Have you been inside a situation the place you require papers for possibly enterprise or personal reasons nearly every day time? There are a variety of legal papers themes available on the Internet, but getting versions you can rely isn`t easy. US Legal Forms gives 1000s of form themes, such as the Tennessee Contest of Final Account and Proposed Distributions in a Probate Estate, that are published to meet state and federal demands.

If you are already informed about US Legal Forms site and get an account, simply log in. Afterward, you may acquire the Tennessee Contest of Final Account and Proposed Distributions in a Probate Estate format.

If you do not provide an profile and want to start using US Legal Forms, adopt these measures:

- Obtain the form you want and make sure it is for the right town/state.

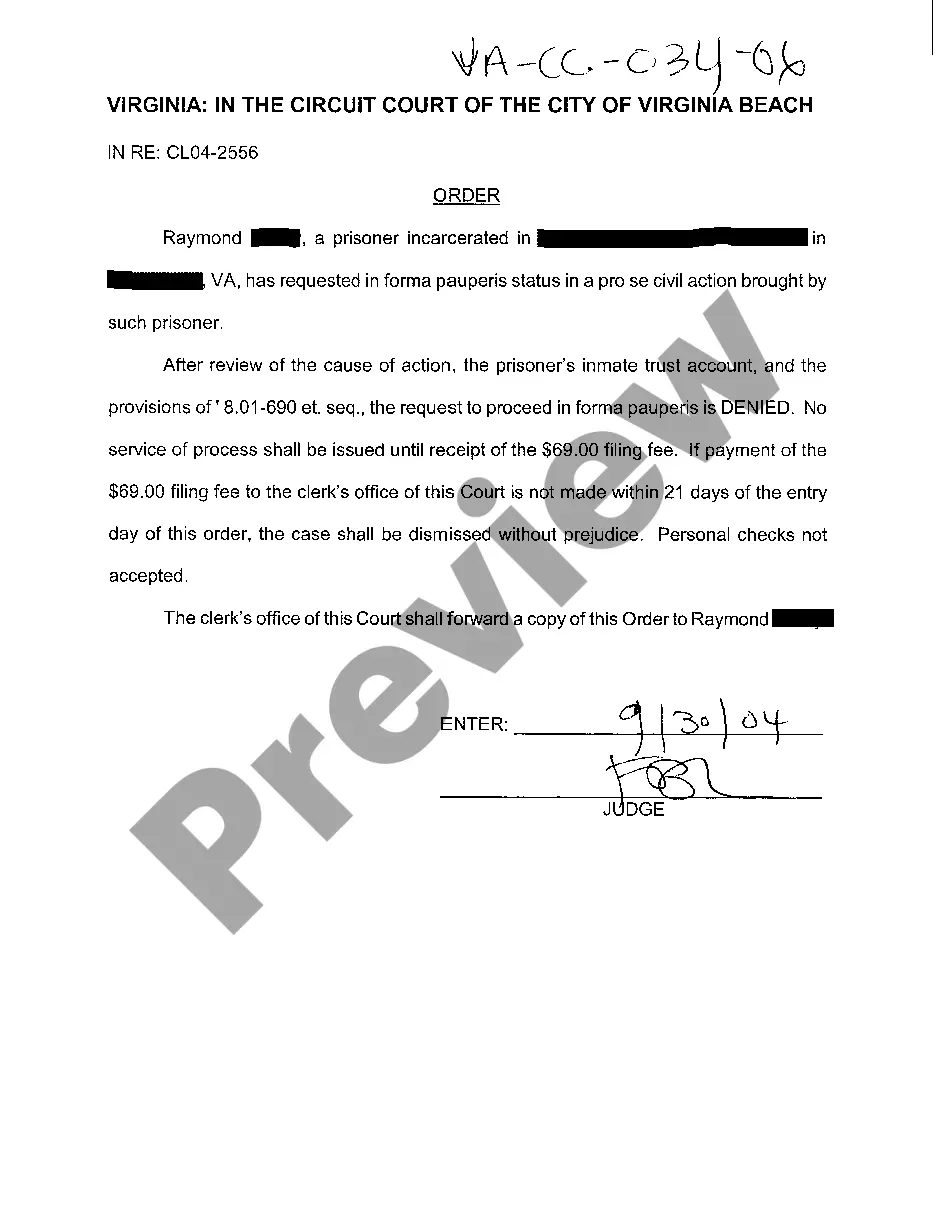

- Make use of the Review option to review the shape.

- Read the outline to actually have selected the correct form.

- In case the form isn`t what you are seeking, make use of the Research field to obtain the form that meets your requirements and demands.

- When you obtain the right form, click Get now.

- Opt for the pricing program you desire, fill in the required info to create your bank account, and purchase the order using your PayPal or credit card.

- Pick a practical file formatting and acquire your duplicate.

Get every one of the papers themes you have bought in the My Forms menu. You can get a further duplicate of Tennessee Contest of Final Account and Proposed Distributions in a Probate Estate anytime, if needed. Just click on the essential form to acquire or printing the papers format.

Use US Legal Forms, by far the most comprehensive variety of legal varieties, to save time as well as steer clear of errors. The services gives appropriately produced legal papers themes which you can use for a range of reasons. Generate an account on US Legal Forms and commence producing your life easier.