An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays his/her own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

There are a number of factors which to consider in making the decision whether people are employees or independent contractors. One of the most important considerations is the degree of control exercised by the company over the work of the workers. An employer has the right to control an employee. It is important to determine whether the company had the right to direct and control the workers not only as to the results desired, but also as to the details, manner and means by which the results were accomplished. If the company had the right to supervise and control such details of the work performed, and the manner and means by which the results were to be accomplished, an employer-employee relationship would be indicated. On the other hand, the absence of supervision and control by the company would support a finding that the workers were independent contractors and not employees.

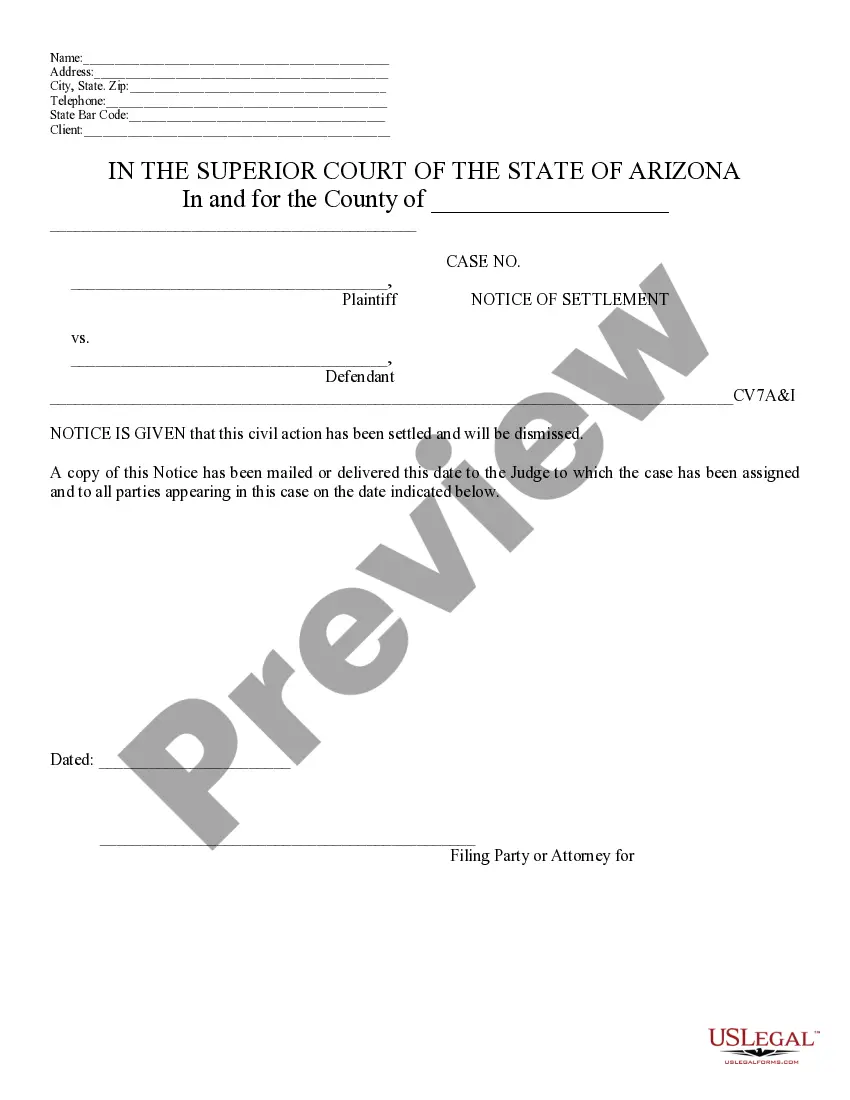

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Tennessee Independent Contractor Agreement with a Crew Member for a Television Production: A Tennessee Independent Contractor Agreement with a Crew Member for a Television Production is a legally binding document that outlines the terms and conditions of a working relationship between a production company and a crew member hired as an independent contractor in the state of Tennessee. This agreement ensures that both parties understand their rights, obligations, and liabilities during the production period. Keywords: Tennessee, Independent Contractor Agreement, Crew Member, Television Production, terms and conditions, working relationship, production company, independent contractor, rights, obligations, liabilities, production period. Different types of Tennessee Independent Contractor Agreements with Crew Members for a Television Production may include: 1. Standard Tennessee Independent Contractor Agreement: This is the most common type of agreement that includes general provisions applicable to crew members working on various television production roles. It covers the essential elements necessary for a legal and successful working relationship. 2. Production-Specific Tennessee Independent Contractor Agreement: In cases where a television production requires specific skills or expertise, a production-specific agreement may be used. This agreement would outline job-specific details, like specialized equipment handling or unique responsibilities, while still encompassing the standard provisions. 3. Short-Term Tennessee Independent Contractor Agreement: Some television productions have a limited duration, such as a single episode or a short-term project. In such cases, a short-term agreement may be utilized, emphasizing the specific time frame and any associated constraints that may be inherent to the defined scope of work. 4. Non-Disclosure Tennessee Independent Contractor Agreement: Television productions often involve sensitive and confidential information. This type of agreement ensures the crew member acknowledges their obligations to maintain confidentiality, preventing the unauthorized disclosure of trade secrets, scripts, or other proprietary information related to the production. 5. Compensation-Structured Tennessee Independent Contractor Agreement: In some instances, crew members may be paid based on a unique compensation structure, such as receiving a percentage of the production's profits. This type of agreement would outline the agreed-upon compensation details, ensuring transparency and fairness in the payment process. Each variant of the Tennessee Independent Contractor Agreement with a Crew Member for a Television Production aims to protect the rights of both parties, define expectations, prevent misunderstandings, and set precedents for professional conduct and legal compliance throughout the production process. It's crucial for all crew members and production companies to enter into a detailed and tailored agreement to safeguard their interests and promote a successful collaboration.