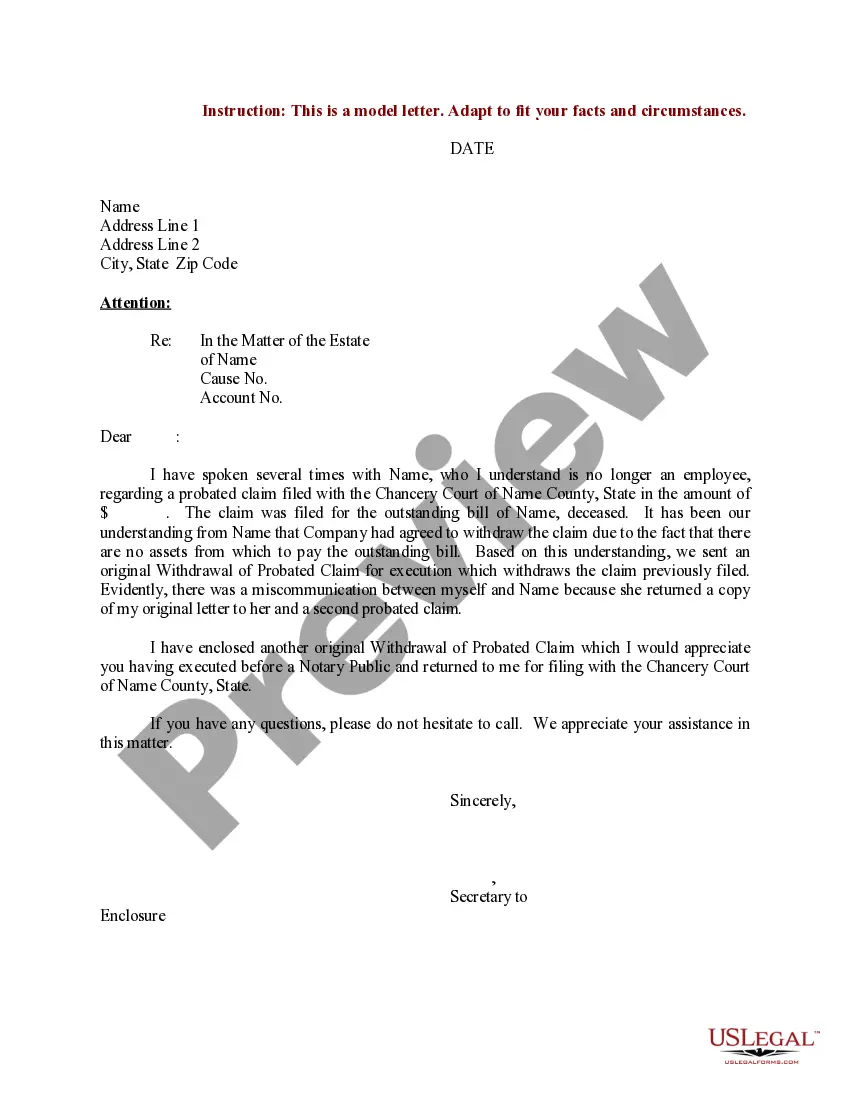

- Step 2. Use the Preview option to review the contents of the form. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Regulation Z mandates that lenders provide clear and accurate information about the terms of consumer credit. This includes disclosures about the annual percentage rate, finance charges, and the total amount financed. These disclosures ensure that borrowers understand their obligations under Tennessee General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

Disclosures in the Truth in Lending Act (TILA) are essential documents that inform consumers about the costs and terms associated with their loans. These disclosures should include vital information like repayment plans, interest rates, and any fees involved. By providing such information, TILA enhances consumer protection, which is particularly important for individuals considering Tennessee General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures. Utilizing platforms like US Legal Forms can simplify the process of understanding and complying with these requirements.

Certain loans are exempt from the disclosure requirements set forth by the Truth in Lending Act. For instance, loans made for business, commercial, or agricultural purposes do not require TILA disclosures. Additionally, loans for amounts below a specific threshold and certain temporary loans may also fall outside these requirements. Being aware of these exemptions helps borrowers navigate the landscape of Tennessee General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures effectively.

Under the Truth in Lending Act (TILA), several disclosures are required, including the annual percentage rate (APR), payment schedule, and total finance charges. These elements ensure that borrowers are fully aware of the costs of borrowing. Compliance with these requirements protects consumers and promotes fair lending practices. Adhering to the Tennessee General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures is essential for lenders.

The value of a closed-end credit APR must be disclosed as a single rate only, whether the loan has a single interest rate, a variable interest rate, a discounted variable interest rate, or graduated payments based on separate interest rates (step rates), and it must appear with the segregated disclosures.

The Truth in Lending Act (TILA) protects you against inaccurate and unfair credit billing and credit card practices. It requires lenders to provide you with loan cost information so that you can comparison shop for certain types of loans.

A Truth in Lending agreement is a written disclosure or set of disclosures provided to the borrower before credit or a loan is issued. It outlines the terms and conditions of the credit, the annual percentage rate (APR), and financing details.

Regulation Z also requires mortgage lenders to provide borrowers with a written disclosure of rates, fees and other finance charges. Plus, if you have an adjustable-rate mortgage, they're required to let you know in advance if your rate will be changing.

Created to protect consumers from predatory lending practices, Regulation Z, also known as the Truth in Lending Act, requires that lenders disclose borrowing costs upfront and in clear terminology so consumers can make informed decisions.