Tennessee General Form of Amendment to Partnership Agreement

Description

How to fill out General Form Of Amendment To Partnership Agreement?

Selecting the appropriate legitimate document template may prove to be challenging.

It goes without saying that there are numerous templates accessible online, but how can you find the correct document you seek.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Tennessee General Form of Amendment to Partnership Agreement, which you can employ for business and personal purposes.

If the form does not fulfill your requirements, use the Search field to find the right document. Once you are confident that the form is appropriate, click on the Buy now button to obtain the document. Choose your preferred pricing plan and provide the necessary information. Create your account and complete your purchase using your PayPal account or Visa or Mastercard. Select the file format and download the legitimate document template to your device. Complete, edit, print, and sign the obtained Tennessee General Form of Amendment to Partnership Agreement. US Legal Forms is the largest repository of legitimate forms where you can find various document templates. Utilize the service to acquire professionally crafted paperwork that meets state requirements.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already a member, Log In to your account and click on the Download button to obtain the Tennessee General Form of Amendment to Partnership Agreement.

- Use your account to search for the legitimate forms you have previously bought.

- Proceed to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

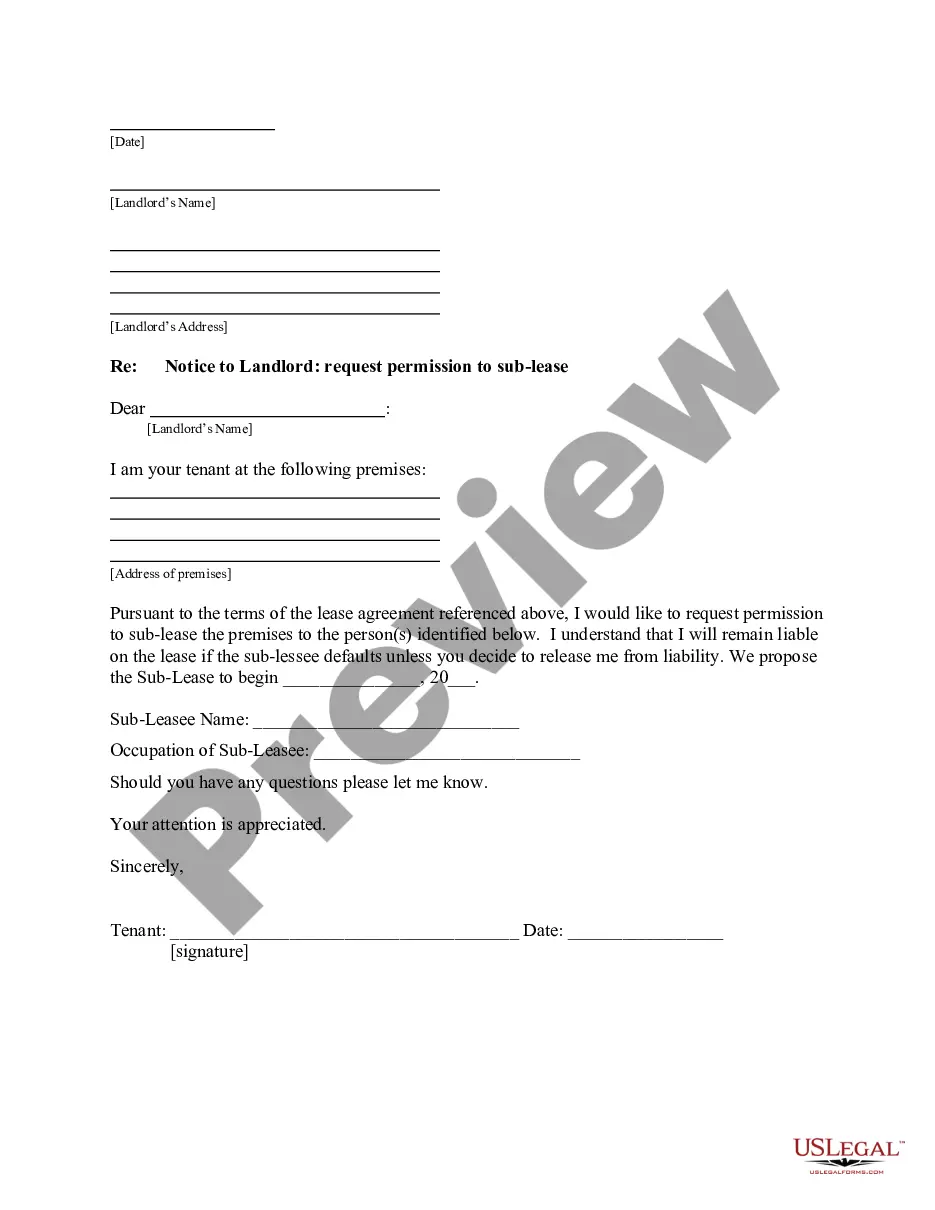

- First, ensure you have selected the correct form for your region/state. You can browse the form using the Preview feature and review the form details to confirm it is suitable for you.

Form popularity

FAQ

A general partnership in Tennessee does not need to register with the state, but doing so can enhance credibility and provide legal protections. While registration is optional, it is recommended to file a Tennessee General Form of Amendment to Partnership Agreement to establish clear records of the business. This can help avoid confusion and disputes among partners and third parties.

When a partner leaves a general partnership, the remaining partners can continue operating or decide to dissolve the partnership. The exiting partner's financial interests must be settled, often requiring the completion of a Tennessee General Form of Amendment to Partnership Agreement. This document will update the partnership terms and clarify the roles of the remaining members moving forward.

To file articles of amendment in Tennessee, you need to prepare the amendment form detailing the changes to your partnership agreement. This can include changes in the partnership structure or operations. Submit the Tennessee General Form of Amendment to Partnership Agreement along with any required fees to the Secretary of State to ensure proper filing and compliance.

Dissolving a general partnership requires agreement among all partners to cease business operations. You must follow legal procedures, including settling debts and distributing assets. Completing the Tennessee General Form of Amendment to Partnership Agreement helps officially document the dissolution and resolve any potential legal issues related to the partnership.

To exit a general partnership, you should first consult the partnership agreement to understand your rights and responsibilities. If applicable, negotiate with your partners to reach an amicable exit. Filing a Tennessee General Form of Amendment to Partnership Agreement is often necessary to formally acknowledge your departure and update the partnership details.

To dissolve a general partnership in Tennessee, all partners must agree to the dissolution. You then need to settle any debts, distribute assets, and file a Tennessee General Form of Amendment to Partnership Agreement to indicate the end of the partnership. It is important to document the dissolution process thoroughly to avoid future disputes.

In Tennessee, partnerships do not have a strict requirement to file with the Secretary of State, but it is wise to stay informed. If your partnership decides to register a trade name or is structured as a limited partnership, filing may be necessary. Utilizing documents like the Tennessee General Form of Amendment to Partnership Agreement allows partnerships to make necessary changes easily and keep records organized, an important aspect of maintaining good business practices.

To form a general partnership in Tennessee, you need to apply a few simple steps. First, select a name for your partnership that complies with state regulations. Next, draft a partnership agreement detailing the roles, responsibilities, and profit-sharing among partners. Finally, while you may not need to file with the state, having the Tennessee General Form of Amendment to Partnership Agreement handy can help ensure clarity and legal compliance as your partnership evolves.

Writing an amendment to a partnership agreement requires identifying the specific sections you wish to change. Clearly state the modifications in a new document, referencing the original agreement and its date. The Tennessee General Form of Amendment to Partnership Agreement provides a structured approach to this process, ensuring that your changes are documented and agreed upon by all partners.

To write a partnership agreement sample, begin by outlining the names of the partners, the business purpose, and how profits will be shared. Be clear and detailed about each partner's responsibilities and decision-making processes. Utilizing the Tennessee General Form of Amendment to Partnership Agreement can serve as a solid foundation for your sample, making it straightforward and compliant.