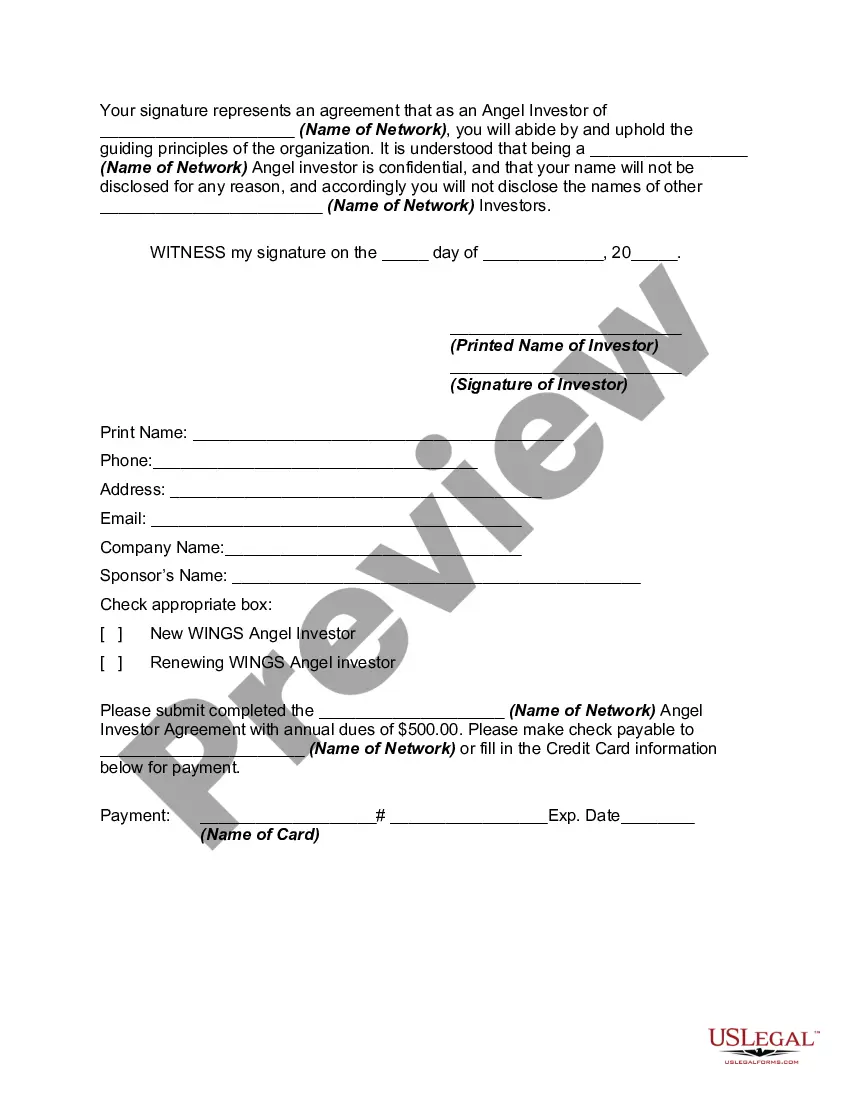

The Tennessee Angel Investor Agreement is a legal document that sets out the terms and conditions that govern the relationship between an angel investor and the startup company they are investing in, operating within the state of Tennessee. This agreement aims to protect the interests of both parties and establish guidelines for the investment process. Key features of a Tennessee Angel Investor Agreement include: 1. Investor Obligations: This section outlines the obligations and responsibilities of the angel investor, such as the amount of investment, the timeline for funding, and any additional support they will provide to the startup. 2. Company Obligations: The agreement also specifies the obligations of the startup receiving the investment, including business plan and financial reporting requirements, milestones, and conditions for follow-on funding rounds. 3. Equity Ownership: The agreement defines the equity ownership structure, including the percentage of ownership the investor will receive in exchange for their investment. It may also outline any rights or preferences the investor has, such as liquidation preferences or anti-dilution provisions. 4. Voting Rights: This clause determines the investor's voting rights in key company decisions, such as board appointments, major strategic decisions, or significant changes to the company's structure. 5. Confidentiality and Non-Disclosure: To protect sensitive business information, this section enforces confidentiality obligations on both parties, ensuring that proprietary and trade secret information remains strictly confidential. 6. Exit Strategy: The agreement may address the investors' exit options, such as rights to sell their shares, initial public offerings, mergers and acquisitions, or other exit opportunities. 7. Governing Law: The choice of which state's laws will govern the agreement is typically included, and, in this case, will be Tennessee law. Different types of Tennessee Angel Investor Agreements include: 1. Convertible Note Agreement: This type of agreement allows investors to provide a loan to the startup initially, which will then convert into equity at a later stage, usually during a subsequent funding round. 2. Equity Purchase Agreement: In this type of agreement, the investor directly purchases equity shares in the startup in exchange for their investment, without any debt component. 3. SAFE (Simple Agreement for Future Equity): This is a relatively new type of agreement that is becoming popular in the startup ecosystem. It provides flexibility for investors by offering the promise of equity in the future, but without setting a specific valuation at the time of investment. In summary, the Tennessee Angel Investor Agreement is an essential legal contract that outlines the terms and conditions of an investment between an angel investor and a startup based in Tennessee. Various types of agreements, such as convertible notes, equity purchase agreements, and SAFE agreements, cater to different preferences and circumstances of the parties involved in the investment process.

Tennessee Angel Investor Agreement

Description

How to fill out Tennessee Angel Investor Agreement?

If you need to total, acquire, or printing authorized papers templates, use US Legal Forms, the biggest variety of authorized types, which can be found on the Internet. Use the site`s simple and practical research to obtain the documents you want. A variety of templates for business and person reasons are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to obtain the Tennessee Angel Investor Agreement in just a couple of mouse clicks.

In case you are currently a US Legal Forms consumer, log in to the profile and then click the Down load button to find the Tennessee Angel Investor Agreement. You can also access types you in the past downloaded inside the My Forms tab of your own profile.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Make sure you have selected the shape for the correct metropolis/land.

- Step 2. Make use of the Review option to check out the form`s content material. Never forget to read through the information.

- Step 3. In case you are unhappy together with the type, use the Research industry at the top of the monitor to find other types from the authorized type template.

- Step 4. Once you have discovered the shape you want, go through the Get now button. Select the rates prepare you favor and add your references to sign up for an profile.

- Step 5. Method the transaction. You may use your bank card or PayPal profile to perform the transaction.

- Step 6. Pick the format from the authorized type and acquire it on the gadget.

- Step 7. Complete, modify and printing or indicator the Tennessee Angel Investor Agreement.

Each and every authorized papers template you buy is your own forever. You have acces to every single type you downloaded with your acccount. Select the My Forms segment and decide on a type to printing or acquire yet again.

Contend and acquire, and printing the Tennessee Angel Investor Agreement with US Legal Forms. There are thousands of expert and status-certain types you can utilize for your business or person demands.